Title: 🚨 $BTC ALERT: Institutional Whales Accumulating Amid Consolidation? Why the Smart Money is Buying!

📉 Market Snapshot: Side-ways Movement & Fear

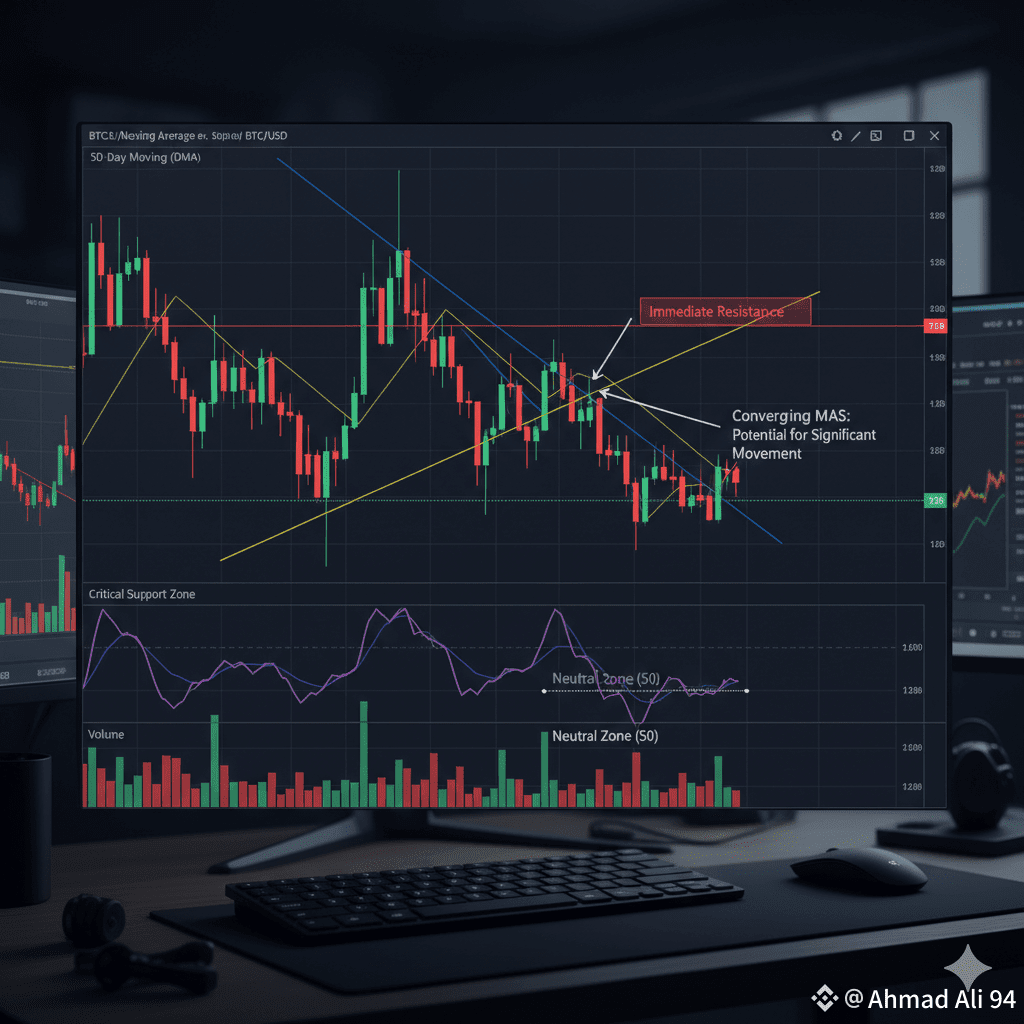

Bitcoin ($BTC ) is currently locked in a tight consolidation range between $96,000 and $103,000. Despite this sideways action, the market sentiment remains dominated by "Extreme Fear," keeping many retail traders on the sidelines.

Bearish Signs: The lingering threat of a Death Cross pattern on the charts continues to signal short-term weakness.

Critical Support: The $94,000 - $96,000 range remains a crucial psychological and technical support level that must hold.

🐋 The Big Picture: Institutional Confidence

Despite the price weakness and retail fear, institutional behavior suggests a strong long-term conviction:

ETF Inflows Resilience: After record daily outflows (including one day hitting $870M), the recent data shows a modest increase in ETF net inflows. This suggests that major institutional players are viewing the price dip as a buying opportunity, defying the general market fear.

Corporate Conviction: Figures like Michael Saylor of MicroStrategy have vehemently denied selling $BTC , emphasizing their strategy of aggressive accumulation. Such corporate backing provides a foundation for market stability.

Ecosystem Integration: Major players like BlackRock continue to show long-term commitment, highlighting a steady pace of institutional integration within the crypto ecosystem.

💡 Conclusion and Strategy

BTC is likely in a mid-cycle consolidation phase, taking a breather before its next major move. While short-term volatility persists, the underlying fundamental conviction from institutions remains solid.

Watch Out: A decisive break below the $94,000 support would be a major bearish trigger.

Strategy: View the current consolidation as a "buying opportunity at a discount," provided you strictly adhere to risk management principles.

#StrategyBTCPurchase #MarketPullback #TrumpBitcoinEmpire #CFTCCryptoSprint