In the last few hours, the crypto market has been profoundly impacted by a wave of liquidations totaling approximately $1.1 billion. Many analysts attribute this turbulence to the return of pressures from U.S. banks — a factor that historically haunts investor sentiment in crypto assets.

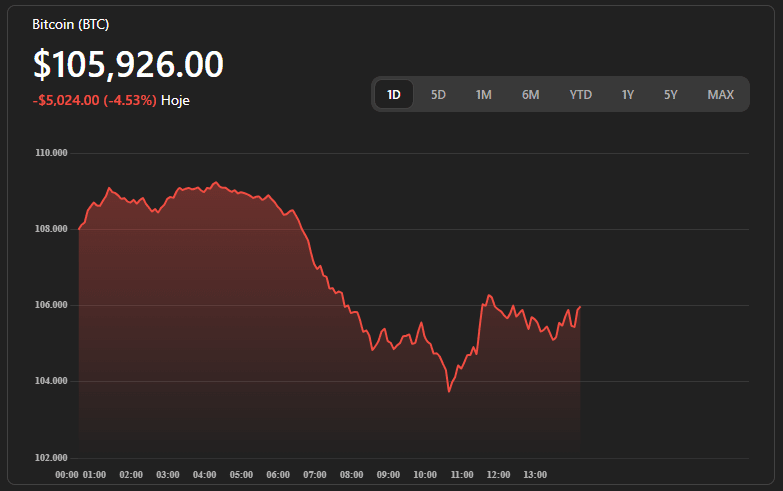

Currently, Bitcoin (BTC) is trading at around $105,926, with a decrease of approximately 4.5% on the day. In this article, we will break down:

- the factors that explain this new negative turnaround,

- the role of US banks in the crypto game,

- possible developments for the short and medium term,

- strategies for those investing or wishing to invest in crypto.

What does 'liquidations of $1.1 billion' mean?

Definition and context

Liquidations (or 'liquidations') refer to the forced closing of leveraged positions in the derivatives market. In other words: when the price of an asset moves against the investor who was trading on margin, the platform automatically closes the position to avoid larger losses.

When there is such a high volume of liquidations — like the recent $1.1 billion — it indicates that many traders were betting on the rise and were 'caught' by the drop.

The trigger: US banks

American banks can influence the crypto market in various ways:

- Increased risk aversion: negative news in the banking sector makes investors rush to safer assets.

- Regulatory actions: speeches or investigations by bodies like the SEC and the Federal Reserve create fear in the market.

- Macroeconomic movements: banking crises reduce liquidity and strengthen the dollar, which usually pushes Bitcoin down.

Whenever the US banking system shows signs of weakness — bankruptcies, collapses, or insolvency alerts — panic also hits the crypto market.

Main causes of the recent decline

1. Excessive exposure and leverage – Many traders use 10x, 20x leverage and end up being liquidated quickly.

2. Lack of liquidity – In times of stress, buyers disappear and small drops turn into large corrections.

3. Domino effect – A strong sell-off generates new drops and triggers more automatic liquidations.

4. External shocks – News of banks, high interest rates, and inflation in the US fuel fear.

5. Regulatory pressure – Expectations of new rules or restrictions directly affect market sentiment.

The role of US banks: why do they 'haunt'?

- Influence on the cost of money: interest rate decisions affect the global flow of capital.

- Global regulation: the US still sets the tone for crypto policies worldwide.

- Systemic risk: American banking crises affect all asset classes.

- Restrictive power: banks can limit the bridge between the traditional system and exchanges.

Possible scenarios

1. Moderate pessimist (more likely)

- Additional drops followed by partial recovery.

- Extreme volatility in the coming days.

- Increased regulatory pressure.

2. Optimistic (less likely, but possible)

- Institutional adoption continues strong.

- Clearer regulation reduces uncertainties.

- Improvements in the global economy favor risk assets.

3. Extreme risk

- A new bank failure could push Bitcoin to even lower levels.

Strategies for investors

1. Avoid high leverage – Protect your capital.

2. Manage risk – Set stop-loss and have reserves in stablecoins.

3. Think long term – Use strategies like 'dollar cost averaging'.

4. Follow the news – Changes in the US can dictate the direction of the market.

5. Plan exits – Know when to take profits or cut losses.

Conclusion

The recent liquidation of $1.1 billion shows that, even in a more mature market, the US banking system still has a significant influence on Bitcoin and other cryptocurrencies.

The interconnection between traditional banks and the crypto universe is real — ignoring it is a mistake. The investor who understands this dynamic, avoids leverage, and acts cautiously has a better chance of surviving and even profiting in the next phases of the cycle.