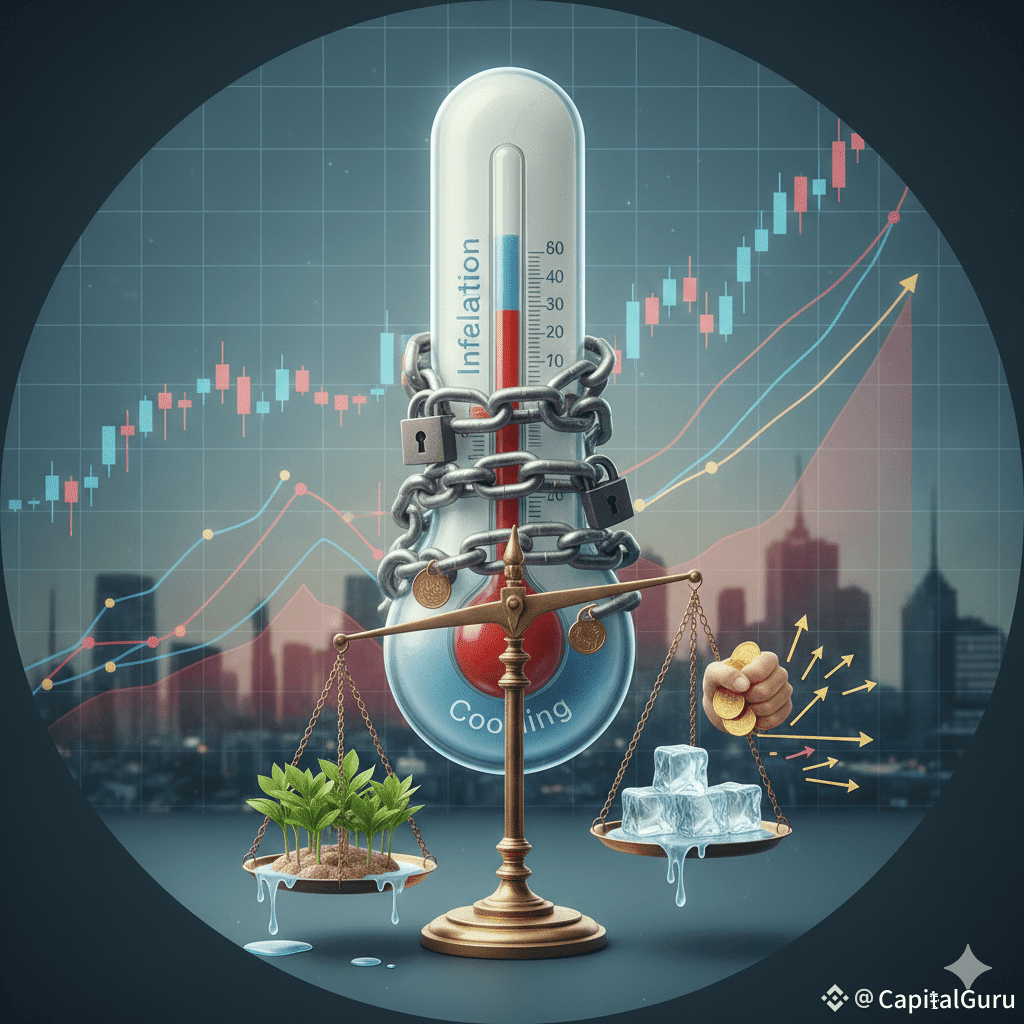

The latest CPI numbers show something everyone has been waiting for — U.S. inflation is finally cooling at a steady pace. Prices aren’tr ising as aggressively as they were months ago, and consumer pressure is easing bit by bit. That’s the good news.

But here’s the part the headlines often miss:

Liquidity in the financial system still hasn’t fully recovered.

While declining inflation usually opens the door for lower interest rates and improved credit flow, the market isn’t feeling that relief just yet. Tighter lending conditions, cautious banks, and lower money supply growth continue to hold back liquidity. Businesses and consumers are still moving carefully, and risk appetite remains weaker than expected.

This imbalance—cooling inflation + tight liquidity—creates a unique moment for investors, traders, and analysts.

It signals that the economy is improving on the surface, yet the underlying gears that drive growth haven’t fully started turning again.

So what does this mean?

📉 Inflation easing → The Fed may eventually consider rate cuts, but timing is uncertain.

💸 Liquidity still tight → Markets might remain volatile in the short term.

🏦 Credit conditions cautious

→ Borrowing won’t feel “easy” anytime soon.📊 Investorsentiment mixed

→ Optimism is growing, but confidence isn’t all the way back.

If inflation continues cooling and liquidity gradually improves, we could see a stronger

market rebound. But for now, this is a “wait and watch” phase — one that

rewards patience and smart positioning.

Join Now... Binance Refferal Link :

Do YOU think liquidity will bounce back by year-end?

Drop your thoughts below. 👇

#Inflation #Economy #Markets #Finance #CPIWatch $BNB

🚀🚀🚀 PLEASE CLICK FOLLOW

@CapitalGuru - Thank You... 🙏 $BTC