Transition from banks to blockchain.

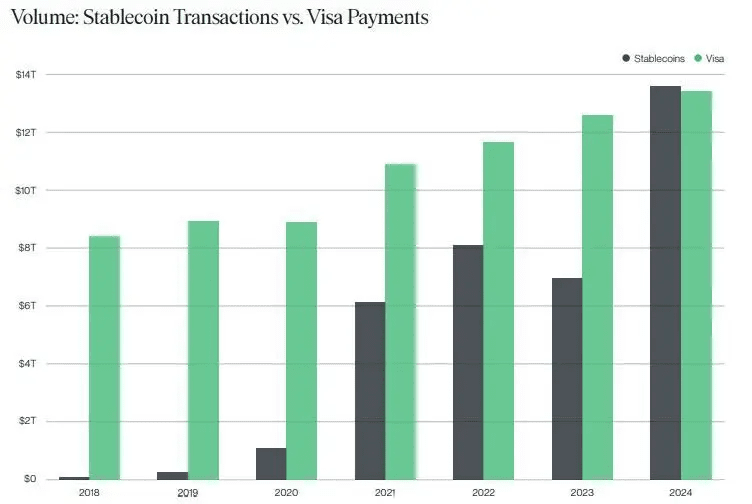

Visa and Mastercard processed over $50 billion in cryptocurrency payments just in the first quarter of 2025.

Generation Z? Over 60% already own cryptocurrencies, not just for investing, but to use them.

Cryptocurrency cards allow you to avoid unnecessary paperwork and spend directly from your wallet.

Spend smarter.

Traditional cards offer between 1% and 2% cashback if you're lucky.

Cryptocurrency cards offer up to 8% cashback, often with tokens you actually own.

Additionally:

- Instant conversion

- Global acceptance

- No bank approval

It's freedom, and it's here.

Avoid beginner mistakes

Use stablecoins (USDC, USDT) for predictable purchasing power.

Control taxes: tools like CoinLedger or Koinly will help you.

Learn about the laws in your country: every transaction may be subject to taxes.

Binance Card (Visa)

Ideal for those who spend a lot on cryptocurrencies

- Spend over 100 cryptocurrencies with real-time conversion

- Up to 8% cashback on $bnb

- No annual fees

Caution: $BNB rewards involve volatility.

2/ Coinbase Card

The easiest way to access cryptocurrency payments

- Expenses of $USDC with no fees

- 4% cashback on $BTC or $XLM

- AI tax tracking

Now available in over 40 countries, including much of Asia.

3/ Ledger Card (Mastercard)

For self-custody enthusiasts

- Spend $BTC, $ETH, $ADA

- 2% cashback on $LST

- Non-custodial, self-sufficient

Priority security. Currently only compatible with select regions.

4/ Revolut Crypto Card

Banking merges with DeFi in the EU

- Supports over 30 cryptocurrencies

- 5% cashback on $SOL (premium)

- Integrated DeFi yield farming

Ideal for travelers and EU citizens, though the best benefits are limited to payment tiers.

5/ KuCoin Card

Designed for traders, not tourists

- Spend $KCS, $ETH, $USDT

- 6% cashback on $KCS

- Save 10% on KuCoin fees

Rewards capped at $500 per month: ideal for advanced KuCoin users.

6/ Osmosis Payment Card

Native DeFi option

- Spend $OSMO + IBC assets

- Up to 6% cashback (based on staking)

- Cross-chain compatible

In early stages, but deeply aligns with the vision of Cosmos.

7/ Fina Cash Card

TradFi joins Web3

- Spend stable cryptocurrencies directly

- 1-5% cashback linked to your wallet

- Yield vaults included

Feels like a traditional card, but with the power of cryptocurrencies.

8/ Bybit Card

For global users who prioritize mobility

- Expenses in $BTC, $ETH, $USDT

- 5% cashback on $USDT

- Withdrawals at ATMs worldwide

Smooth user experience and excellent mobile support.

9/ MetaMask Card (NEW 2025!)

Finally, from wallet to card

- Spend $ETH, $USDC, and L2

- 2-5% cashback on $MASK

- Directly integrated with your MetaMask

- Non-custodial and directly integrated with your wallet.

Currently available in the U.S. and the EU.

Trustee Plus Card 10/

Hardware security at no cost

- $BTC, $ETH, $USDT, $TRX

- 4% cashback

- Real-time wallet synchronization

Excellent balance between simplicity and security: no staking traps or yields.

Many cashback rates are already being drastically reduced as more users join.

Early adopters of cryptocurrencies secure between 5% and 8%, while latecomers will see reduced gains.

So choose a card. Load it. And start spending as if the world already operated on cryptocurrencies, because it almost does.

Which card will you use in 2025?

Are you still waiting for your bank to approve your transactions?

Leave me your choice: I will respond to all answers.