CPI (Consumer Price Index) – The Consumer Price Index is a measure of the average change in prices of goods and services that consumers pay over a specific period of time.

In other words, the CPI indicates how quickly your currency is depreciating (or holding its value).

For example:

If the CPI this month increases by 4% compared to the same period last year, it means that the average price has increased by 4%, and the purchasing power of the currency has decreased by 4%.

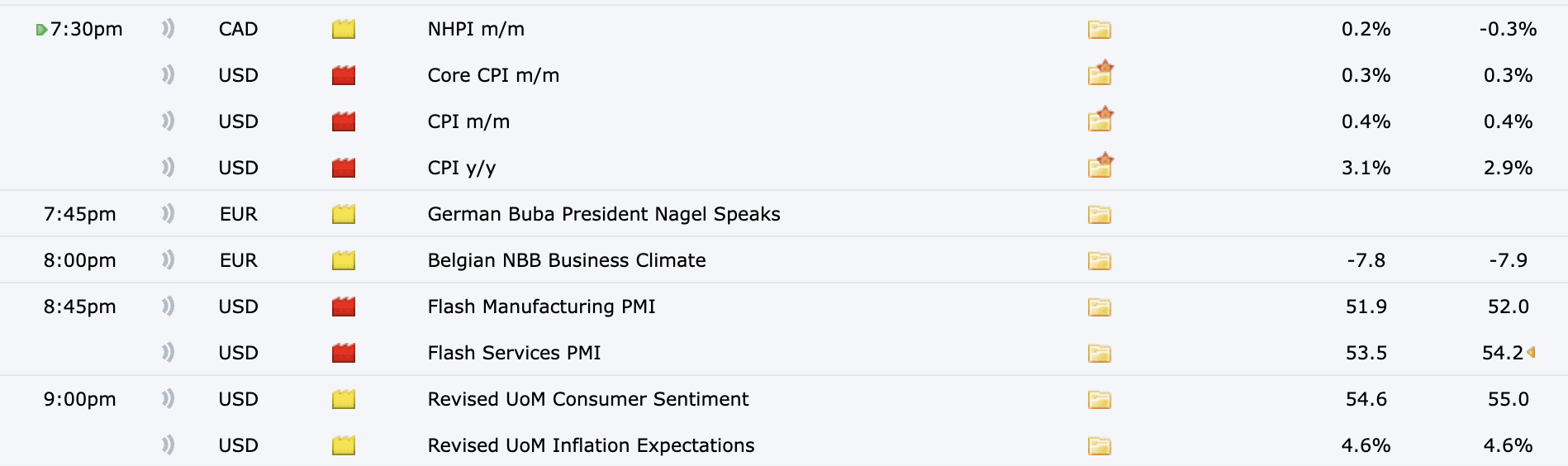

Previous month's CPI: 2.9%

The prediction is: 3.1%

📊 CPI is divided into 2 main forms:

Overall CPI: Includes all categories of goods, including energy and food (which are highly volatile).

Core CPI: Excludes energy and food prices, providing a more stable reflection of inflation trends, less affected by short-term fluctuations.

📍 When central banks like the FED (US) or the State Bank of Vietnam analyze inflation to adjust interest rates, they pay particular attention to core CPI.

💣 Why is CPI so important?

CPI affects almost everything in the economy:

1. Interest rates:

When CPI rises sharply → Inflation rises → Central banks may raise interest rates to cool down the economy.

→ Directly affects home loans, stocks, gold, and crypto.

2. Wages and income:

CPI is used to adjust wages, pensions, and rental contracts, helping to ensure that people are not harmed by rising prices.

3. Investment and financial markets:

Every time the US announces CPI, the stock market, gold, Bitcoin, and USD react strongly.

A higher-than-expected CPI often causes the market to react negatively, as investors fear the FED will raise interest rates.

🔮 CPI, inflation, and the future of the economy

CPI is a guiding indicator for policymakers:

* If CPI rises too quickly → high inflation → need to tighten monetary policy.

