I want to be honest with you. I’ve seen people stuck in impossible situations with their crypto. They hold something they truly believe in, but when life throws a curveball, they’re forced to sell at the worst possible moment. That feeling of having to choose between your financial freedom and your beliefs is painful. Falcon Finance is trying to change that. I’m genuinely excited about what they’re building because it feels like a real solution for people who want control, flexibility, and stability all at once.

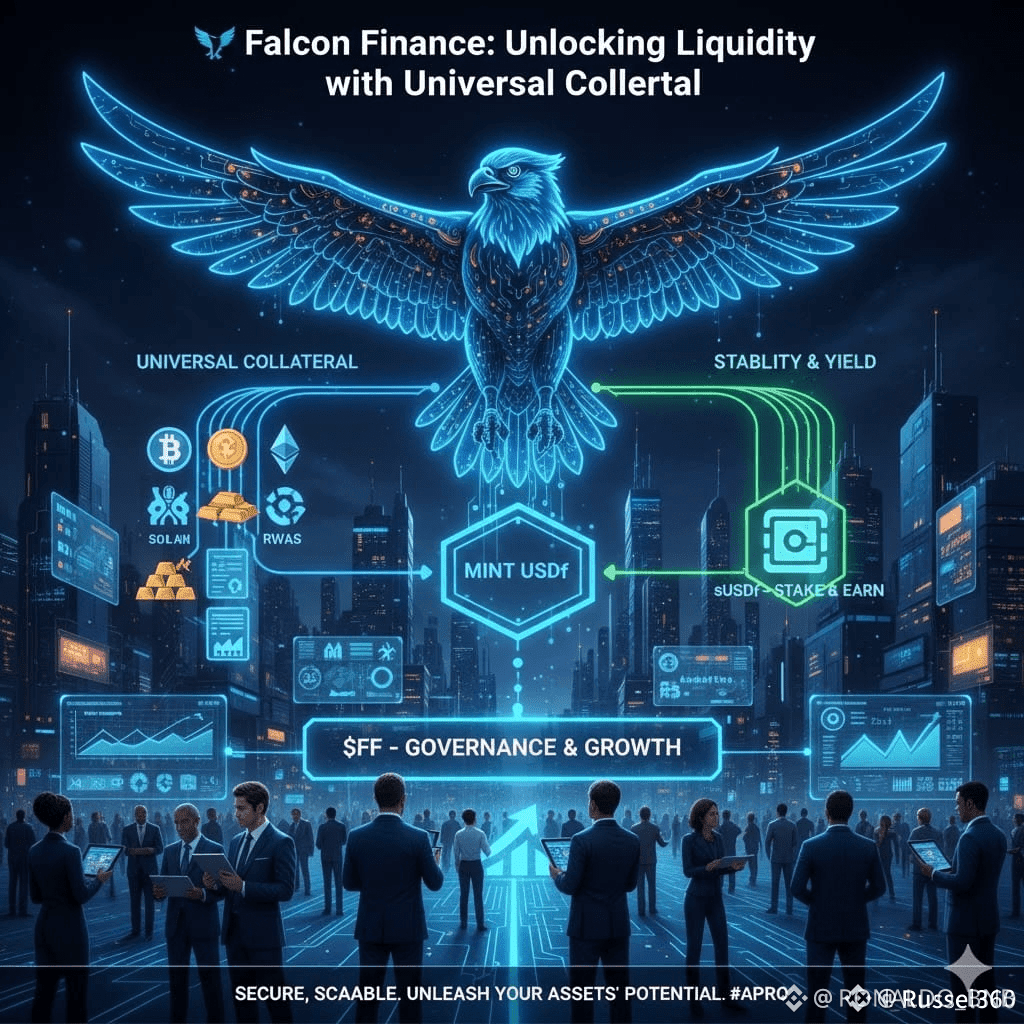

They’re creating something called a universal collateralization infrastructure. In simple terms, it’s a system where your assets, whether crypto tokens or tokenized real-world items, can work for you without you having to give them up. You lock them in, and you can mint a synthetic dollar called USDf. This dollar is fully usable on-chain, overcollateralized, and stable. That means you get liquidity without selling your cherished assets.

Why This Matters to Me and Maybe You

If you’re like me, you hate feeling forced. Forced to sell, forced to panic, forced to miss out. Falcon Finance gives you a choice. I can hold what I love and still access liquidity if I need it. Whether it’s paying bills, seizing an opportunity, or funding a project, I don’t have to sacrifice ownership. That’s freedom, plain and simple.

Imagine holding a token you know has huge potential. Suddenly, you need cash. Normally, you’d sell, losing potential upside. With Falcon, you can mint USDf using your token as collateral. You keep your original token, and your money is ready to move. That’s the kind of empowerment I think about when I see this project.

