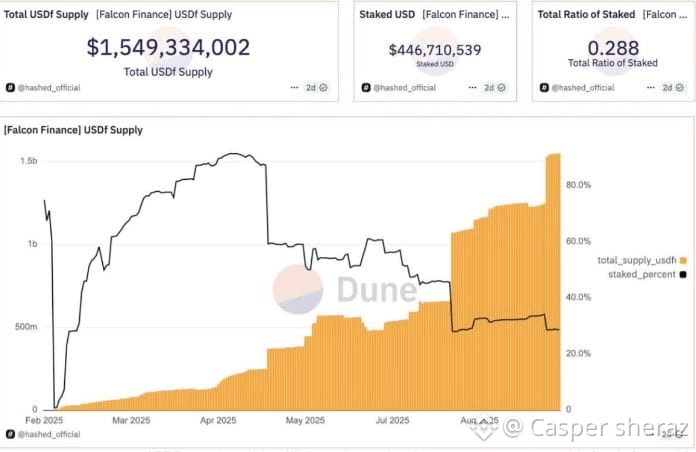

Real-world asset tokenization has captured significant attention in 2025, yet many tokenized holdings suffer from limited usability. Falcon Finance's USDf protocol offers a sophisticated solution by creating a synthetic dollar backed by a diverse collateral pool, enabling users to access value without liquidating assets.

The December 18 deployment of over $2.1 billion USDf on Base represented a major milestone, aligning with the network's peak activity and expanding reach to a broader DeFi audience.

Chainlink CCIP integration announced December 23 ensures secure cross-chain operations, critical for a multi-asset stable.

sUSDf has distributed more than $19 million in yields through diversified strategies, providing consistent returns.

Vault launches, including tokenized gold and OlaXBT options, offer varied risk-reward profiles.

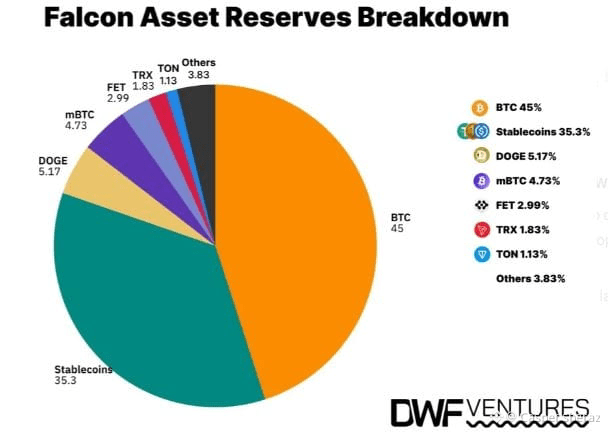

Reserves surpassing $2.3 billion, with regular audits, establish institutional-grade transparency.

Insurance mechanisms protect against extreme market conditions.

Base's efficiency enhances composability with protocols like Aerodrome.

Whale inflows reflect growing large-player interest.

Falcon Finance is building a bridge for traditional assets into decentralized finance.

What collateral types would you include in a universal stable?

@Falcon Finance | #FalconFinance | $FF