In a market where success is often measured by the number of trades, not trading may seem, to many, like hesitation or weakness.

But the professional trader knows a deeper truth:

Being present in the market doesn’t always mean participating, and participating doesn’t always mean making the right decision.

In Bitcoin specifically, stepping back can sometimes be a step forward,

and silence at the right moment can be more valuable than any impulsive trade.

1️⃣ When Trends Are Absent and Randomness Dominates

Bitcoin goes through long periods of sideways movement,

where price oscillates within narrow ranges without a clear direction.

During these phases:

Technical signals often conflict

News is consumed more than it is understood

Trading becomes a reaction rather than a deliberate decision

Entering the market at this stage does not build experience,

it drains both capital and patience.

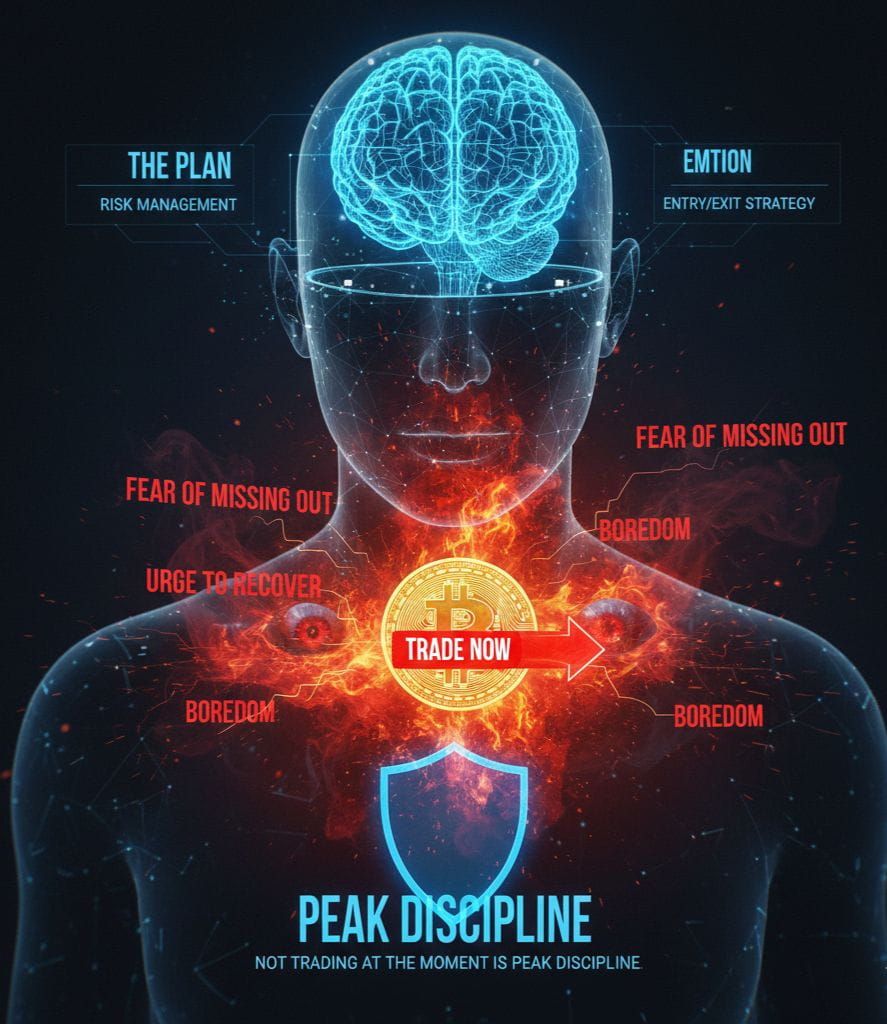

2️⃣ When Emotion Overrides the Plan

Before any trade, the real question isn’t:

Will the price move?

But:

Am I acting according to a plan or reacting to a temporary feeling?

Fear of missing out,

the urge to recover losses,

or even boredom from waiting…

All these are clear signs that not trading at this moment is peak discipline.

