what’s risky, and what to watch in the coming weeks.

📊 What’s going on with SOL recently

✅ What’s looking positive

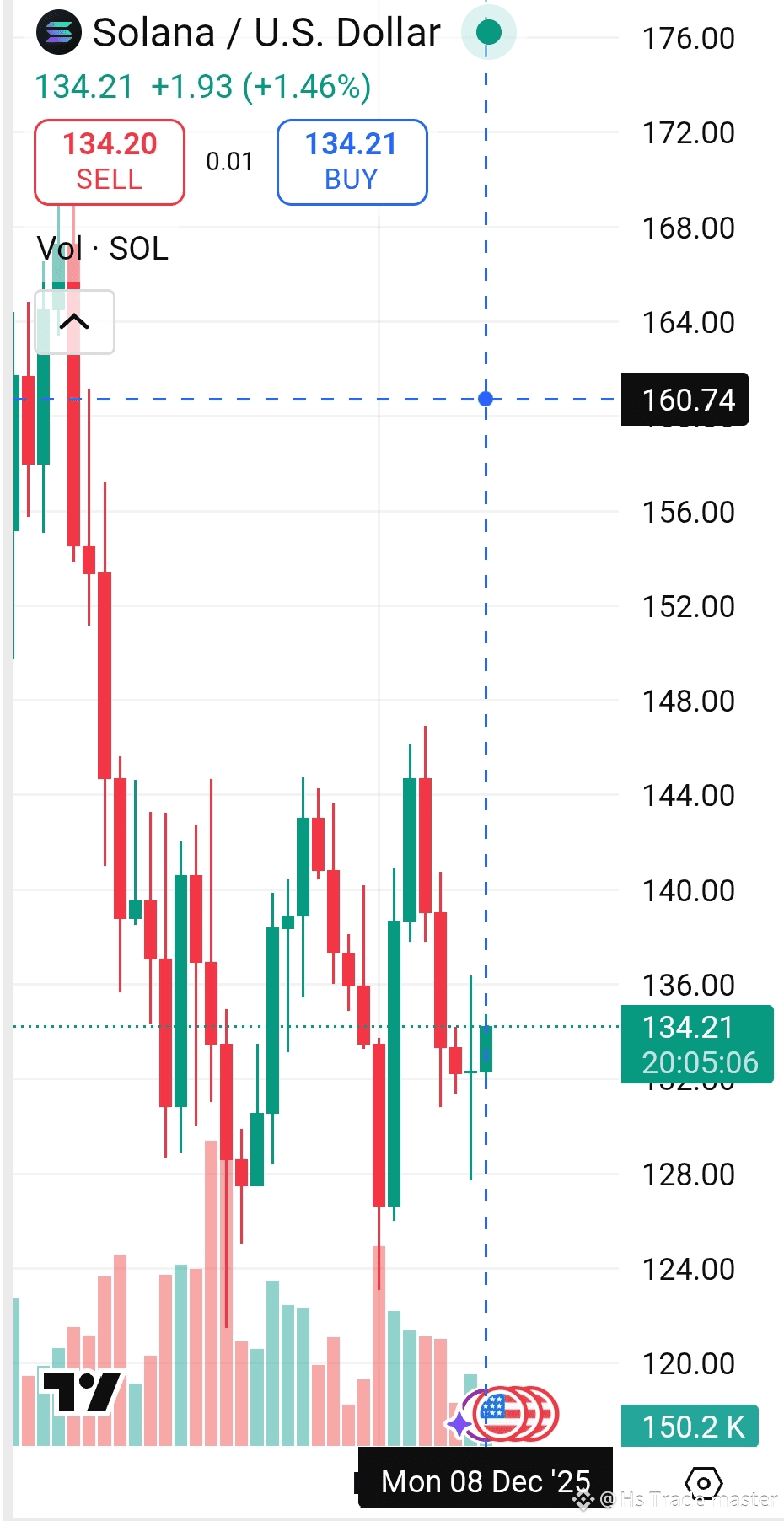

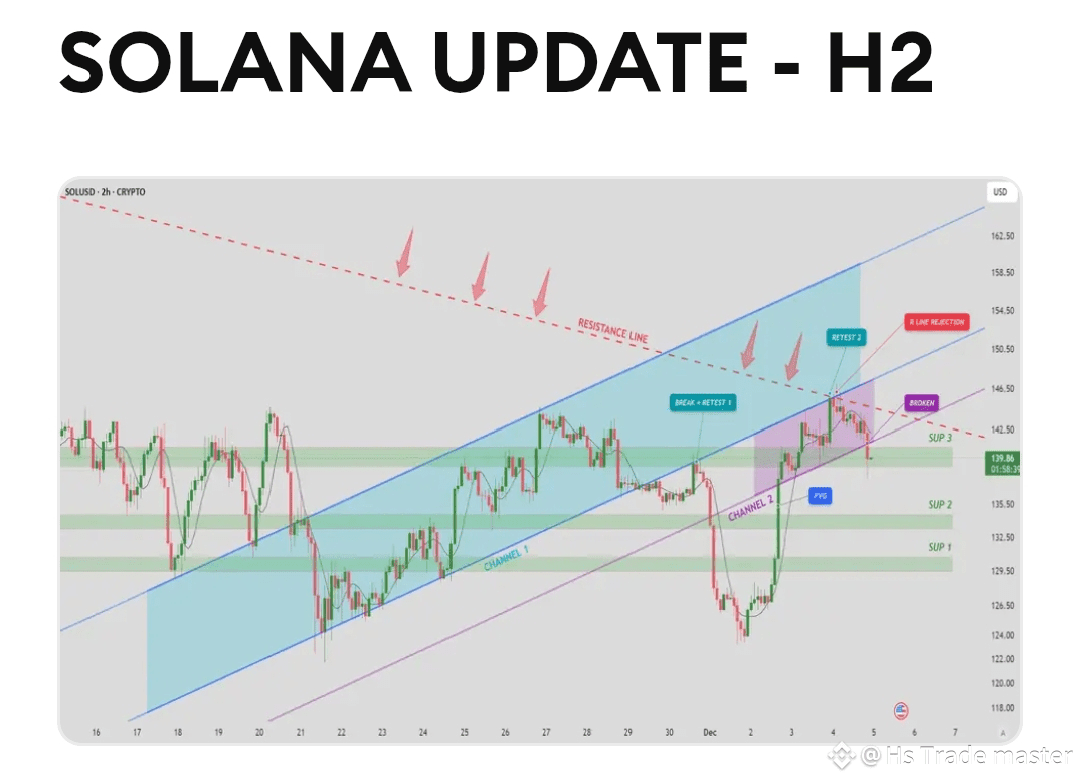

According to a recent technical breakdown, SOL is “stabilizing above a key support zone,” around $133, and some oscillators + Fibonacci-level signals suggest a possible bounce toward $172–$180.

Longer-term, bullish scenarios remain alive: one forecast (assuming favorable conditions) targets $190–$200 by end of 2025.

