$BTC /USD are strongly bullish: the RSI (14-day) is approx. 74.8, moving averages (5-, 10-, 20-, 50-, 100-, 200-day) are all in “buy” configuration.

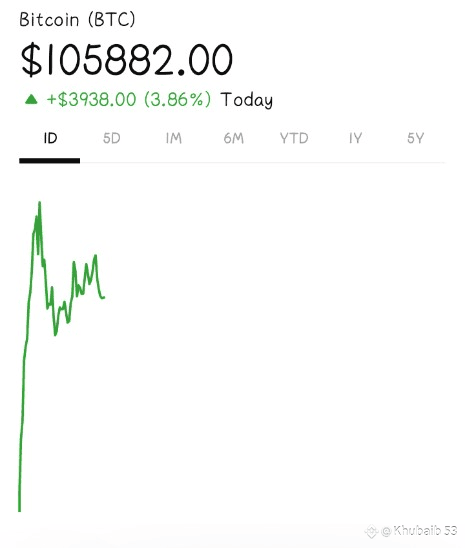

However, recent charting shows BTC is consolidating just above the ~$100 K mark after being rejected near ~$116 K.

Volume and open interest show some “flush” in bullish momentum, suggesting caution despite the strong indicators.

2. Key Support & Resistance Levels

Resistance: The ~$115 K–118 K region continues to act as a barrier; a clear breakout above this could trigger a renewed rally.

Support: The ~$100 K–104 K zone is crucial. If BTC loses this, it might retrace further downward.

Recent flows of institutional investment (notably spot ETFs) are acting as a tailwind for upside potential.

3. Market Narrative & Outlook

On the positive side: With ETF flows and institutional demand increasing, some analysts project targets of ~$120 K+ in the near term if momentum returns.

On the caution side: Some market participants argue the famous “four-year cycle” narrative may be losing reliability in this phase, which raises concern about upside sustainability.

The broader crypto market is somewhat correlated: weakness in Bitcoin tends to drag major altcoins with it.

4. Strategic Considerations for Developers & Tech-Focused Investors

For someone in your field (web design/development), consider how the narrative around Bitcoin (and crypto broadly) might influence payment integrations, blockchain-based services, and UX/UI decisions for crypto finance clients.

Given consolidation near key levels, it may be wise not to assume a runaway rally; plan interfaces or platforms with scenarios for both upside and downside crypto price moves.

Ensure risk management in any crypto-related feature: volatile moves in BTC can ripple into user behaviour (e.g., wallet holdings, deposit/withdrawal surges).

For content, dashboards or analytics widgets: consider showing live or near-live price bands (support/resistance) rather than static bullish assumptions.#ADPJobsSurge #BinanceHODLerSAPIEN #BinanceHODLerMMT #PrivacyCoinSurge