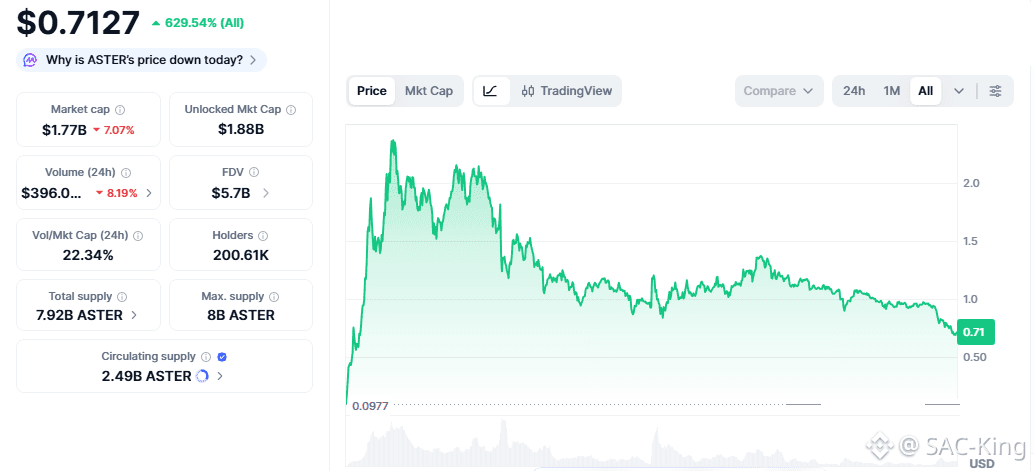

$ASTER is a relatively new cryptocurrency that quickly captured attention in the crypto market due to its rapid price surge, strong community interest, and positioning within the decentralized finance (DeFi) trading sector. Like many high-profile crypto launches, ASTER experienced an intense early rally, followed by volatility and consolidation. This article explores ASTER’s past performance, current state, and future outlook, with a special focus on the moment it crossed the $1.30 price level.

ASTER is the native token of the Aster ecosystem, a decentralized trading platform focused on spot and perpetual derivatives. The token is designed for:

Governance participation

Trading incentives and rewards

Fee discounts and platform utility

Future staking and ecosystem features

ASTER was introduced after a merger of two DeFi trading initiatives, with the goal of creating a more advanced and trader-friendly decentralized exchange. Its tokenomics include a large community allocation, which played a major role in its early market behavior.

The Past: Launch and Rapid Rise

ASTER launched in September 2025 at a very low price, initially trading well below $0.10. The early days of the token were marked by:

A large community airdrop

Extremely high trading volume

Strong speculative interest

Significant whale activity

Within days of launch, ASTER entered a parabolic price phase. Demand outpaced supply as many traders rushed to gain exposure, driving the price sharply upward.

When ASTER Crossed $1.30

ASTER first crossed the $1.30 level around September 20–21, 2025. This move occurred during the peak of its initial rally, as momentum traders and early holders pushed the price higher. The $1.30 mark acted as a psychological milestone, confirming ASTER’s transition from a low-priced launch token to a high-valuation DeFi asset.

Shortly after breaking $1.30, ASTER continued climbing and eventually reached its all-time high near the $2.20–$2.40 range before market conditions shifted.

Correction and Market Reality

Following its explosive rise, ASTER entered a correction phase — a common pattern for newly launched tokens. Early airdrop recipients began taking profits, leverage was unwound, and market sentiment cooled.

The correction did not erase ASTER’s relevance but instead marked a transition from hype-driven price action to a more realistic valuation phase. Volatility remained high, but price movement became more range-bound as the market searched for fair value.

The Present: Consolidation and Development

In the present phase, ASTER trades well below its peak but remains actively traded. This period is defined by:

Price consolidation after the initial hype cycle

Ongoing platform development and feature rollouts

Gradual expansion of the ecosystem

Periodic token unlocks adding supply to the market

The Aster platform has continued to improve its trading interface, introduce advanced order types, and explore privacy-focused trading features. While these developments have not yet triggered a return to previous highs, they help establish longer-term utility for the token.

At this stage, ASTER is no longer purely a speculative launch asset — it is being tested on whether it can sustain real user activity and trading volume.

The Future: Can ASTER Return Above $1.30?

Whether ASTER can reclaim and hold above $1.30 depends on several factors:

Potential Bullish Drivers

Growth in active users and trading volume on the Aster platform

Introduction of staking and governance mechanisms

Expansion into new markets such as real-world asset trading

Major exchange listings that increase liquidity and visibility

Broader crypto market uptrend

If these conditions align, $1.30 could once again become a support level rather than resistance.

Risks and Challenges

Ongoing token unlocks increasing circulating supply

Strong competition from established perpetual trading platforms

Regulatory pressure on leveraged DeFi trading

General crypto market downturns

ASTER remains a high-risk, high-reward asset, particularly sensitive to sentiment and market cycles.

Conclusion

ASTER’s journey so far reflects the classic crypto lifecycle:

Past: A dramatic launch and rapid surge, crossing $1.30 within days and reaching an all-time high above $2

Present: A period of correction, consolidation, and product development

Future: A test of whether real utility and adoption can justify higher valuations

The moment ASTER crossed $1.30 in September 2025 remains a defining milestone in its history. Whether that level becomes a long-term floor again will depend on execution, adoption, and the broader direction of the crypto market.