🔹 Gravity (G) — What’s the deal

G is the primary token for the Gravity blockchain — a new Layer-1 chain — and also serves as the utility token for the broader Web3 ecosystem by Galxe.

It works both as a native “gas” token (for transaction fees on Gravity chain) and as a utility/governance token for the existing Galxe ecosystem (for services like identity, user incentives, dApp access, etc.).

Tokenomics & Utility

Total supply: 12 billion G. docs.

Uses: paying gas fees, staking (to help secure the network), governance/voting (via what they call “G DAO”), and payments within Galxe’s suite of applications (quests, identity, dApps, etc.).

G aims to provide a unified experience: once you hold G, you can use it across both the blockchain layer and application layer — bridging infrastructure and user-facing services.

Why it matters (or claims to)

Gravity positions itself as a high-performance blockchain: built for “omnichain” transactions — enabling cross-chain settlement, high throughput, and fast finality.

The idea is to make Web3 more seamless: users and developers don’t have to juggle many tokens for different chains/apps — G is meant to cover both infrastructure (blockchain) and applications (Galxe suite).

👉 Bottom line: G is something of a “bridge-coin” between base-layer blockchain and real-world use within the Galxe ecosystem. Its potential depends heavily on whether Gravity chain and Galxe ecosystem gain wide adoption.

