🚨 THIS IS THE MOST POWERFUL BITCOIN AD EVER — AND IT WAS NEVER PAID FOR

According to WSJ, nearly 80% of Venezuela’s oil revenue was moved using USDT.

Many people are calling this an “escape from the system.”

It is not.

It is actually the clearest demonstration of why Bitcoin exists.

Let’s break this down in simple, professional terms.

USDT is not independent money.

It is the U.S. dollar in digital form.

Yes, it moves faster.

Yes, it settles easier.

But it still has:

• A centralized issuer

• A CEO and management team

• A compliance framework

• A freeze function

That last point changes everything.

Tether has already frozen wallets connected to Venezuela’s oil trade.

Recently, it froze approximately $182 million USDT on the Tron network in a single action.

This tells us one critical truth:

Stablecoins are efficient.

But they are not sovereign money.

If an asset can be frozen, censored, or seized, it cannot serve as a long-term reserve for a nation seeking independence or control.

Now look at the global options through a game-theory lens.

USDT → Centralized, censorable, reversible

Yuan → Politically constrained, export-controlled

Gold → Illiquid for modern settlement; cannot move $500M in minutes

CBDCs → Full government control with programmable restrictions

Every option fails under real geopolitical stress.

Except one.

There is exactly one asset that allows final settlement without permission.

• Fixed supply: 21 million

• No issuer

• No CEO

• No compliance department

• No freeze button

• No jurisdiction

Bitcoin does not ask.

Bitcoin settles.

This is the advertisement Bitcoin never needed to buy.

When a sanctioned nation moves billions and learns that even “crypto dollars” can be frozen, the lesson becomes permanent.

At the highest level of capital allocation, trust matters more than speed.

Final settlement matters more than convenience.

This is why countries hedging against financial weaponization will not stop at stablecoins.

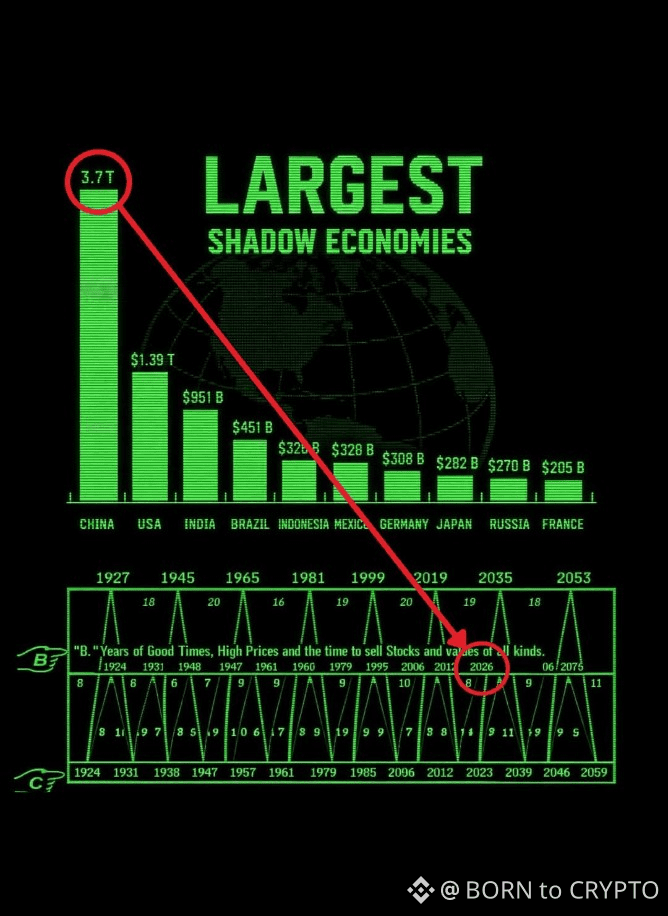

China.

India.

Brazil.

Russia.

And others watching quietly.

They will not announce it.

They will not advertise it.

They will allocate.

Trillions will move over time — not out of speculation, but out of necessity.

The price does not reflect this yet.

But structural demand always shows up eventually.

I’ve studied macro cycles for over a decade and have identified major market tops and inflection points, including Bitcoin’s October ATH.

When the real shift becomes visible, it will already be too late to react.

Pay attention before it reaches the headlines.