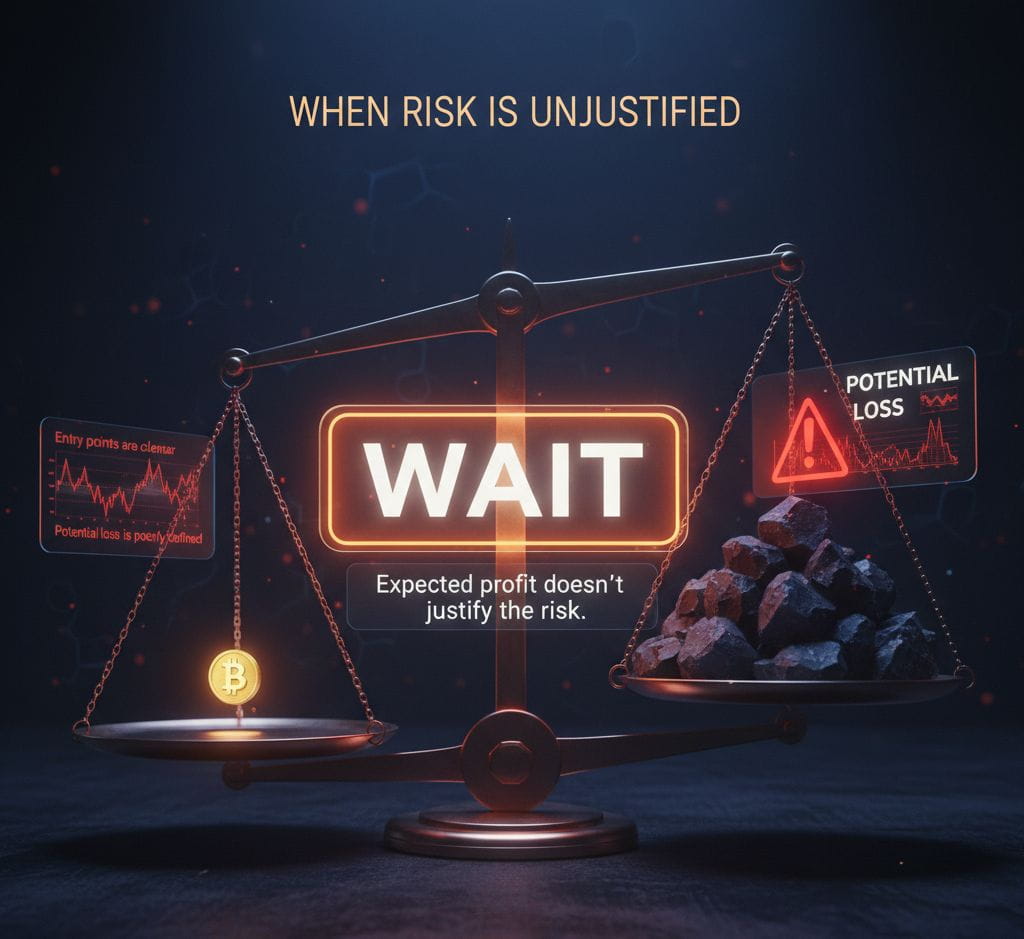

3️⃣ When Risk Is Unjustified

Smart trading is not based on prediction,

but on a careful balance between risk and reward.

If:

Entry points are unclear

Potential loss is poorly defined

Expected profit doesn’t justify the risk

then you are not facing just a suboptimal trade,

you are facing a clear message from the market: wait.

