While retail traders have been reacting emotionally to the recent pullbacks, the blockchain tells a very different story. Large institutional wallets and strategy-linked addresses continue to accumulate quietly in the background.

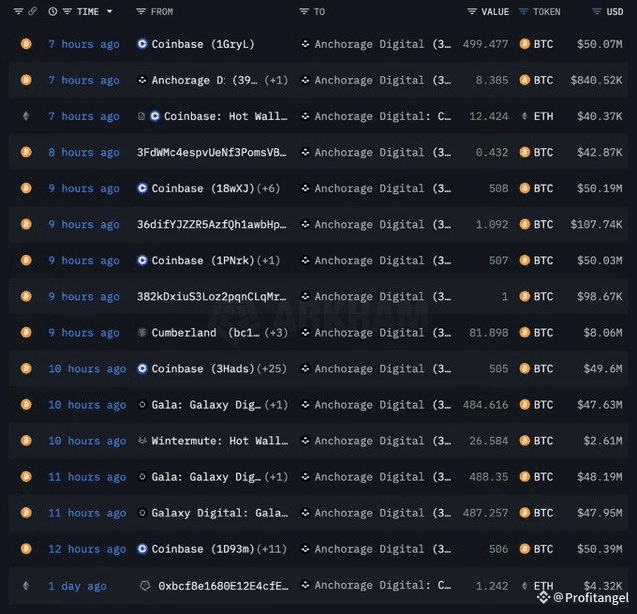

Here are the verified on-chain movements from the screenshots:

🟠 Bitcoin (BTC)

• Multiple Strategy (Prev. MicroStrategy) wallets moved hundreds to thousands of BTC per transaction — several transfers ranged between 883 BTC to 1,006 BTC, consistently across the last 24 hours.

• Whale-to-custody flows remain active, with Coinbase, Anchorage Digital, and Cumberland showing steady inbound BTC transfers such as:

499 BTC

508 BTC

507 BTC

484 BTC

487 BTC, etc.

These are not retail-sized moves — they are high-value, structured inflows.

🔵 Ethereum (ETH) & AETHWE

• The “Satoshi Era ETH Whale” received multiple large transfers of ETH and wrapped ETH versions (AETHWE):

110,101 AETHWE (~$379M)

47,222 AETHWE (~$161M)

19,508 ETH (~$61M)

16–19K ETH chunks repeatedly • Significant stablecoin inflows also landed in the same whale-controlled address, including $40M, $50M, and $80M USDT.

These movements show consolidation and accumulation, not distribution.

🟡 Stablecoin & Custody Inflows

• Aave, Binance hot wallets, and multiple null-address (mint) allocations point to fresh liquidity being positioned.

• Anchorage Digital, a major institutional custodian, received numerous deposits of BTC and ETH throughout the day — usually an indication of long-term storage, not selling.

𝐖𝐡𝐚𝐭 𝐓𝐡𝐢𝐬 𝐑𝐞𝐚𝐥𝐥𝐲 𝐒𝐮𝐠𝐠𝐞𝐬𝐭𝐬

This isn’t hype — it’s observable chain data:

✔ Big wallets are positioning.

✔ Custody platforms are receiving inflows, not outflows.

✔ Whale addresses continue to accumulate during volatility.

✔ Retail is reacting emotionally, institutions are acting strategically.

Every cycle has the same pattern:

Fear at the bottom… accumulation in silence… then the trend continues.

This time is no different. #MarketPullback