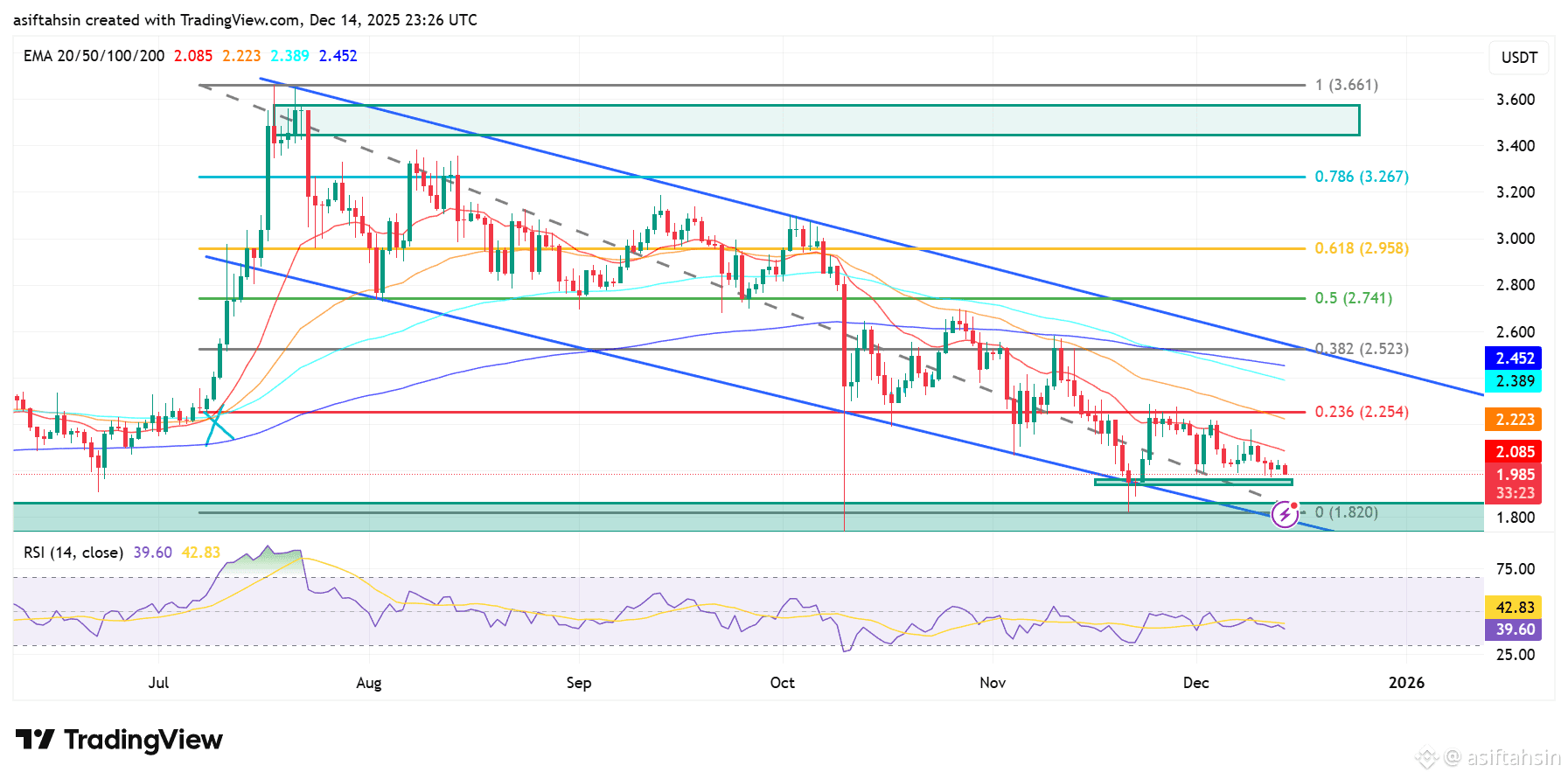

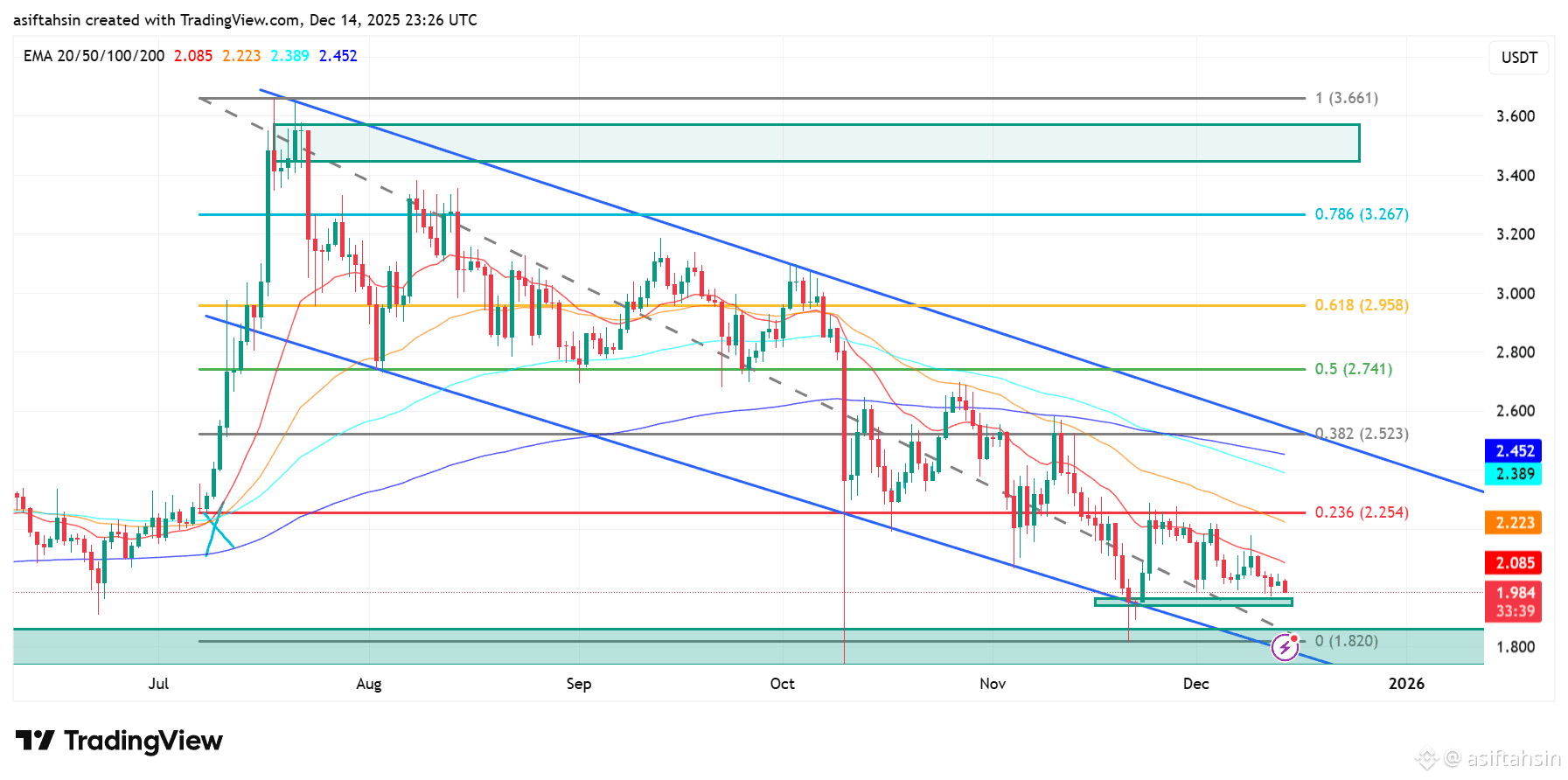

XRP remains under bearish pressure, trading inside a well-defined descending channel after a strong rejection from the $3.45–$3.65 supply zone, where price topped near the Fib 1.0 level. This rejection marked a macro distribution phase and initiated a sustained downtrend.

The decline accelerated once XRP lost the $2.95–$2.74 region (0.618–0.5 Fib), pushing price decisively below all major EMAs, confirming continued bearish dominance.

EMA Structure (Bearish Alignment)

20 EMA – $2.085

50 EMA – $2.223

100 EMA – $2.389

200 EMA – $2.452

All EMAs are sloping downward and stacked above price, meaning every bounce continues to face strong dynamic resistance.

XRP is currently consolidating near the $1.85–$1.90 major demand zone, which aligns closely with the Fib 0 level at $1.82. This zone has historically acted as strong support, and current price action suggests selling pressure is slowing, increasing the probability of a short-term relief bounce within the channel.

For bulls, the first critical level to reclaim is $2.25 (0.236 Fib). A daily close above this level would signal early stabilization. A stronger recovery would require XRP to break above $2.52 (0.382 Fib) and then reclaim $2.74 (0.5 Fib) — a zone that previously acted as strong support and is now heavy resistance.

A full trend reversal would only be confirmed if XRP regains $2.95 (0.618 Fib) and breaks out of the descending channel — a scenario that currently remains unlikely without broader market strength.

On the downside, losing the $1.82 support would invalidate the current base structure and expose XRP to $1.60–$1.50, where deeper historical demand resides.

RSI is currently around 39, indicating weak momentum, but not deeply oversold — consistent with consolidation rather than panic selling.

📊 Key Levels

Resistance

$2.085 (20 EMA)

$2.223 (50 EMA)

$2.254 (0.236 Fib)

$2.523 (0.382 Fib)

$2.741 (0.5 Fib)

$2.958 (0.618 Fib)

$3.267 (0.786 Fib)

Support

$1.85–$1.90 (major demand zone)

$1.82 (Fib 0)

$1.60 (extended downside support)

RSI

39.6 — weak momentum, stabilizing near demand

📌 Summary

XRP is holding above a key long-term demand zone while trading inside a bearish descending channel. Although selling pressure has eased and a short-term bounce is possible, the broader structure remains bearish unless XRP reclaims the $2.50–$2.75 resistance zone with strength. A breakdown below $1.82 would expose XRP to deeper downside risk.