* If CPI rises too low or negative → risk of deflation → need to stimulate the economy.

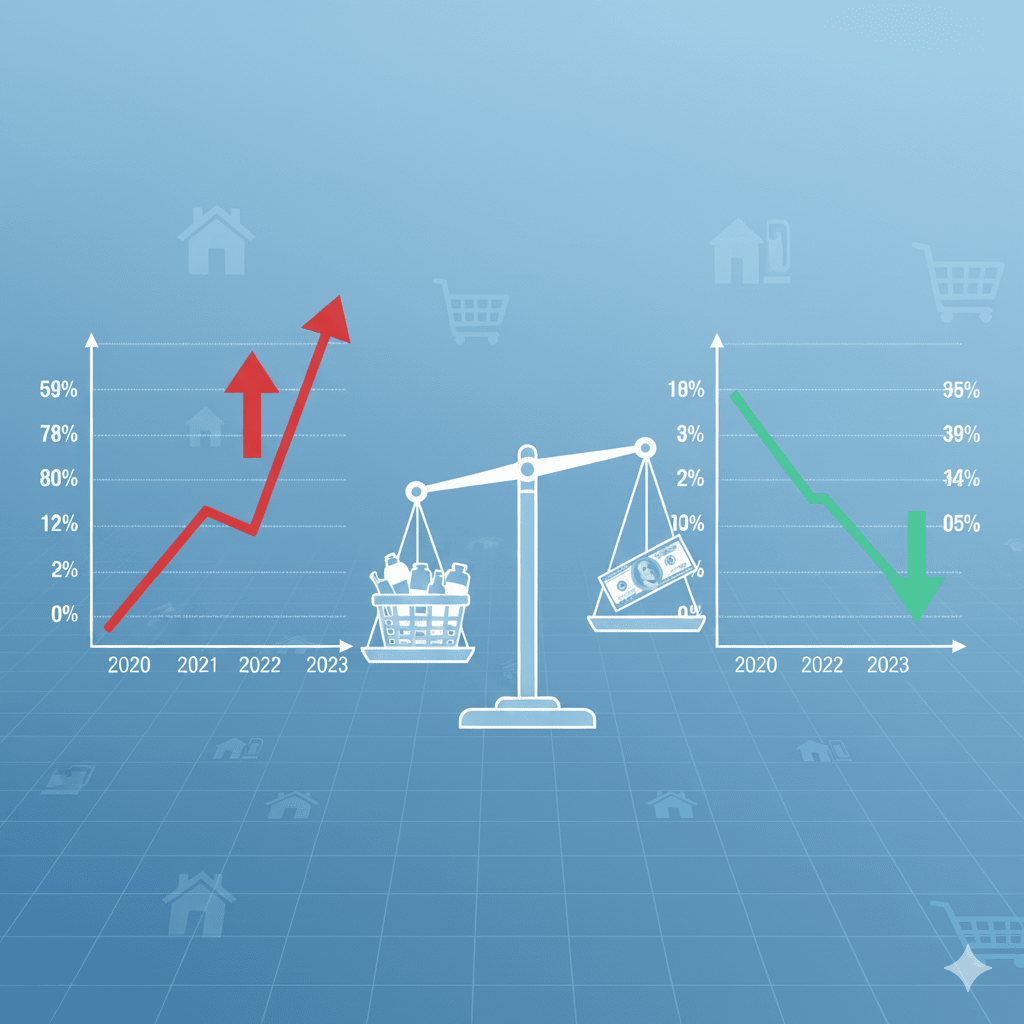

In the post-COVID period, many countries witnessed a sharp rise in CPI due to:

* Disrupted supply,

* Rising energy and transportation prices,

* The government injects money to stimulate the economy.

As a result, central banks are forced to raise interest rates, leading to a downturn in stocks and crypto during the 2022–2023 period.