🔹 Axelar (AXL) — Cross-Chain Connectivity Backbone

What is Axelar / AXL

What is Axelar / AXL

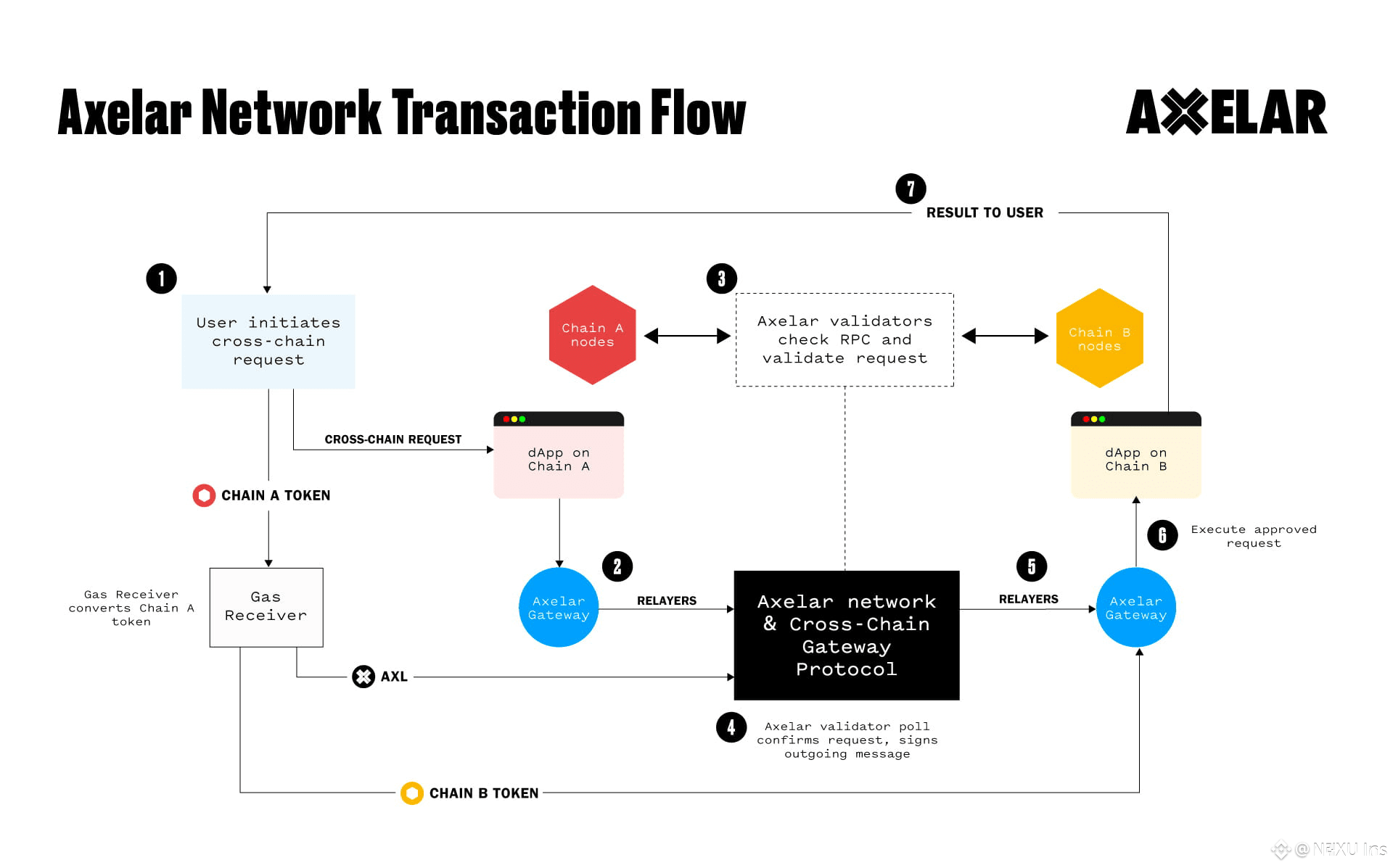

Axelar is a decentralized cross-chain infrastructure network: its job is to allow secure interoperability — meaning it helps different blockchains talk to each other, transfer assets/data, run cross-chain smart contracts, etc.

AXL is the native token of Axelar. It fuels the network: used for fees, staking, validator incentives, and more.

Tokenomics & Utility

Circulating supply: around 1.08 billion AXL.

Use cases:

Pay for cross-chain transaction fees (gas/bridge fees) when assets or data move through Axelar.

Stake AXL to participate as a validator / secure cross-chain operations — validators are rewarded in AXL.

Governance: token holders / delegators can vote on network proposals, upgrades, parameter changes, etc.

Recent Developments & Strengths

Axelar recently rolled out an upgrade (“Cobalt”) that changed its tokenomics: now, a large portion of cross-chain transaction fees are burned — making AXL more deflationary and potentially raising token value over time.

Axelar continues expanding — it supports many blockchains (EVM and non-EVM), making it a backbone for multi-chain DeFi, cross-chain bridges, cross-chain asset transfers, etc.

👉 Bottom line: AXL (and Axelar) aims to be one of the “plumbing” layers of Web3 — making cross-chain interoperability smooth and secure. Its long-term value hinges on adoption by developers and cross-chain projects.

