🔷 Ethereum shows one of the strongest reversal signals in recent months — both on-chain and in the derivatives markets — following the activation of the Fusaka upgrade overnight from December 3 to 4.

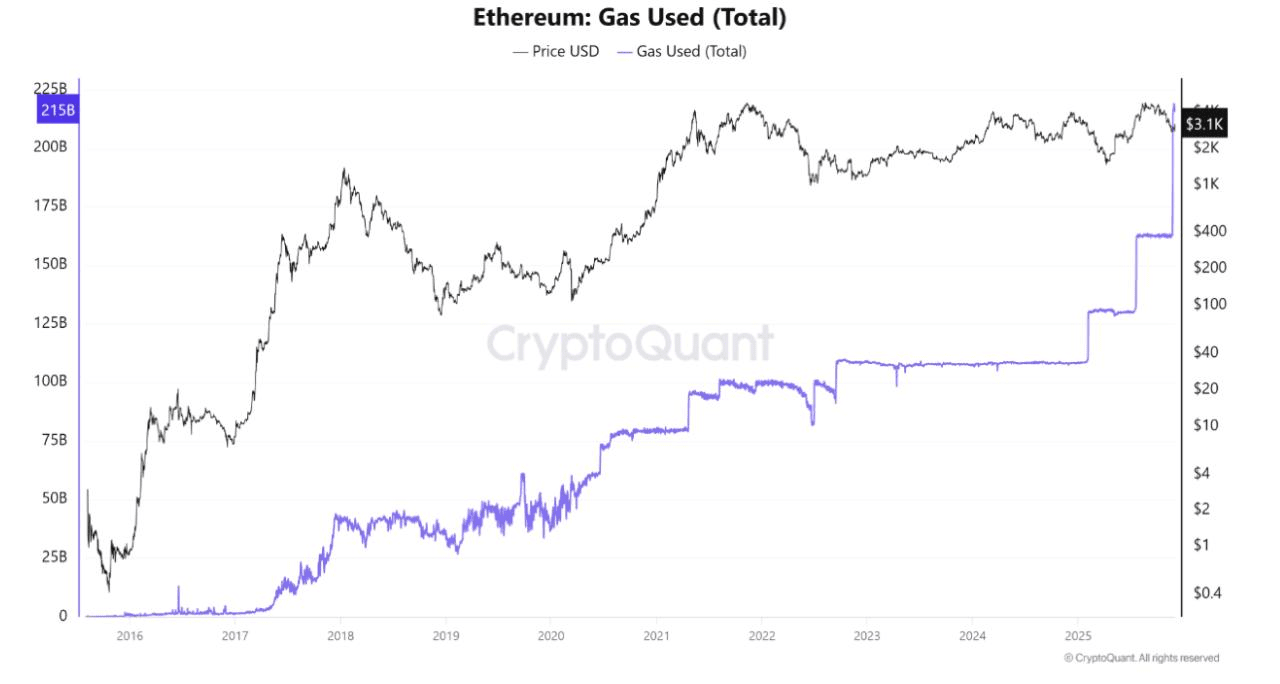

On-chain explosion before the upgrade

🔼 Just a day before the upgrade, the Total Gas Used metric increased from 165 to 215 billion — a new historical maximum (+30%).

Such a jump is not 'random'. This means that users:

— actively blocked funds in DeFi,

— launched complex smart contracts,

— prepared infrastructure for the post-Fusaka Ethereum economy.

Essentially, this was a mass vote of confidence in the update and a strong increase in real demand for the blockchain.

And at the same time — an increase in deflationary pressure through gas burning.

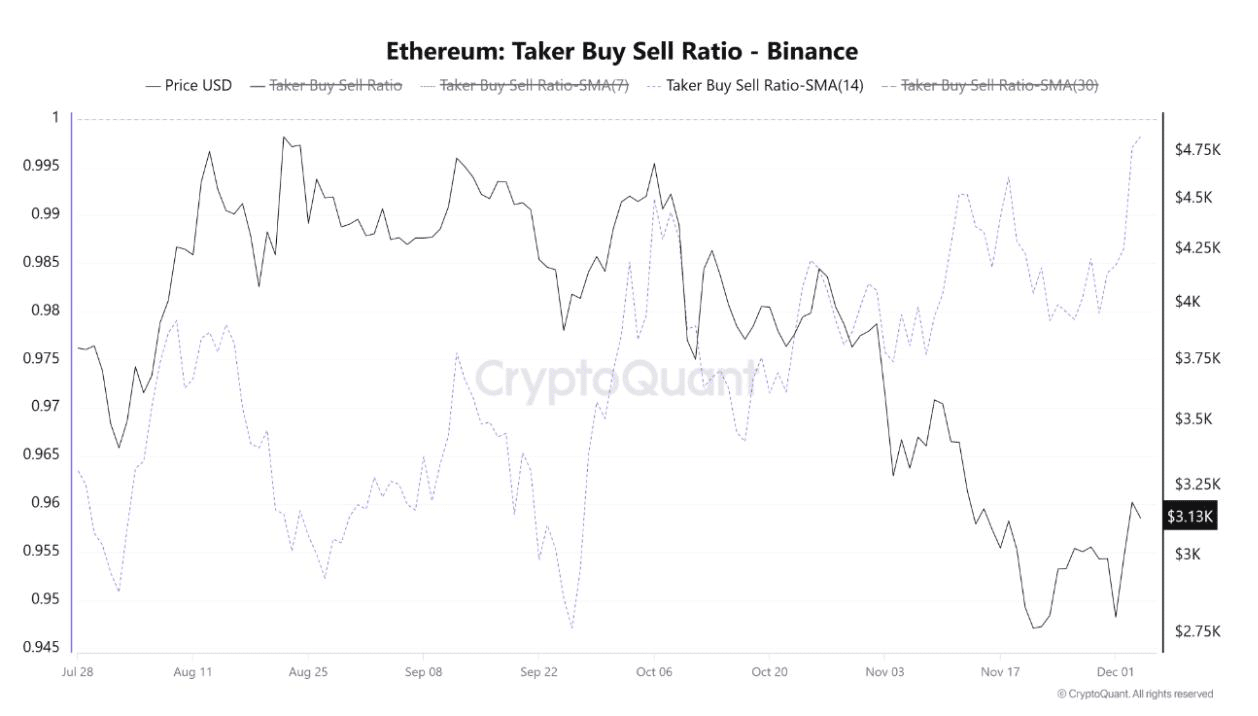

Futures confirm the reversal

📈 After the activation of Fusaka, the Taker Buy/Sell Ratio on Binance rose to 0.998 — the highest since August.

This means:

— traders began aggressively opening longs,

— the market anticipates a continuation of the upward movement,

— interest in growth precedes the price itself.

✔️ If the metric breaks the 1.0 level, it will be a formal confirmation of the completion of the November correction and will open the way to the $3,500 — $4,000 zones.

What does this mean for the market

Combination:

the explosion of on-chain activity before the upgrade + aggressive longs after it — a classic scenario for the beginning of a new impulse for ETH.

The price is still lagging behind the metrics, but the structure has already turned bullish.

If Bitcoin does not create pressure, Ethereum is capable of testing $3,500 in the coming weeks.

Fusaka strengthens Ethereum's status as the technological benchmark of the crypto market, and the market begins to reassess this.

$ETH