Over the past several weeks, I’ve been revisiting the October 10th sell-off—not from the perspective of headlines or narratives, but by studying behavior. Price behavior, liquidity behavior, and most importantly, who was forced to act and when.

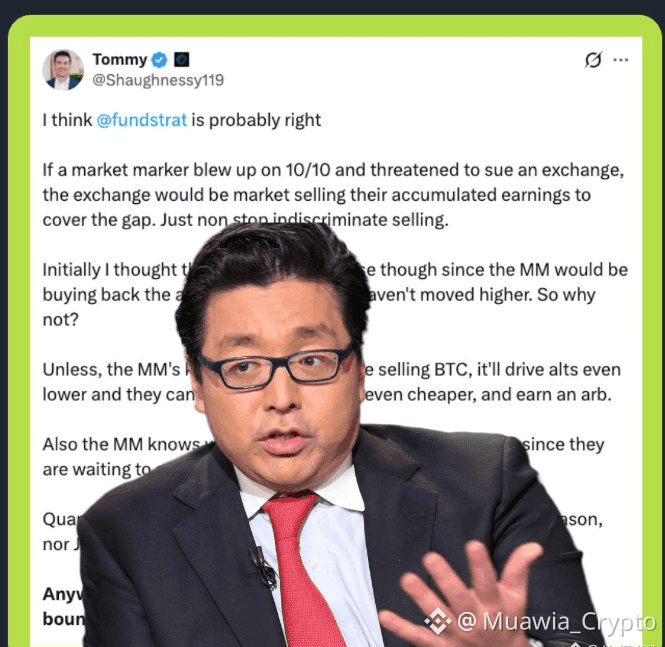

One thesis that initially seemed speculative—but now deserves serious consideration—is the idea that the October 10th move was not a macro-driven panic, but a structural liquidity event, potentially validating what Tom Lee has been hinting at.

According to insights shared by the co-founder of Delphi, a plausible sequence emerges if we assume a large market maker experienced a sudden financial failure around that date. In such a scenario, legal and contractual obligations would force the exchange involved to immediately cover the deficit. The fastest and least discretionary way to do this is not careful portfolio rebalancing—it’s indiscriminate liquidation.

When exchanges are forced into this position, they don’t “choose” what to sell based on conviction. They sell whatever has liquidity. BTC first. Then anything else that clears. This creates a steady, mechanical flow of sell orders—what traders recognize as non-price-sensitive selling.

At first glance, this theory appears flawed. If market makers lost inventory—particularly altcoins—logic would suggest they’d need to buy those positions back, leading to a recovery. Yet that recovery never materialized. Altcoins stayed suppressed.

That contradiction is the key.

The more realistic explanation is not that market makers couldn’t buy back—but that they chose not to. Market makers understand market microstructure better than anyone. They know that when BTC is being sold aggressively by an exchange, altcoins typically fall faster and deeper due to thinner order books and reflexive risk-off behavior.

So instead of rushing in, they wait.

They allow the forced BTC selling to cascade through the market, pushing altcoins lower than fair value. Only then—once the exchange’s selling flow is exhausted—do they step in. This allows them to both rebuild exposure and capture the spread created by panic-driven inefficiency.

Another subtle but critical point: market makers know exactly when the selling ends. They’re not guessing. They’re literally waiting to be paid. Once those flows dry up, that’s the signal. That’s when accumulation begins—not before.

This framing also helps explain why popular narratives gained traction so quickly. Stories about “quantum risks,” “Japan,” or other macro shocks spread easily because they’re emotionally satisfying. But structurally, they fail to explain the timing and behavioral consistency of the sell pressure.

What we saw looked less like fear… and more like plumbing.

My personal read—based purely on pattern recognition and unconfirmed information—is that the bulk of this indiscriminate selling pressure is now largely behind us. If that’s correct, the market is transitioning from forced liquidation to organic price discovery, which historically opens the door for sharp, reflexive rebounds.

That said, this remains speculation. There is no official confirmation, and none of this should be treated as fact. But markets often reveal the truth through behavior long before they do through statements.

And October 10th, in hindsight, may end up being remembered less as a “crash”… and more as a clearing event.

---