🔹 Hyperlane (HYPER) — The Messaging & Cross-Chain Infrastructure

What is Hyperlane / HYPER

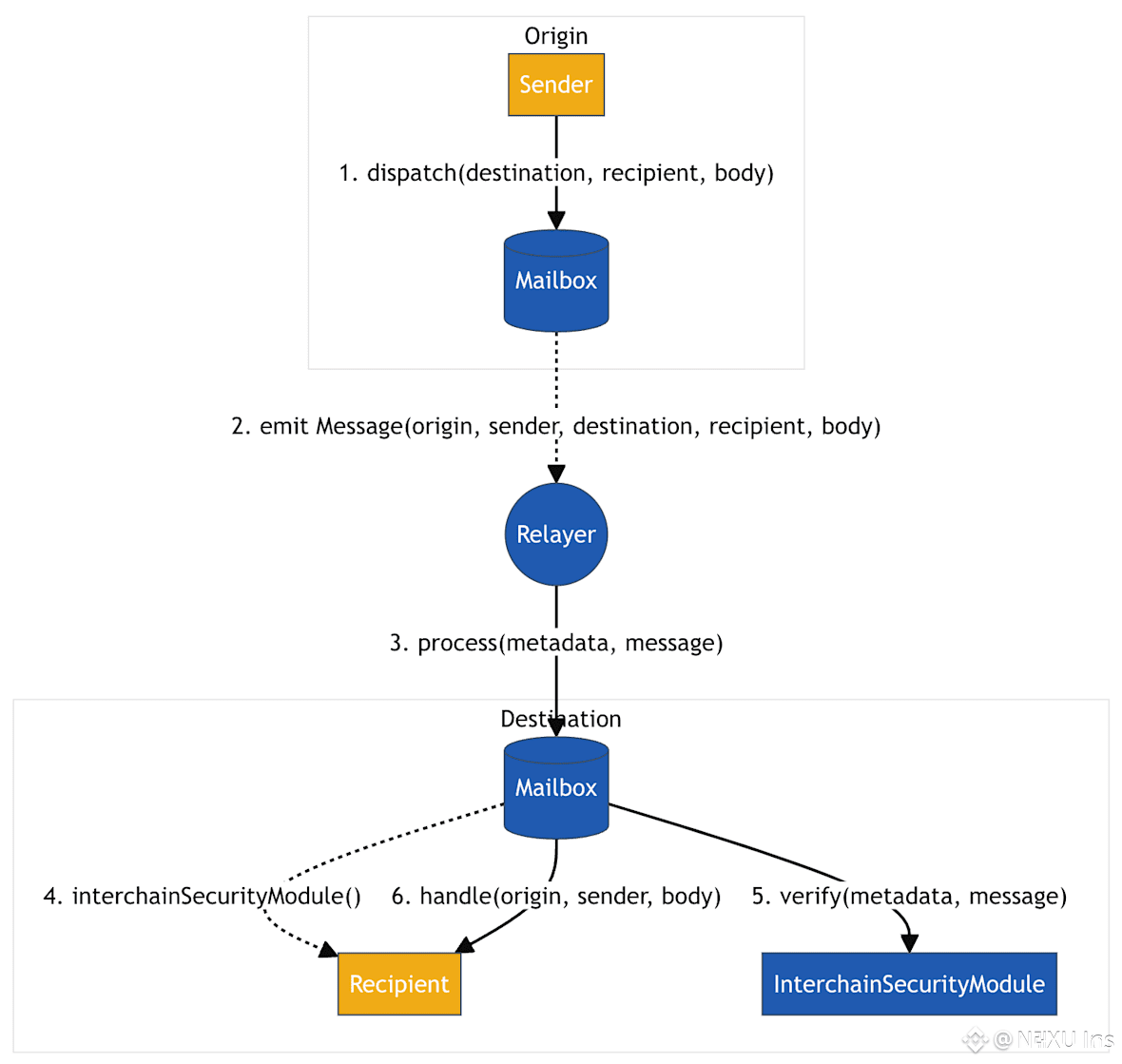

Hyperlane is a permissionless interoperability protocol — think of it as a messaging/bridge infrastructure that connects many blockchains: enabling cross-chain communication, data transfers, asset transfers, and cross-chain smart-contract calls.

HYPER is the native token of Hyperlane. It powers staking, validator incentives, governance, and helps secure the cross-chain operations.

Supply & Tokenomics

Total supply: capped at 1 billion HYPER. XT.com+2ICO Analytics+2

Circulating supply (as of recent data): ~ 205–206 million HYPER.

Allocation: At launch / TGE (token generation event), about 57% of supply was allocated to the community, while 25% to core team, 10.9% to investors, and 7.1% to foundation treasury.

What Hyperlane does / Why it exists

It offers cross-chain messaging & asset transfers across a large number of blockchains (hundreds), supporting different Virtual Machines (EVM, Solana, CosmWasm, etc.) — enabling even cross-VM interoperability.

For developers: they can build interoperable apps without building custom bridges for each chain pair. For users: easier bridge or cross-chain experience.

HYPER token underpins security and governance: staking HYPER helps validators secure message relays, and token holders can participate in governance and network decision-making.

What to watch out for / Risks

As with most interoperability protocols, success depends on how many chains & projects adopt Hyperlane. If adoption is low, utility (and thus demand for HYPER) could stay limited.

Token’s value has been volatile: last all-time high was much higher than current price (so downside risk).

👉 Bottom line: Hyperlane is aiming to be a universal “inter-chain communication highway.” If Web3 continues to fragment across many chains, Hyperlane could become highly useful — but it’s still early, and value depends on broad adoption.

⚠️ Common Themes — What to Keep in Mind

All three — G, AXL, HYPER — are infrastructure-level or cross-chain-oriented tokens, not simple “meme” or trend-coins. Their long-term prospects depend more on technology adoption and ecosystem growth than on hype.

That means utility and adoption matter more than price swings. If the respective blockchains/protocols stay active and used, there’s potential. If not — risk of stagnation.

Interoperability + multi-chain compatibility is increasingly important if Web3 keeps fragmenting. So tokens like AXL and HYPER might benefit from that trend.