Hi, friend, and what if we talk about what is currently happening in the market.

To better truly understand what is building up, we will go through a rational reading to better interpret price movements

The cryptocurrency market is often seen as unpredictable, dominated by speculation and emotions. However, behind the strong price fluctuations lie clear macroeconomic logics, often similar to those observed in traditional financial markets.

Understanding these links not only allows for better interpretation of trends but also for more rational decision-making, distancing from media noise.

This article offers a structured analysis of the link between global macroeconomics and crypto market cycles, with a particular focus on Bitcoin and major assets.

1. The crypto market does not evolve in a vacuum

Contrary to a widespread belief, cryptocurrencies are not completely uncorrelated with the global economy. Over the past few years, there has been an increasing correlation between Bitcoin and certain traditional assets, particularly technology stock indices.

Three macroeconomic factors strongly influence the crypto market:

The monetary policy of central banks

The level of overall liquidity

Investor risk sentiment (risk-on / risk-off)

When these elements are favorable, the crypto market tends to enter expansion phases. Conversely, their tightening often leads to prolonged corrections.

2. Monetary policy: the heart of the cycle

Monetary policy, particularly that of the U.S. Federal Reserve (FED), plays a central role.

Low interest rates: a fuel for the crypto market

When interest rates are low:

The cost of borrowing decreases

Investors seek riskier assets to achieve returns

Liquidity is directed toward growth stocks and cryptocurrencies

It is in these contexts that we generally observe bullish crypto markets.

High interest rates: return to caution

Conversely, when rates increase:

Bonds become more attractive

Capital is gradually withdrawing from risky assets

Fragile crypto projects disappear

These phases often correspond to bearish or consolidation markets, necessary to cleanse the ecosystem.

3. Bitcoin as a liquidity indicator

Bitcoin is often described as an alternative store of value, but in practice, it mainly acts as a barometer of global liquidity.

When liquidity increases:

Bitcoin quickly captures incoming flows

Altcoins follow with a delay

On-chain volumes are increasing

When liquidity contracts:

Volumes decrease

Volatility decreases

Investors prefer preservation over speculation

This reading helps to avoid a common mistake: believing that every price drop is a signal of failure, whereas it is often just a simple macroeconomic adjustment.

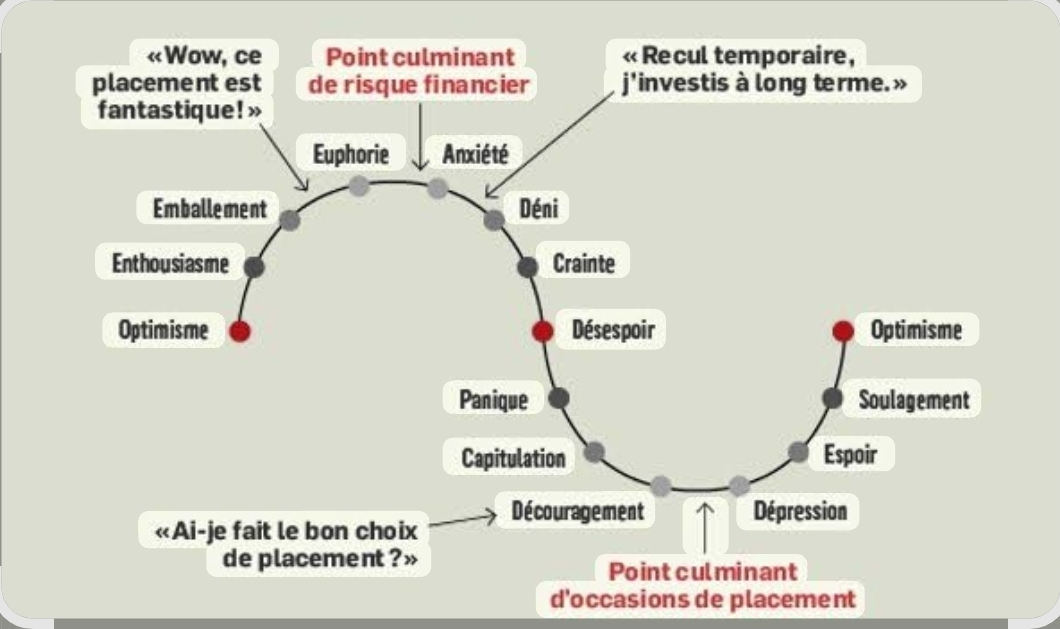

4. Psychology of markets and structure of cycles

Crypto cycles follow a relatively recurring structure:

Silent accumulation

Gradual expansion

Euphoria and excess

Correction and capitulation

Return to accumulation

Macroeconomics acts as the external trigger that speeds up or slows down these phases. Investors who understand this dynamic focus more on market structure than on daily fluctuations.

5. Practical implications for investors

A macroeconomic reading of the crypto market allows:

To reduce emotional decisions

To avoid buying in a phase of euphoria

To better identify periods of rational accumulation

To understand why some projects survive cycles and others do not

This does not guarantee success, but it provides a coherent analytical framework, essential for any serious approach.

If the cryptocurrency market is neither completely chaotic nor purely speculative. It is deeply influenced by global macroeconomics, liquidity, and monetary policy.

Understanding these interactions allows one to move from being a mere observer to an informed actor, capable of analyzing the market with perspective and method.

In a still young ecosystem, knowledge remains the most valuable asset.