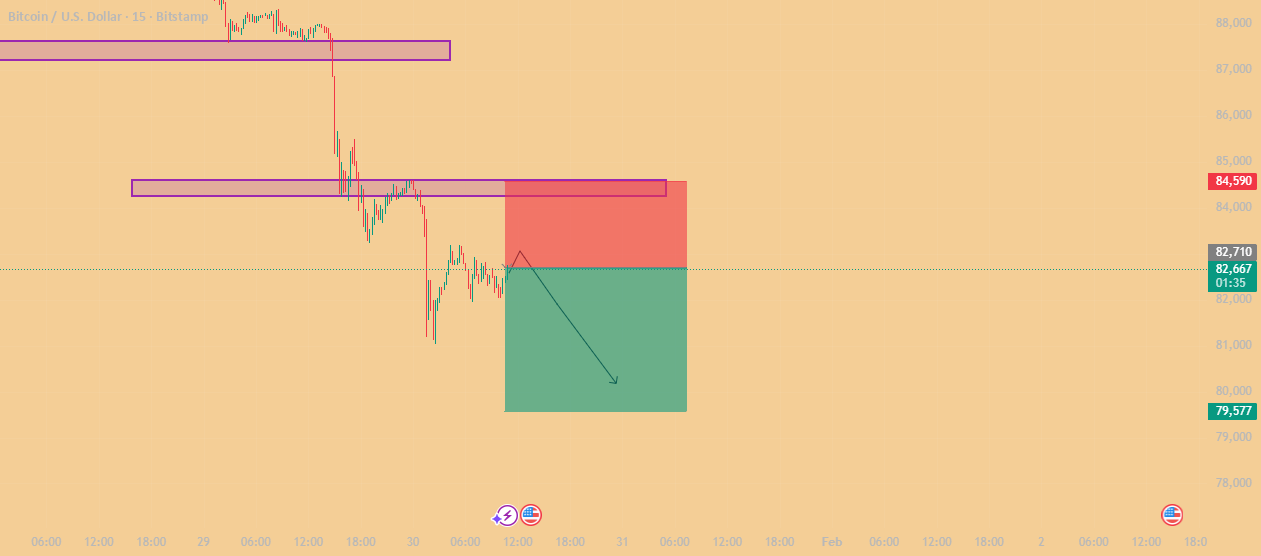

Bitcoin (BTC/USD) has shown a significant structural change on the 15-minute timeframe, where the price has decisively broken down previous institutional support levels. Market sentiment has now shifted from a consolidation phase to aggressive downward expansion.

Technical Breakdown:

Major Support Breach: The critical support level of $85,150, which had previously held the price two times, has now broken. This is an indication of a shift in market psychology from bullish to bearish.

Resistance Flip: Previous foundational support zones ($86,500 and $85,150) will now act as primary supply barriers (resistance).

Current Market State: Bitcoin is currently trading in the range of $81,000 – $82,729.

Forecasted Path: According to the "Break and Retest" sequence, there may be a minor relief bounce in the price up to the area of $84,000, after which further decline is expected.

Key Targets:

Primary Objective: $81,000 – Immediate local low and liquidity pool.

Major Target: $80,000 - $80,500 – An important psychological and structural support zone.

Risk Management: Bearish outlook will remain as long as the price is below the pivot level of $85,150.

Strategy Note: The current bias is "Sell on Strength". Traders should wait for bearish confirmation (such as rejection wicks) at the resistance area of $84,000 in order to capture the move towards the $80,000 targets.