JP Morgan has successfully arranged one of the first-ever debt issuances on a public blockchain, executing a US Commercial Paper offering for Galaxy Digital Holdings LP on the Solana network.

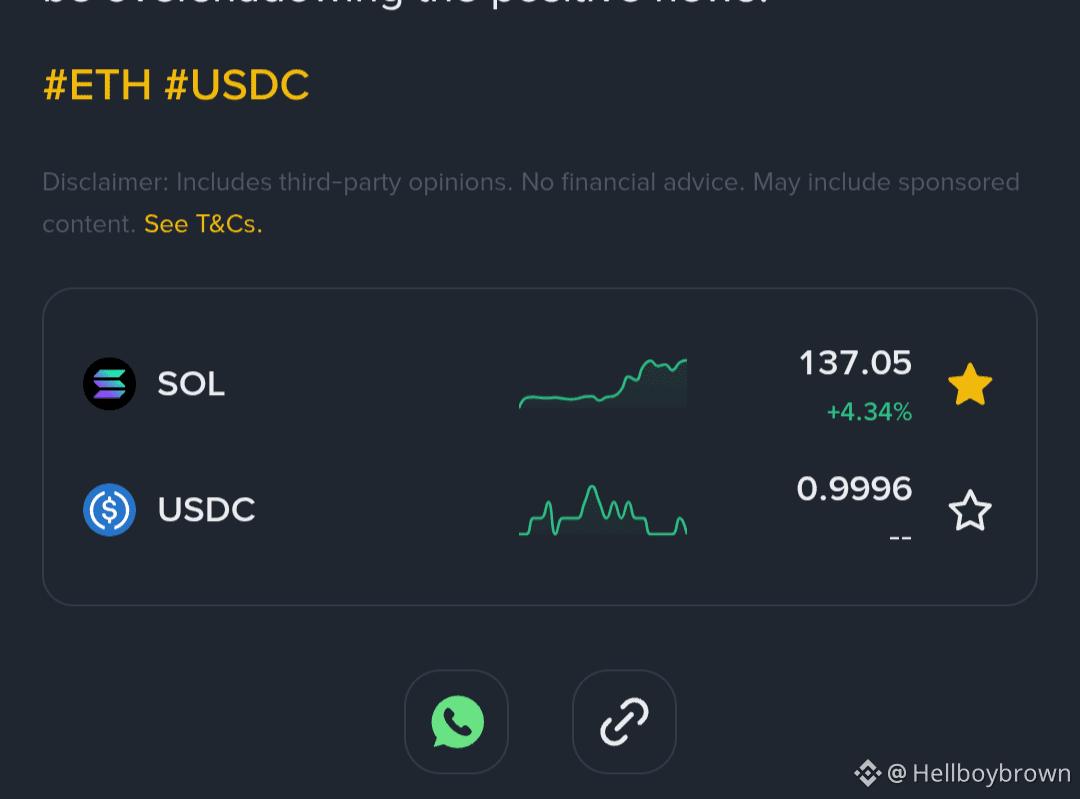

The transaction, announced December 11, was purchased by Coinbase and Franklin Templeton, with all settlement conducted in Circle’s USDC stablecoin—a first for the commercial paper market.

Wall Street No Longer Experimenting

The deal represents a significant departure from JP Morgan’s previous blockchain strategy, which relied primarily on its private Onyx network and JPM Coin. By choosing Solana’s public infrastructure, the Wall Street giant has effectively validated the network’s capability to handle institutional-grade financial products.

“This issuance is a clear example of how public blockchains can improve the way capital markets operate,” said Jason Urban, Global Head of Trading at Galaxy. Franklin Templeton’s Head of Innovation Sandy Kaul added that institutions are no longer just experimenting with blockchain—they’re “transacting on it in a big way.”