$BTC 🔹 Bitcoin (BTC) – Current Situation & Market Analysis

Bitcoin recently reached an all-time high of around ≈ US$126,000 in October 2025.

Since that peak, BTC has pulled back significantly — the downturn was driven by macroeconomic pressure, shifting investor sentiment, and profit-taking after the rally.

Northeastern Global News

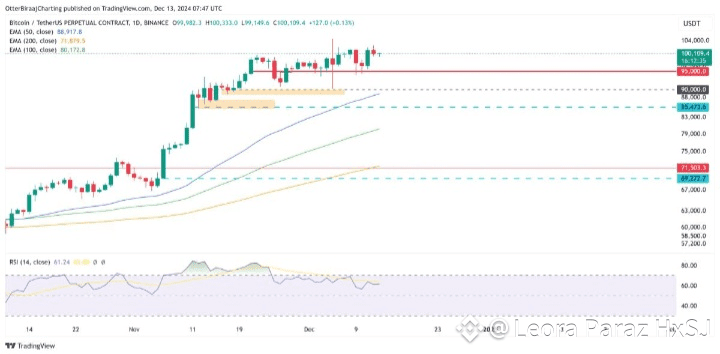

As of early December 2025, BTC seems to be consolidating, with valuations oscillating around the US$85,000–US$92,000 range.

🧭 What the Chart & Technical Signals Show

The chart shows Bitcoin price bouncing around a support zone: after the sharp drop, the price appears to be finding some stability — indicating that selling pressure might be easing off.

This consolidation suggests a “reset” phase, where the market digests the earlier rally and awaits new catalysts (macro events, institutional inflows, or market sentiment shifts).

Given Bitcoin’s fixed supply (21 million coins), supply-demand dynamics remain favorable: if demand rises (for example driven by institutional buyers or macro hedging demand), reduced sell pressure could re-ignite upward momentum.

🔮 What Could Happen Next — Bullish & Cautious Scenarios

Bullish case: If market sentiment recovers and external conditions improve (e.g. favorable macroeconomic news, institutional inflows, renewed demand), BTC could bounce back toward US$110,000–US$130,000 over the next few months — essentially re-testing previous highs or setting new ones.

Base case / consolidation: Bitcoin could remain stuck in a range between US$85,000 and US$95,000, as the market absorbs volatility while investors wait for clearer signals.

Cautious / bearish case: If macroeconomic headwinds intensify (e.g. interest-rate hikes, global economic stress, tighter liquidity), BTC might test lower support levels around US$75,000–US$80,000, as risk-off sentiment pushes investors away from volatile assets.

📈 Why Bitcoin Still Holds Strength, Despite Volatility

Bitcoin’s underlying scarcity — capped supply — continues to be a major long-term bullish factor.

In 2025, increased institutional adoption and macro shifts (inflation concerns, search for non-sovereign assets) have reinforced BTC’s role as “digital gold” for many investors.

Also, improved infrastructure — wider exchange access, regulatory clarity in some regions, and growing acceptance among financial institutions — supports Bitcoin’s long-term legitimacy.

🧠 My View: Watchful, But Bitcoin Remains a Core Hold

Bitcoin is in a volatile yet potentially pivotal phase — the recent decline was steep, but the consolidation suggests that the market might be preparing for a next move. For long-term investors or traders with moderate risk tolerance, this could be a good time to stay alert: if macro conditions improve or demand returns, BTC may rally again.

That said — because volatility remains high — it’s wise to approach with caution: don’t expect smooth upward trends; instead, prepare for swings, and use disciplined entry/exit strategies if trading.

#BinanceBlockchainWeek #BTCVSGOLD #BTC86kJPShock #TrumpTariffs #USJobsData