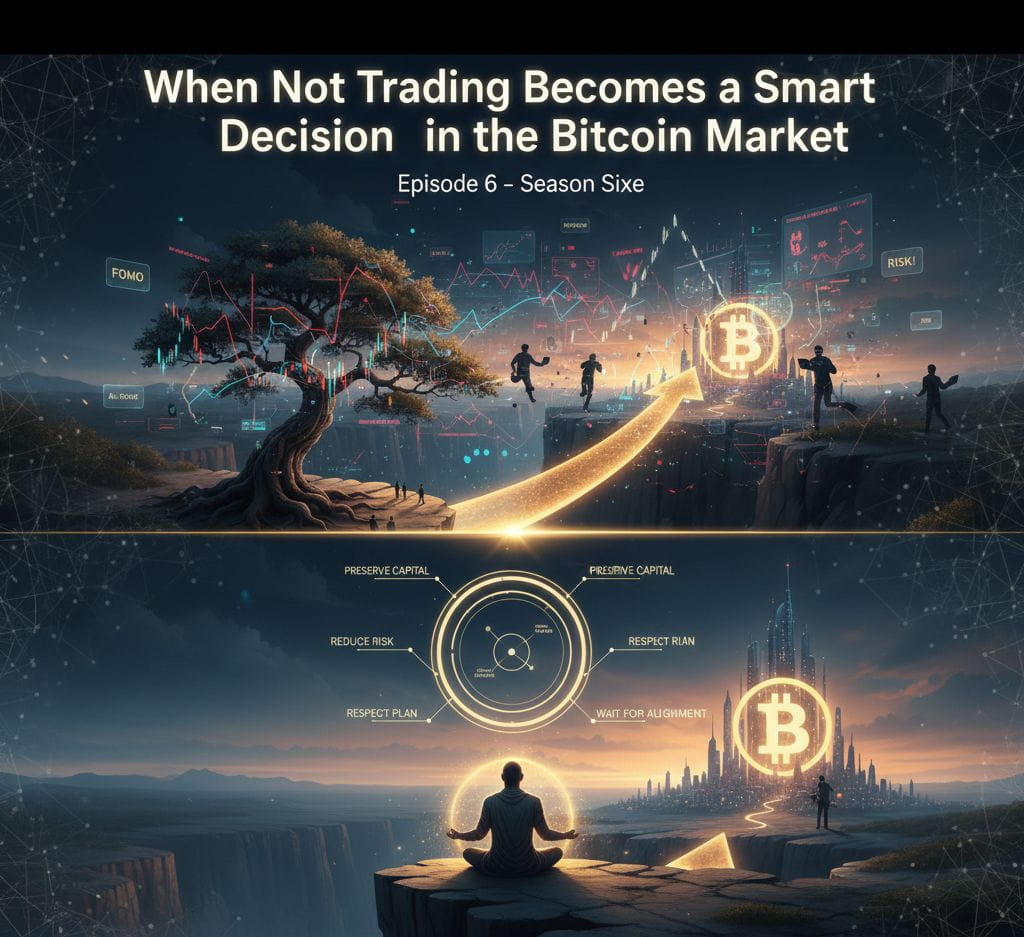

4️⃣ Bitcoin Rewards Patience, Not Activity

Bitcoin is an asset that does not respond to haste.

Its strongest moves often occur after long periods of quiet,

and its clearest opportunities appear when most traders have lost interest.

The market is always open,

but real opportunities are rare,

and those who wait don’t feel compelled to trade every day.

5️⃣ Not Trading as Part of Decision Management

Professionalism is not measured by the number of trades,

but by the ability to distinguish between genuine opportunities and transient movements.

Often, choosing not to enter means:

Preserving capital

Reducing unnecessary exposure to risk

Respecting a pre-defined plan

Not trading here does not indicate passivity,

but a conscious choice to wait until market conditions, timing, and circumstances align with your criteria.

In a fast-moving market like Bitcoin,

discipline in selection is essential for sustainability, even before considering profits.

Conclusion

Not all silence is a loss,

and not every movement is an opportunity.

Sometimes, the wisest decision in the Bitcoin market is to observe without acting.

A successful trader doesn’t only ask: When should I enter?

They also ask, with greater awareness: When should I stay out?

Because the market does not reward the boldest,

nor the fastest decision,

but those who know when to wait… and when to act.

This episode is dedicated to the dear brother: @FÈS - TEAM MATRIX - TinkTank

#Binance #BinanceSquare $BTC $BNB

Read and benefit from the information. 💚✌🏼