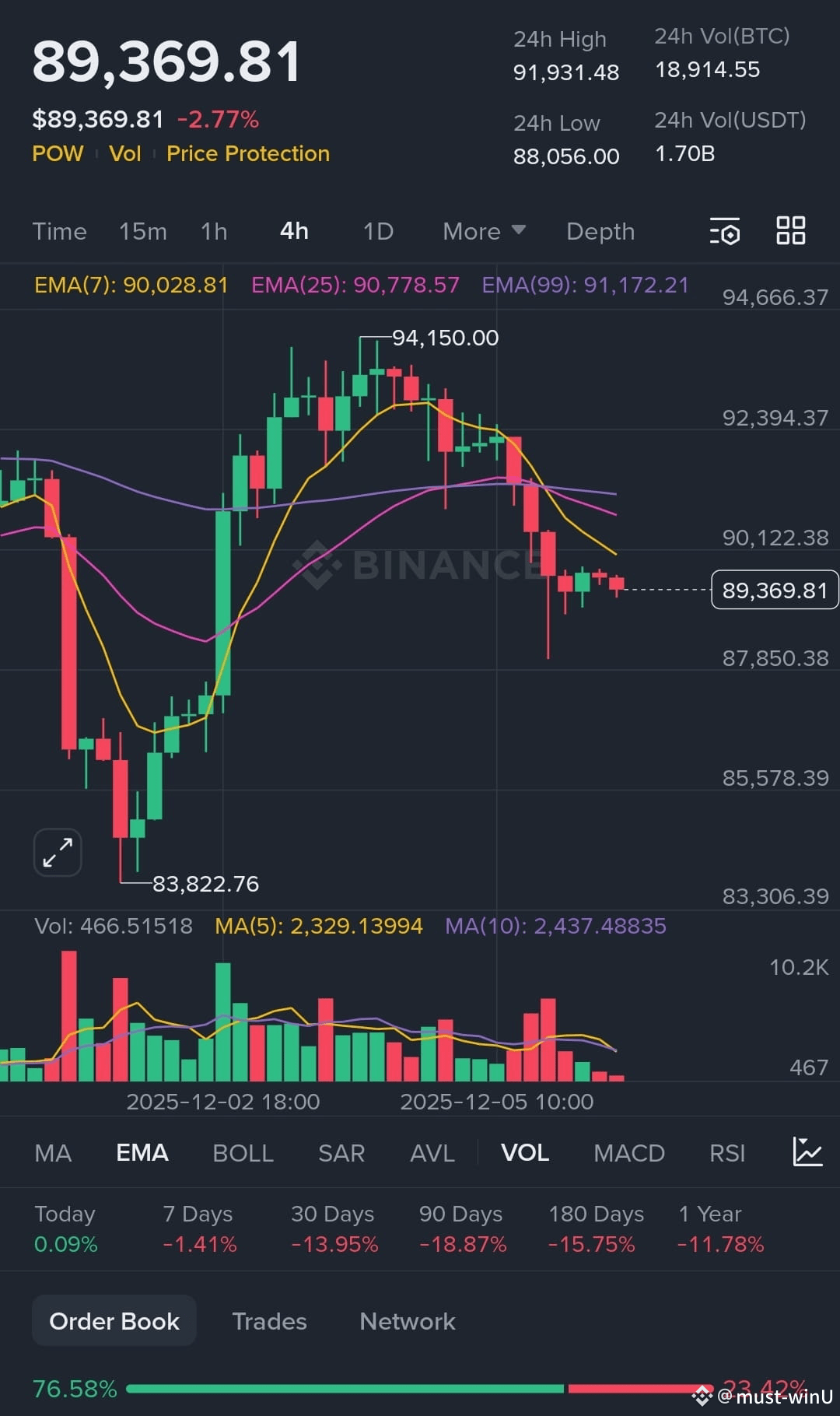

Bitcoin recently slid to around $90,000–$92,000, pressured by declining investor sentiment as macroeconomic uncertainty and risk-off mood resurged.

After hitting an all-time high near $126,000 in early October, BTC has dropped roughly 25-30%.

🧭 What’s driving the slump

Global risk aversion: as equities and tech shares wobble, crypto — seen as a risk asset — is bearing the brunt.

Liquidity pressure and macro uncertainty: concerns around central-bank moves (especially in the US and Japan) and weakening demand for speculative assets are cooling appetite. Nervousness among large holders: Some institutional players may be wary of further drops, which could trigger selling pressure.

Still as experts recently noted — despite swings this year, crypto’s broad infrastructure and investor base remain intact.

🚀 Outlook & What Analysts Are Saying

JPMorgan projects a possible rebound, estimating Bitcoin could climb to $170,000 within the next 6–12 months signaling long-term optimism.

Some traders and institutions expect the market to remain range-bound for now, anticipating continued volatility into early next year.

Broader adoption may still grow: recent changes suggest financial firms are becoming more open to offering crypto exposure to clients, which could support future demand.

If you like I can break down 3 possible scenarios for BTC in the next 6 months, based on current macro conditions, institutional behavior, and candle-chart patterns.#BinanceBlockchainWeek