Tonight's Federal Reserve major decision: A "hawkish rate cut" may trigger a global market explosion!

At 3 AM Beijing time on Thursday, the global financial market enters a countdown as the Federal Reserve will announce the latest interest rate decision.

The market generally bets on a third consecutive rate cut of 25 basis points, with the rate falling in the range of 3.5%-3.75%.

But the focus is not on "cutting rates", but on

⚡ This is a rate cut with a warning: "hawkish rate cut"

The Federal Reserve is seriously divided internally: #加密市场反弹

• One faction: Employment worsens → Need to continue cutting rates

• One faction: Inflation remains high → Cannot loosen monetary policy further

Thus, the most dangerous combination appears:

➡️ One side cuts rates

➡️ One side hints 'this may be the last time'

This is more dangerous than not cutting rates.

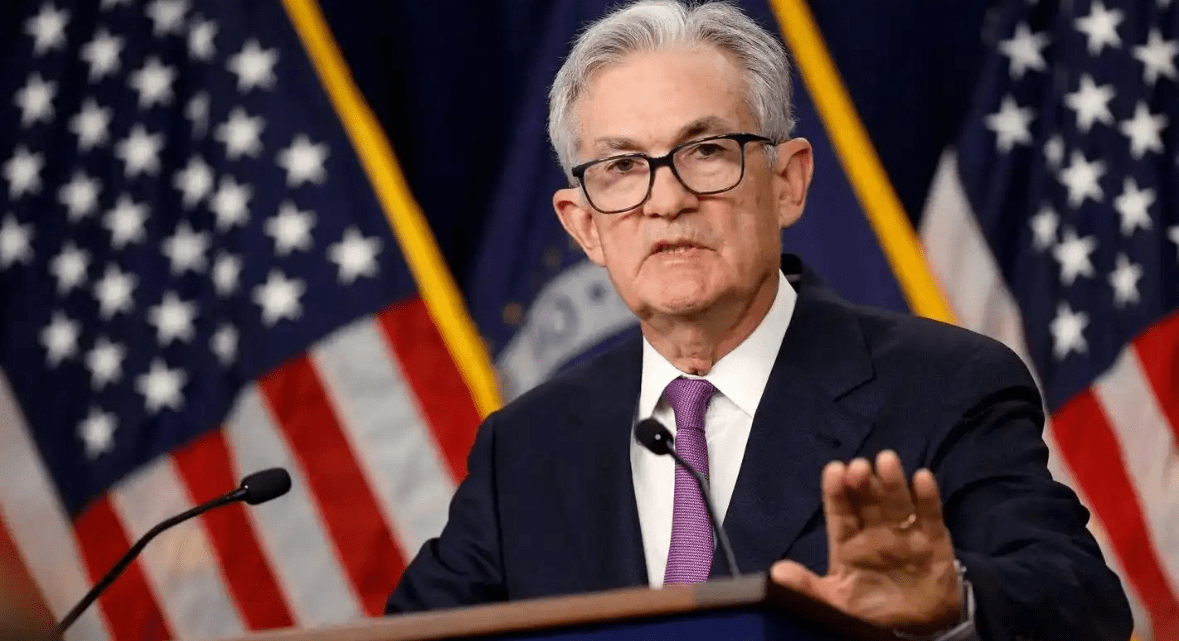

🔥Focus 1: How will Powell 'speak' tonight?

Goldman Sachs predicts: the statement will revert to cautious wording like 'further adjustments in magnitude and timing'

👉 This tells the market: don't expect continued rate cuts.

Every word from Powell's press conference could trigger instant fluctuations in BTC, ETH, and the Nasdaq.

🔥Focus 2: Internal voting may face a 'wave of opposition'

This decision is very likely to see multiple opposing votes: #美联储重启降息步伐

• Kansas City President George: Expects to continue opposing rate cuts

• St. Louis President Bullard: Concerned inflation may lead to opposition

• Director Milan: May even call for a 50bp rate cut again

The Federal Reserve has not seen such a three-way split in a long time.

🔥Focus 3: If inflation doesn't go down, employment starts to 'soften'

• Core PCE still at 2.8% → Higher than target

• US hiring slows, layoffs increase → Employment under pressure

This combination = the situation the Federal Reserve fears the most.

🔥Focus 4: Something more explosive is coming: Will QE return?

The Federal Reserve just stopped tapering in October, and now it's reported—

➡️ May restart bond purchases (but won't publicly call it QE)

The reason is: market liquidity is tight.

This is a super big signal.

🔔Tonight's market expectations (personal opinion) #ETH走势分析

• Hawkish rate cuts emerge → BTC, ETH will first fluctuate, then find direction

• Dot plot leans hawkish → US stocks briefly shake, US dollar rebounds

• If hinting at continued rate cuts → Strong stimulus → BTC may surge to 110k

(Market conditions change rapidly, the above does not constitute investment advice)