For years, on-chain finance worked like this:

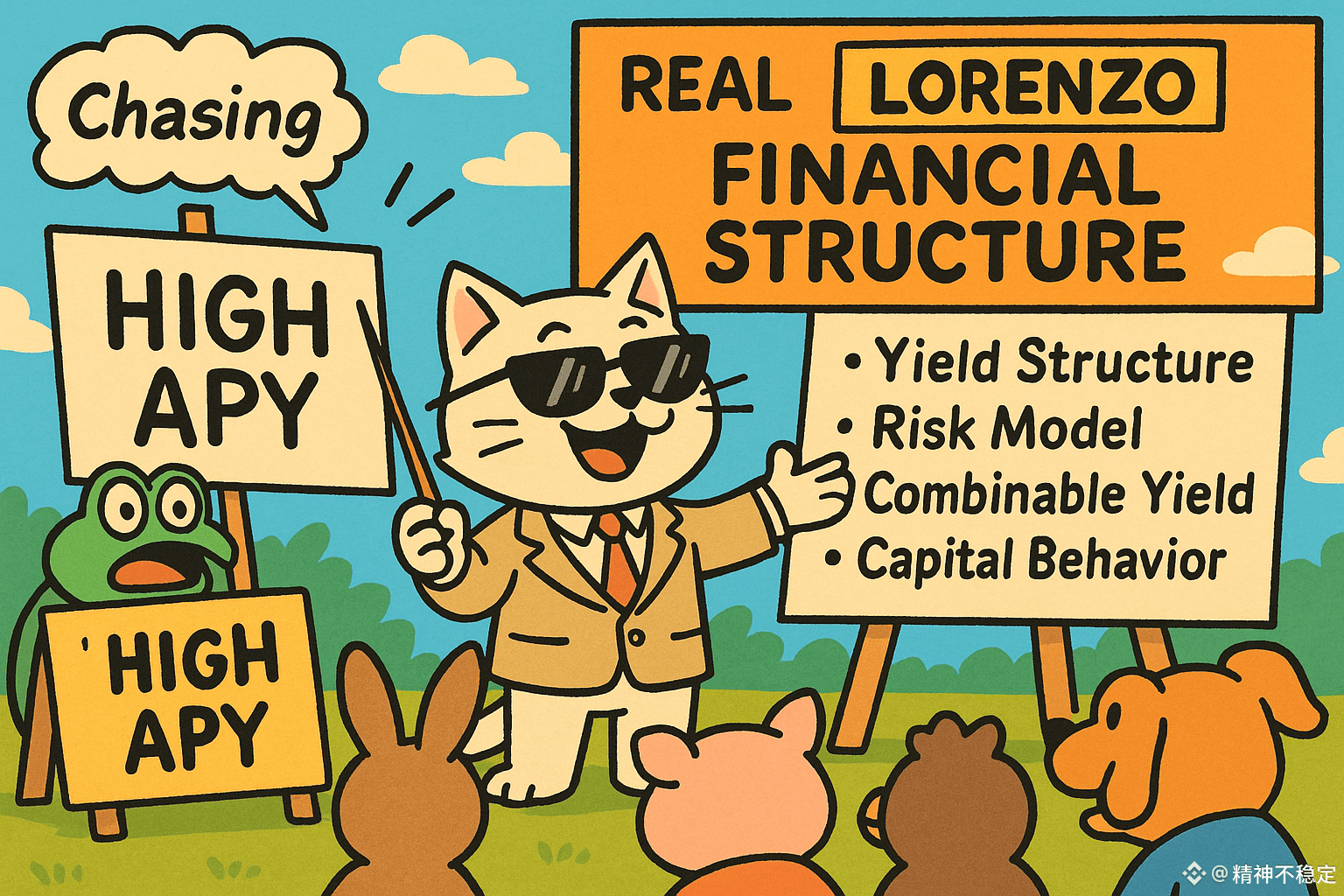

Whoever offered the highest APY won. Liquidity rushed to the newest incentives, pools exploded overnight, and narratives changed every week. But this kind of competition is basically price competition — and it can’t attract serious, long-term capital. You can’t build a reliable financial system on ever-shifting APYs.

As the market matures, capital now cares more about stability, predictability, risk transparency, and governance. Yield isn’t just the final number anymore — it’s becoming a structure that must be priced, understood, and managed. That means the real power in the next era won’t belong to whoever offers the highest yield, but to whoever controls how yield is structured.

This is where @Lorenzo Protocol becomes important.

The Problem With Old Yield Pools

Traditional on-chain yield products are just pools with incentives.

They have:

one source of return

one type of risk

one source of volatility

no visibility into how yield is created

no ability to break yield into parts or build portfolios with it

These pools only show the APY result, not the structure underneath it. Because of this, yields can’t last across market cycles — they aren’t composable or modelable.

A Turning Point: stBTC and YAT

With stBTC/YAT, yield can finally be broken into clear, modelable cash flows.

That means yield is no longer determined by one pool but can come from multiple sources, each with different behaviors.

Separating:

principal paths, and

yield paths

is what allows returns to enter a true multi-asset portfolio system, just like traditional finance.

Capital has never cared about “APY hype.” It cares about whether:

the cash flow is sustainable

the risk is diversified

the yield can be modeled, valued, and governed

For the first time, on-chain yield can meet those standards.

FAL: Turning All Yields Into One Common Language

FAL takes yield abstraction even further.

It turns all yield sources — which used to be incompatible — into a unified, combinable format.

It’s like turning different languages into machine code.

Once everything speaks the same language:

yields can be combined

risks can be redistributed

models can be built on top

At this point, control shifts from individual pools to structural design.

Yield becomes a type of financial compute, not a lucky byproduct of some pool.

OTF: A System That Defines Yield Instead of Chasing It

OTF isn’t just a “stablecoin with a NAV.”

It’s a structural engine where the yield curve is created deliberately through:

weights

rebalancing

exposure control

The result is a continuous, predictable yield path — something capital can truly assess and price.

This is what serious capital actually wants: not the highest yield, but the most modelable yield.

Multi-Factor Yield = Priceable Yield

OTF builds yield from multiple factors, each with:

its own risk

time distribution

volatility

Together, these form a mathematical structure behind the yield curve. This is what makes yield priceable, just like traditional fund structures.

BANK Governance = Controlling the Yield Structure

BANK doesn’t “change the APY.”

It decides:

which yield sources enter the portfolio

how weights shift

how exposure is controlled

how risk is distributed

Changing structure = changing the pricing foundation.

And whoever controls pricing foundations controls capital flow.

This is why banks, investment committees, and index providers hold so much power in traditional finance. Lorenzo brings that logic on-chain.

The Bigger Picture

The future of on-chain yield won’t be about:

who offers the highest APY

who throws the biggest incentives

It will be about:

who has the strongest yield structure

who has the best risk model

who offers transparent, stable, combinable yield

who provides predictable capital behavior

who has governance that can actually manage yield

Lorenzo is building the foundation for this future.

@Lorenzo Protocol #lorenzoprotocol $BANK