How Falcon Works: The Heart of the System

They’re not building just another stablecoin. They’re building a foundation that can take almost any liquid asset and let it become collateral. Here’s how it comes together:

Collateral Variety

They accept crypto tokens, wrapped versions, and even tokenized real-world assets like bonds, real estate shares, or invoices. Each asset has a risk factor determining how much you can mint. Safer assets give better ratios. Newer or more volatile ones are treated cautiously.

Overcollateralization

To mint USDf, you must lock more than you borrow. That buffer protects both you and the system. For example, locking $150 worth of a crypto token might let you mint $100 USDf. Lock $200 worth of a real-world tokenized asset, and you might mint $100 USDf. The exact numbers vary, but the idea is clear. Safety first.

Oracles and Pricing

The system relies on accurate pricing. Decentralized oracles and curated feeds make sure the numbers you see reflect reality. If I were designing it, I would combine multiple feeds and add sanity checks to prevent sudden crashes or fake data from triggering liquidations.

Liquidation Mechanics

If collateral value drops below a threshold, the system triggers liquidation. Falcon plans to make it smart. Partial liquidations happen first so you’re not wiped out over minor swings. Liquidators are incentivized, and part of the penalty strengthens the USDf peg.

Collateral That Earns While You Hold

One thing I love is that your locked collateral doesn’t have to sit idle. Interest-bearing tokens or wrapped vault shares can keep generating yield. That yield can either flow back to you or support the protocol. Imagine locking your asset and watching it work for you in multiple ways.

Composability and Open Access

Falcon is designed as a foundation for other products. Lending, yield farming, derivatives, or AMMs can integrate with USDf. They’re creating an ecosystem where everything can interact naturally.

Real-World Assets

Tokenizing real-world assets is tricky because of legal complexity, but Falcon plans to pair with trusted partners, custodians, and legal frameworks. That’s the only way to make real-world assets truly usable on-chain.

Tokenomics That Feel Fair

Here’s how I imagine a healthy, organic structure:

Total supply: 1 billion tokens

Ecosystem and partnerships 20 percent

Liquidity incentives and staking rewards 20 percent

Team and founders 15 percent with vesting over four years and one-year cliff

Seed and strategic investors 15 percent with staggered unlocks

Public sale and launch liquidity 10 percent

Treasury and reserves 10 percent

Community allocations and airdrops 10 percent

Tokens are used for governance, staking, fee discounts, liquidity incentives, and as a backstop in emergencies. Everything is designed to align long-term incentives, not just quick gains.

A Roadmap That Makes Sense

If they do this carefully, it can work. Here’s what I’d expect:

Testnet Alpha with core contracts and community testing

Security Audits and Bug Bounties

Mainnet Beta with a conservative collateral list and tight risk controls

Liquidity Incentives and Integrations with AMMs and staking programs

Real-World Asset Pilots with legal wrappers and small-scale adoption

Cross-Chain Expansion with secure bridges

Gradual Governance Decentralization with DAO safeguards

Broad Ecosystem Growth encouraging builders to use USDf for lending, payroll, and more

Real-Life Examples That Hit Home

I want this to feel personal. Here’s why it’s different:

I own $3,000 of a token I believe in. I need $2,000. Normally I sell, losing potential upside. With Falcon, I lock my token, mint USDf, get my $2,000, and still hold the token.

A small studio holds NFTs for revenue. They tokenize a few NFTs and mint USDf to pay staff, keeping ownership intact.

An investor with tokenized bonds borrows USDf for market-making, without selling bonds.

These aren’t abstract ideas. They’re real-life ways Falcon can protect what you care about while still giving you liquidity.

Risks They’re Honest About

I’m excited, but I also think clearly about risk:

Smart Contract Bugs can happen even with audits

Oracle Manipulation could trigger unfair liquidations

Liquidity and Peg Risk if USDf loses confidence

Real-World Asset Legal Risk from custody and compliance issues

Centralization Risk if a few validators or custodians control too much

Governance Attack if token holders manipulate votes

Bridge Risk with cross-chain movement

Economic Attacks like flash loans or oracle manipulation

This is not a get-rich-quick system. The reward comes if they execute carefully and build trust.

Why I’m Watching Falcon Finance

I’m rooting for projects that protect ownership, empower users, and treat assets as more than numbers. Falcon is trying to give people optionality, stability, and flexibility. If they get audits right, oracles right, RWAs legally right, and governance right, this project could be a meaningful piece of the on-chain economy.

They’re not promising a miracle, but they’re promising a better way to use what you already have. That’s why I’m paying attention.

If the project seeks exchange liquidity, listing on Binance could provide wide access and deep liquidity for both USDf and the protocol token.