Recently, a very interesting phenomenon has appeared in the cryptocurrency market:

The Solana spot ETF has experienced the largest capital outflow in history, while the XRP ETF has absorbed 90 million dollars in one go.

Funds are starting to be reshuffled, and market sentiment is changing accordingly. Let's quickly understand what has happened below 👇

The Solana ETF has seen record outflows, but the SOL price has rebounded against the trend.

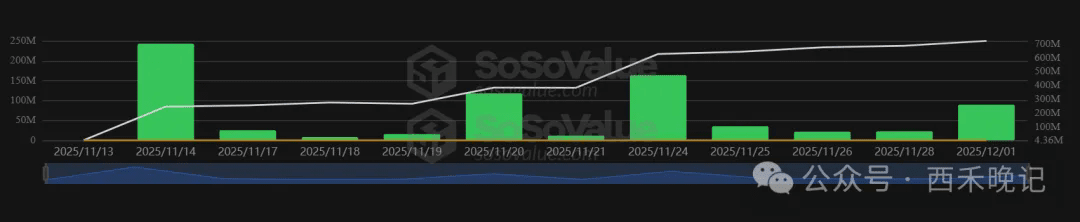

According to SoSoValue data, the Solana spot ETF recorded a capital outflow of 13.55 million dollars on December 2 — the largest since its listing.

Among them:

21Shares Solana ETF (TSOL) redeemed 32.54 million dollars in a single day

TSOL has accumulated a net outflow of $60.14 million since its establishment

However, there is also good news:

Bitwise's BSOL and Grayscale's Solana ETF still recorded inflows on the same day, and institutional interest has not completely disappeared.

And more subtly:

SOL's price surprisingly rebounded by over 3%, returning to around $127.

This indicates that the short-term selling pressure has not crushed market confidence, but the slight drop in trading volume suggests that retail sentiment remains cautious.

XRP ETF is strongly attracting capital: Institutions net bought $90 million

In stark contrast to Solana, the net inflow of XRP spot ETF reached as high as $90 million, marking the fourth largest single-day inflow since its launch.

Main contributions come from:

Grayscale GXRP: $52.3 million inflow (leading)

Franklin Templeton's XRPZ: $28.41 million

Canary Capital XRPC: $5.79 million

Bitwise XRP ETF: $3.15 million

In the context of shrinking trading for Bitcoin and Ethereum ETFs, institutions are clearly looking for new growth points, and XRP is a hot candidate.

On-chain data: The whales haven't run away, but are 'changing hands'

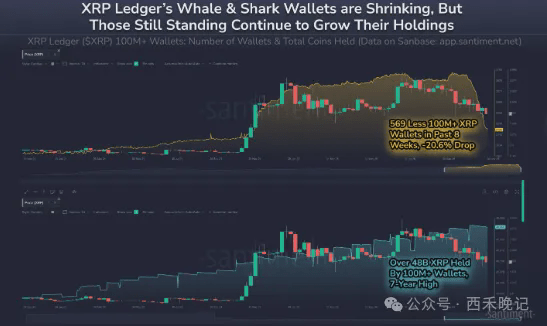

Santiment data shows:

The number of XRP whales and sharks has decreased

The number of super whales holding more than 100 million XRP is at a 7-year high, controlling 48 billion XRP

This indicates:

👉 Selling comes from small holders

👉 The real big players are strengthening their control

Moreover, TD Sequential has given a weekly buy signal, and the market's bullish expectations for XRP are beginning to rise.

Currently, XRP is fluctuating around $2.01, with a strong short-term trend.

Summary: Funds are changing direction, the market is changing its main character

This wave of ETF fund flow reveals three important signals:

Some funds have withdrawn from SOL, but overall institutional interest remains

XRP is becoming a new potential coin in the eyes of institutions

The market is looking for new leaders after the weak period of BTC/ETH

The current situation is very clear: