#FalconFinance $FF @Falcon Finance

Crypto has never lacked ambition. What it has often lacked is patience. For years, projects raced to attract attention with inflated rewards, fast emissions, and short-term excitement. The results are familiar. Liquidity comes quickly and disappears just as fast.

FF approaches the problem from a different angle. It does not try to force growth. It tries to earn it.

Instead of treating incentives as marketing tools, FF treats them as design choices. Every benefit attached to FF staking exists for a reason. Nothing feels accidental. Nothing feels rushed.

This article explores FF as a system, not a slogan. How it works. Why it was built this way. And what it says about where decentralized finance may be heading next.

FF Is Not a Token Chasing Attention

Many tokens try to be everything at once. Governance token. Yield engine. Trading asset. Brand symbol. FF avoids this trap by staying focused.

FF is about alignment.

When users stake FF, they are not just locking value. They are making a long-term decision. The protocol responds by improving how those users interact with the ecosystem rather than paying them with endless token inflation.

This is a quiet but meaningful distinction.

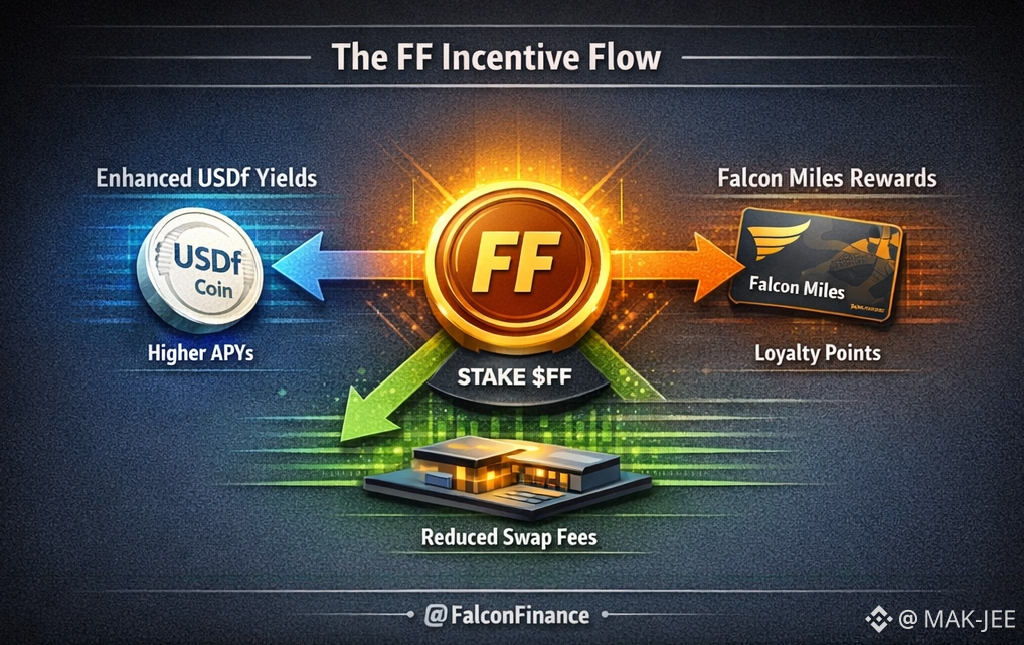

What Really Happens When You Stake FF

Staking FF does not feel like pulling a lever for instant rewards. The benefits unfold through better conditions.

Users who stake FF gain access to

Improved APYs when staking USDf

Lower swap fees across the platform

Entry into the Falcon Miles reward program

Each reward touches a different part of the user journey. Yield supports capital holders. Fee reductions help active traders. Falcon Miles reward commitment over time.

The system encourages balance instead of extremes.

USDf and FF A Relationship Built on Purpose

USDf is designed to be steady. It does not promise miracles. It promises reliability.

FF strengthens that promise.

When users stake FF, they unlock higher USDf yields. This turns FF into an access layer. It does not create value by dilution. It creates value by improving efficiency.

This relationship changes how users think. FF is not something you dump after rewards. It is something you keep because it improves everything else you do inside the ecosystem.

The Technology That Makes This Work

FF relies on clean, modular infrastructure. Each function has its own role.

Staking contracts record commitment length and size

Fee modules calculate discounts dynamically

Reward systems track Falcon Miles independently

Yield logic pulls accurate data through reliable feeds

Because these components are separated, the protocol can evolve without breaking trust. This is not experimental engineering. It is practical engineering.

Image Description

Incentive Flow Map

A central FF staking hub

Three clear paths extending outward

One path shows USDf yield improvement

One path shows reduced swap costs

One path shows Falcon Miles accumulation

The visual tells a story of flow and balance.

Falcon Miles Rewarding Behavior Not Speed

Falcon Miles are not designed for fast farming. They reward presence.

You earn them by staying engaged. By participating consistently. By acting like a long-term user instead of a temporary visitor.

Because Falcon Miles are separate from direct token emissions, they allow the protocol to reward loyalty without weakening FF itself.

This makes them quiet but effective.

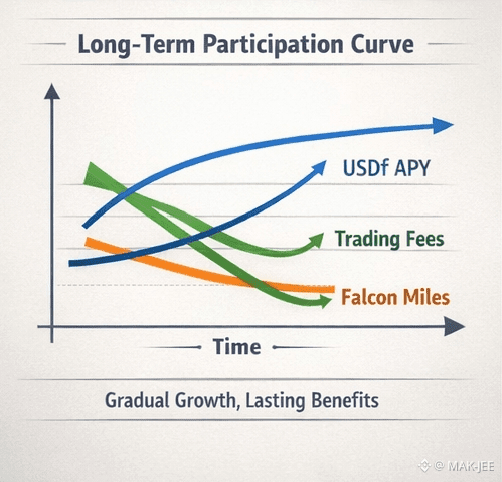

Chart Description

Long-Term Participation Curve

Time on the horizontal axis

User advantage on the vertical axis

USDf APY rises gradually

Trading fees trend lower with longer staking

Falcon Miles increase steadily with engagement

No sharp spikes. Just slow improvement.

A Personal Observation From Inside the Space

While studying FF’s structure, one thing stood out clearly.

As Muhammad Azhar Khan (MAK-JEE), my opinion is that FF feels built for people who are tired of chasing numbers. It assumes users value consistency. That assumption alone makes it different from most of the market.

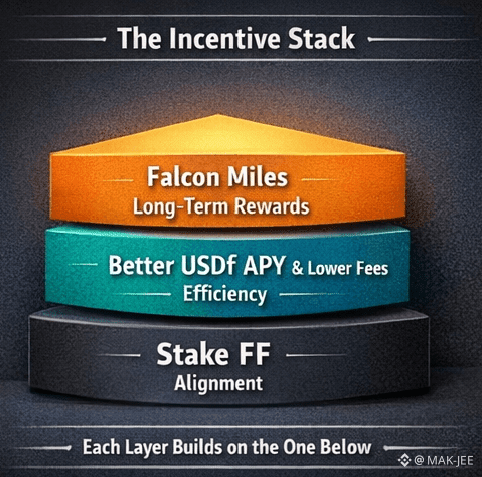

Incentives as Architecture

In traditional finance, incentives are built into contracts, terms, and timeframes. DeFi often forgets this and replaces structure with speed.

FF brings structure back.

Higher yields reward commitment

Lower fees reward usage

Falcon Miles reward patience

Nothing is decorative. Everything has intent.

Infographic Description

The Incentive Stack

Base Layer Alignment

Stake FF

Middle Layer Efficiency

Better USDf APY

Lower transaction costs

Top Layer Continuity

Falcon Miles

Long-term rewards

Each layer depends on the one below it.

Why This Design Fits the Current Market

Markets mature. When they do, noise loses power.

Users now ask harder questions. Where does yield come from. Who benefits long term. What happens when growth slows.

FF does not depend on constant expansion. It benefits from stability. That makes it better suited for uncertain cycles.

Honest Risks and Real Strengths

No protocol is immune to reduced activity. If participation drops, rewards naturally soften.

The strength of FF lies in flexibility. Incentive parameters can evolve. Structures can adjust. The foundation remains intact.

That is how systems survive.

Final Reflection

FF is not trying to impress everyone. It is trying to keep the right people.

It improves conditions instead of printing promises.

It rewards patience instead of speed.

It treats incentives as engineering, not marketing.

In a market that often values volume over value, FF chooses restraint. And restraint, over time, compounds.