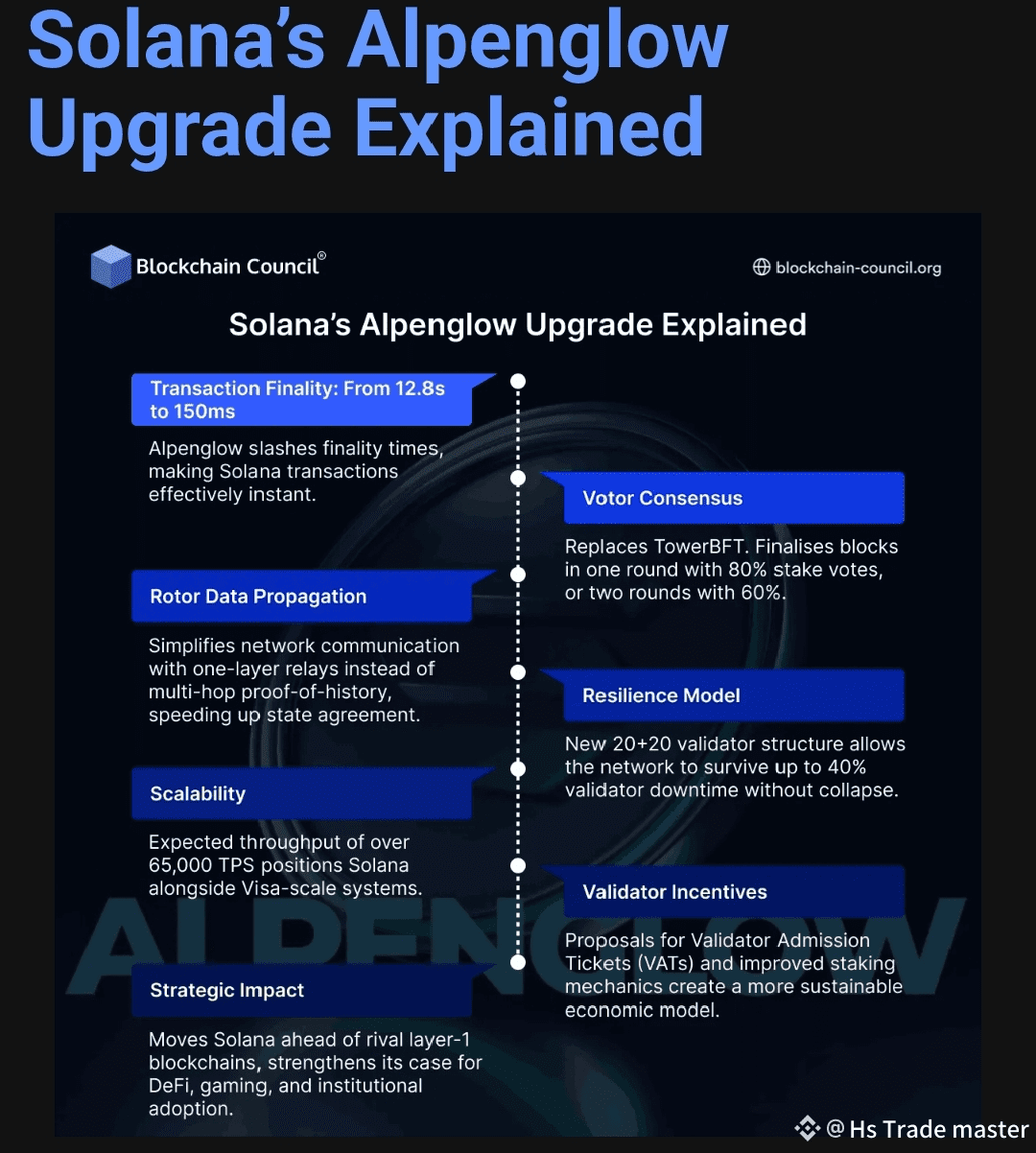

Beyond just price, the underlying blockchain fundamentals appear to be improving: network upgrades (like the described “Firedancer” validator client and consensus improvements, per recent coverage) aim to enhance throughput, scalability and resilience — a structural plus if adoption or on-chain activity picks up.

⚠️ What could go wrong / current headwinds

On the technical side: one analysis flags a strong resistance at around $144–$145. If SOL fails to break convincingly above that, there’s a risk of a drop toward $130.

Some models remain cautious or bearish: one forecast warns that selling pressure might persist if major support/resistance zones are violated.

The broader crypto sector remains volatile — macroeconomic conditions, regulatory shifts, or broader sentiment swings (especially tied to larger assets) could drag SOL down even if its fundamentals remain sound.

🔮 What might happen next — Scenarios for SOL

ScenarioWhat could trigger itPossible price rangeBullish / RecoverySOL reclaims $144–145 resistance, positive adoption news or ecosystem upgrades, bullish market sentiment returns$180–$200 (possibly higher if momentum strong) Base / ConsolidationSOL remains stuck in current range, market stays neutral, no big catalysts$130–$150 — consolidation, sideways price action Downside / RiskKey support fails, negative macro/market-wide shocks, weak demand or outflowsPotential dip toward ~$120–$130

🧠 What to Watch — Key Indicators & Catalysts

Whether SOL can break and hold above ~$144–145, which seems to be a strong resistance zone.

Confirmation via technical signals: e.g. momentum indicators turning bullish, moving averages, or volume picking up.

Ecosystem developments — network upgrades, adoption in real-world apps or DeFi, increased on-chain activity, institutional interest. Positive developments here could reinforce bullish scenarios.

Broader macro / crypto-market sentiment: regulation, macroeconomic news, big-cap crypto performance — as these affect general risk appetite and alt-coin flows.

If you like — I can pull up 3 different price-scenarios for SOL for 2026 (bearish, base-case, bullish), with probabilities (low / medium / high) and what key triggers you should watch.

#solana #CPIWatch #BinanceBlockchainWeek