$LISTA If you want to arbitrage, and you need his low-interest loan, he might want your principal or your life.

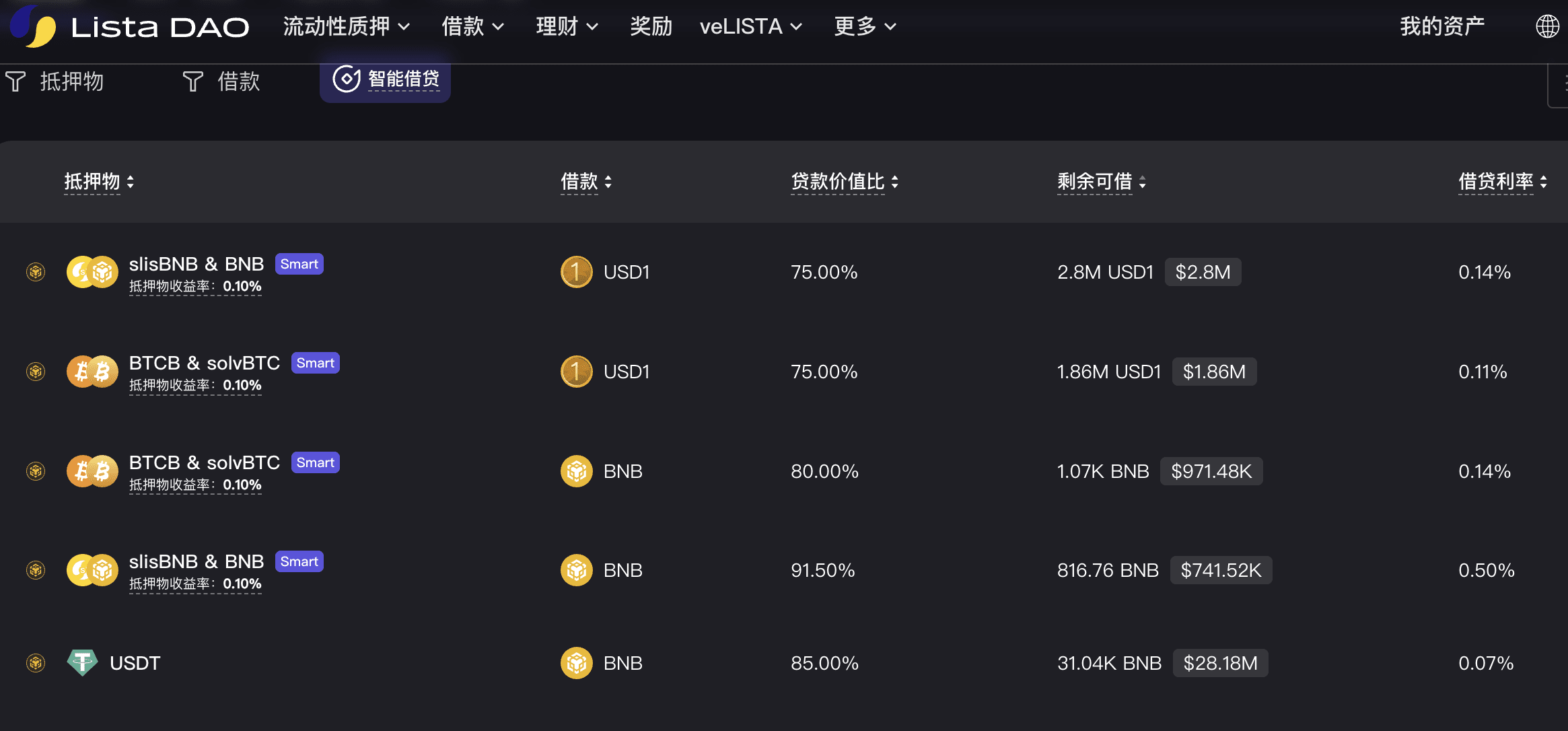

Now on Lista, you can exchange BNB for slis BNB, enjoy an annual yield of 12%, and simultaneously borrow USD1 at an annual low interest of 0.14% to reinvest in buying BNB. Then... mortgage and borrow again, infinitely nesting.

This model seems to have a guaranteed profit, but there are significant liquidation risks.

1. slis BNB annual yield of 12% comes from obtaining BNB airdrops, BNB deflation, BNB staking node earnings, etc.;

2. The source of the low-interest borrowing of USD1 at an annual rate of 0.14%: this USD1 belongs to algorithmic stablecoins, not WLFI (Trump)'s USD1, so there is a risk of decoupling, and it will definitely happen. Once the scale reaches a certain level, it will inevitably decouple.