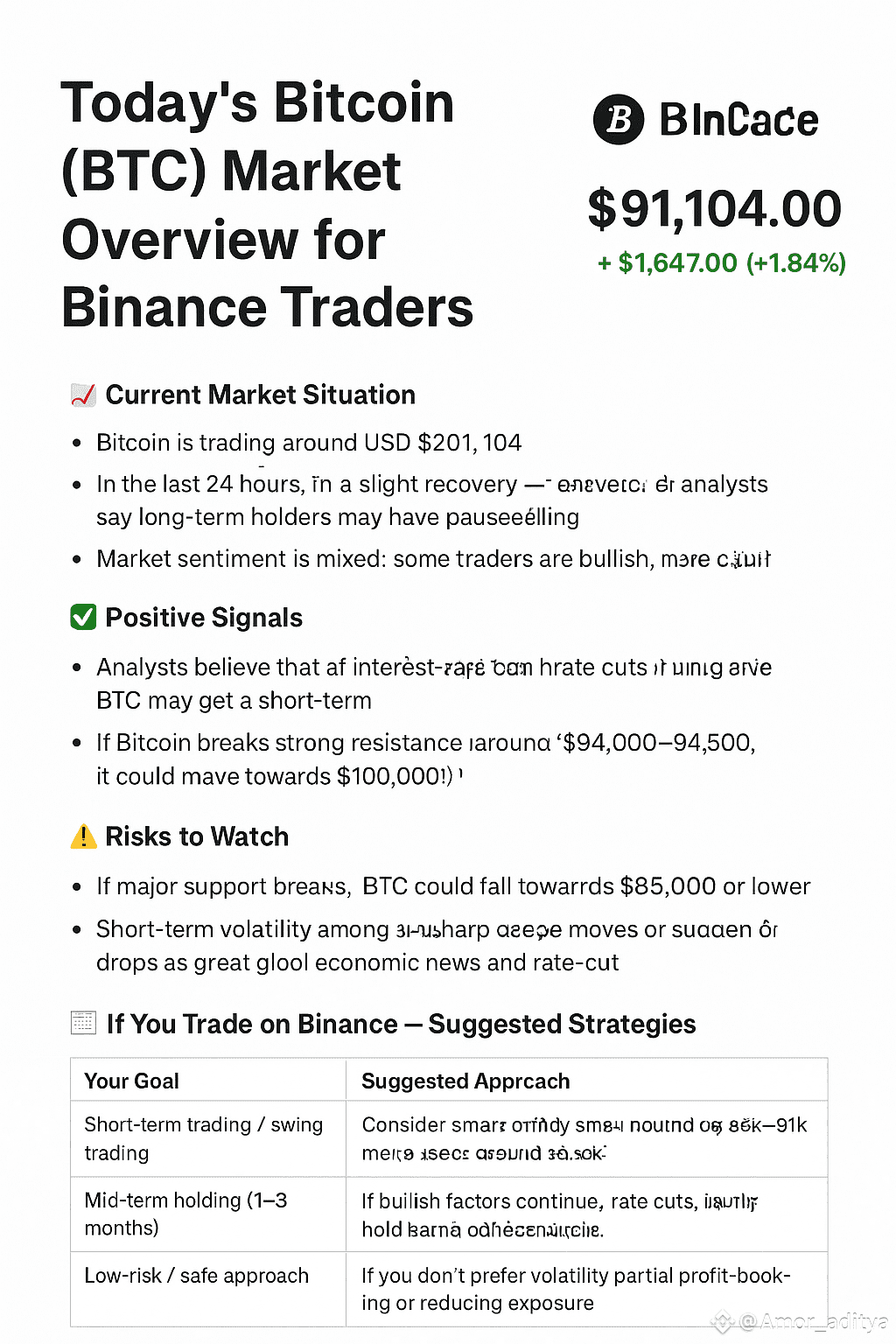

📈 Current Market Situation

Today, Bitcoin (BTC) is trading around USD 91,104.

In the last 24 hours, BTC has shown slight recovery — several analysts say long-term holders may have paused selling.

Market sentiment is mixed: some traders are bullish, while others remain cautious.

✅ Positive Signals

Some analysts believe that if interest-rate cuts continue, BTC may get a short-term bounce.

If Bitcoin breaks strong resistance (around $94,000–94,500), it could move towards $100,000 or higher.

⚠️ Risks to Watch

If major support breaks, BTC could fall towards $85,000 or lower.

Short-term volatility remains high — sharp upward moves or sudden drops are both possible due to global economic news and rate-cut announcements.

📅 If You Trade on Binance — Suggested Strategies

Your Goal Suggested Approach

Short-term trading / swing trading If BTC holds support around $89k–91k, you may consider small buying. Always set a stop-loss (example: around $85k or according to your risk level).

Mid-term holding (1–3 months) If bullish factors continue (rate cuts, liquidity), holding BTC could be beneficial. Keep position size controlled.

Low-risk / safe approach If you don’t prefer volatility, partial profit-booking or reducing exposure can help manage risk.

🧮 Long-Term Outlook

Some analysts expect BTC to rise again if macroeconomic conditions remain supportive (rate cuts, institutional buying, etc.).

But crypto remains unpredictable — regulatory moves or economic issues can cause sharp volatility.

🎯 My Personal Suggestion

If I were in your position today:

If I can take some risk: I would hold a portion of BTC, booking partial profit on every 5–10% upward move and using stop-loss to control risk.

If I want safety: I would keep only a small BTC position and hold the rest in stable assets or cash.