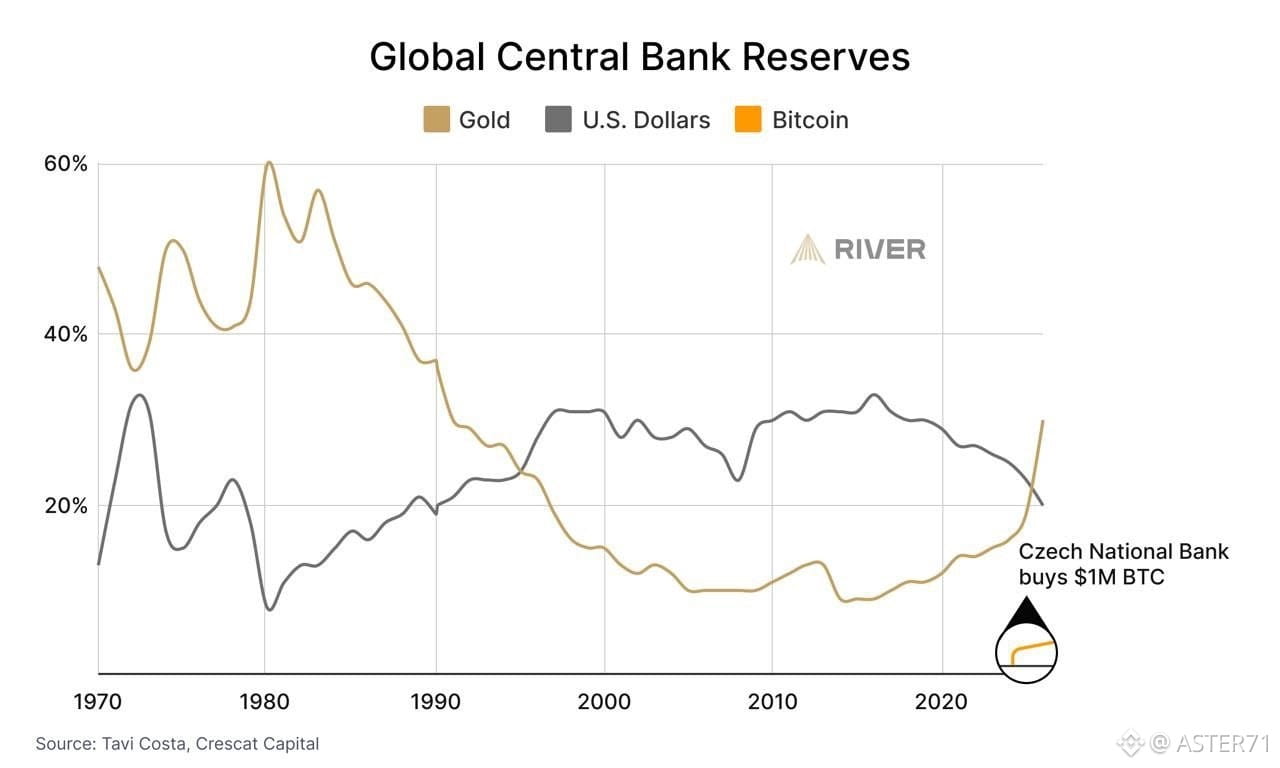

Gold has officially become the top global reserve asset for central banks, edging out the US dollar's dominance as its share keeps sliding.

Central banks worldwide have been dumping Treasuries and piling into physical gold like crazy. In early 2026, the total value of official gold holdings crossed over US Treasuries for the first time in decades—around $4 trillion in gold versus under that in foreign-held US debt. Gold prices smashed through $5,000+ (even hitting $5,500 recently), driven by record central bank buying, de-dollarization fears, geopolitical mess, and straight-up doubts about the dollar's long-term credibility. The USD's portion of global reserves has tanked to historic lows, down big over the past decade and accelerating lately.

Meanwhile, Bitcoin is just starting to poke its head into the reserve game. We're seeing the first real moves: the US set up a Strategic Bitcoin Reserve with seized coins (holding ~200k BTC), some countries like the Czech National Bank are experimenting with small holdings or pilots, and others are openly debating or evaluating it as a diversification play. Analysts (even from Deutsche Bank) are saying BTC could sit alongside gold on balance sheets by 2030 as volatility chills and it acts more like "digital gold." But right now? It's super early—tiny positions compared to gold's massive stockpiles, and most big central banks are still super cautious or outright rejecting it due to volatility and risks.

The core takeaway: The old dollar hegemony is cracking hard, gold's reclaiming its throne as the ultimate safe-haven/store-of-value beast, and Bitcoin's quietly entering the chat as the potential next evolution. If you're in crypto, yeah... we're still very fucking early. This shift could run for years.