Refute the following information with arguments, or leave the FUD aside.

Settlement Risk Analysis: MSTR as of 1/12/25

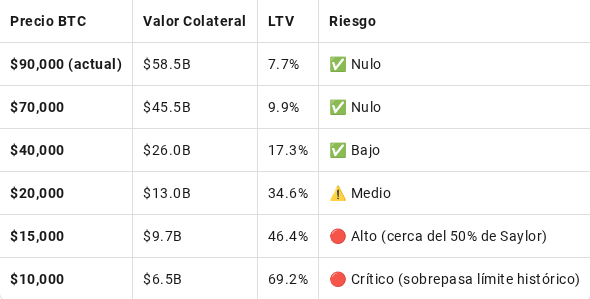

Based on current holdings of 649,870 BTC at an average cost of $74,033 and an estimated total debt of ~$4.5 billion, the risk of liquidation is practically nonexistent in the short/medium term. However, there are critical structural risks that must be understood.

1. Immediate Settlement Risk: ZERO.

Why is there no margin call at $70k (or even much less):

a) The debt is mostly UNSECURED (not backed by BTC):

Convertible bonds ($2B at 0% 2030, $1.01B at 0.625% 2028) are senior unsecured obligations

They do not have margin call clauses based on the price of BTC

The only historical collateralized loan was Silvergate's ($205M) which has already been resolved

b) Extremely low Loan-to-Value (LTV):

BTC value at cost: 649,870 × $74,033 = $48.1 billion

BTC value at $70k: 649,870 × $70,000 = $45.5 billion

Total debt: ~$4.5 billion

LTV at $70k: 10% (debt) / 45.5 (collateral) = 9.8%

Safety threshold: Even at BTC $15,000, the LTV would be ~30%, below the 50% limit that Saylor mentioned for collateralized debt.