One speech.One shift in tone.And the entire market flipped within minutes.

📰 Crypto Market Breakdown After Powell’s Speech

The global crypto market just slipped below $3T, and the reaction was almost instant.

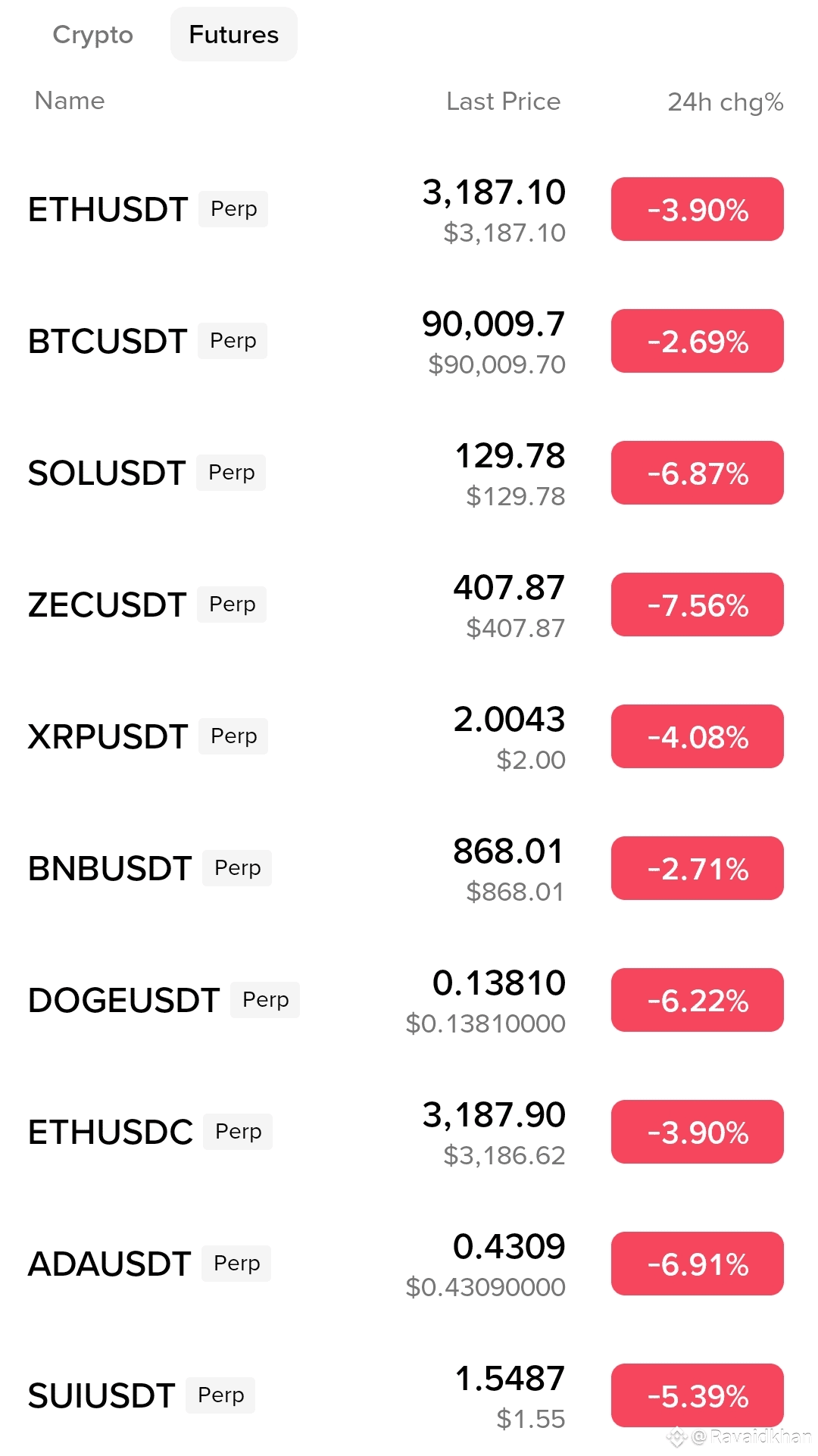

BTC cooled near $90K, ETH pulled back toward $3.1K, and major alts like SOL, ADA, DOGE, and SUI dropped between 5–7%.

This wasn’t random volatility…

It began right after Jerome Powell’s #FedRateDecisions

---

🧨 What Actually Triggered the Drop?

The Fed delivered a 0.25% rate cut, exactly what the market expected. No surprises there.But the tone of the speech changed everything.

Powell’s message came with:

A cautious outlook on inflation

Slower expectations for future cuts

A stronger U.S. dollar

Rising Treasury yields and a clear reminder: “We’re not easing aggressively.”

This is what traders call a “hawkish cut” —you get the rate cut, but lose the hope for fast easing.And hope is what markets were priced for.

,........................

📉 Why Crypto Reacted So Fast

Crypto is one of the most sensitive sectors to macro tone shifts.

Once Powell signaled a slower path ahead, we saw:

Instant unwinding of risk positions

Alts dropping harder due to thin December liquidity

BTC dominance rising as traders moved to safety

High volatility right after the press conference

It’s the same pattern we’ve seen after multiple FOMC events this year:

Price in the cut → react to the message → short-term pullback.

---

🌤️ But the Bigger Picture Still Matters

Zoom out, and nothing structural has changed for the long-term:

Liquidity tapering continues

QT is slowing

Institutional interest remains

The broader cycle is still intact

Short-term macro noise is just that — noise.

The long-term narrative is built on adoption, innovation, and capital flow, not one press conference.

---

💬My Personal Take...

Markets don’t move on numbers alone…They move on expectations, emotions, and surprises. .

Powell didn’t kill momentum —he simply reminded the market that nothing moves in a straight line.

Staying informed > staying scared.

Staying patient > chasing reactions.

The story isn’t over — this is just the post-Fed chapter. $SOL