Tired of speculation? Forget it

let's look at something more important: infrastructure.

Because honestly, speculation is fun… but a future built on a foundation is very different from just FOMO for a moment.

And amidst this infrastructural development, one name keeps coming up: Momentum.

Not just a DEX, but a full on-chain Financial Operating System that is too big to ignore.

So, let's break down why Momentum has become a topic of discussion and why its position in the Sui ecosystem should raise your eyebrows a bit.

Momentum: Just an ordinary DEX? Nope. This is an On-Chain Monster.

Momentum is the most popular spot DEX on the Sui network and it's no joke, its performance has reached the level of 'how can it be this big in such a short time?!'

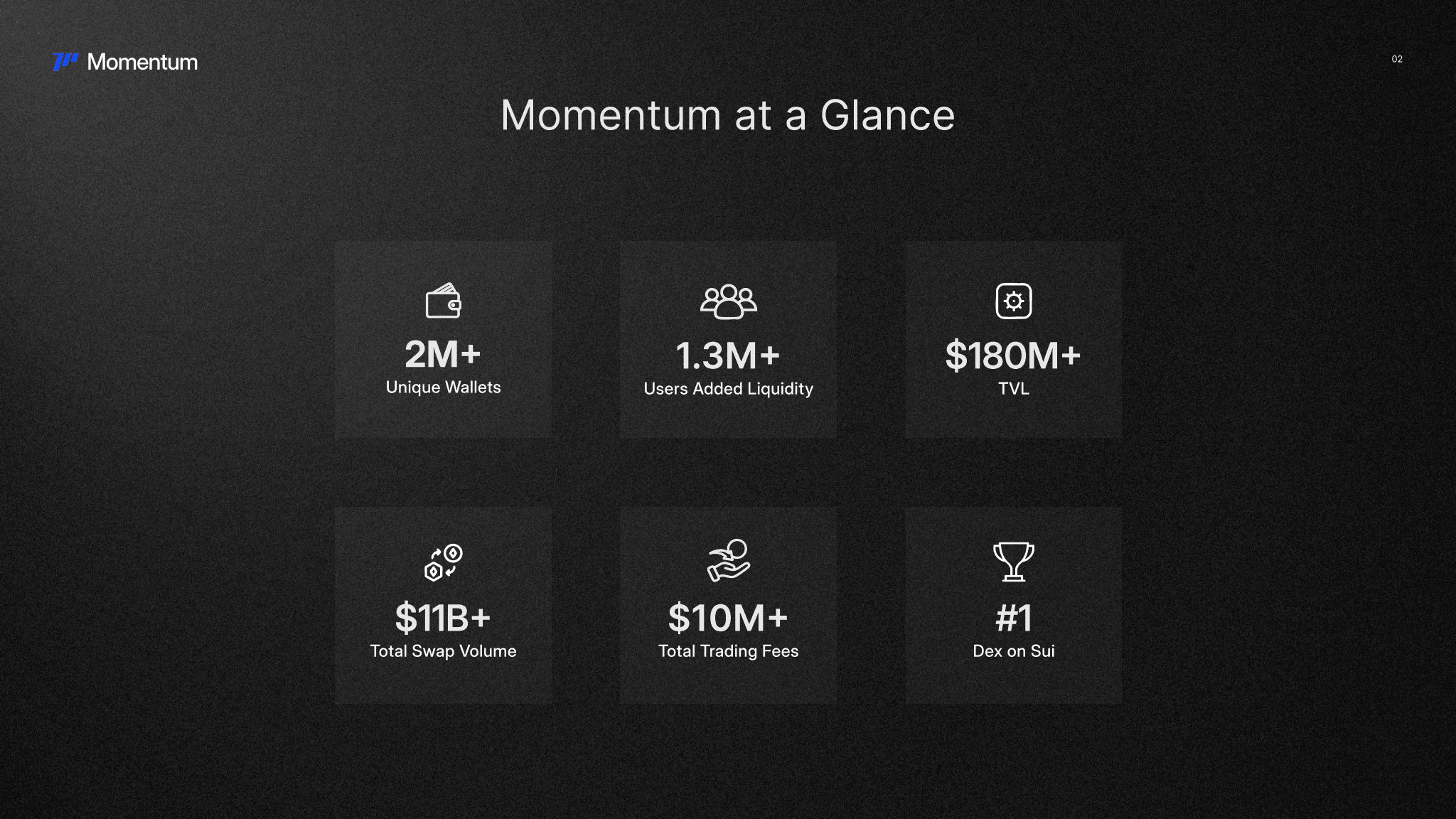

Their data:

>120M total value

>29.1B trading volume

>2.1M users

1.3M active LPs

>10M trading fees

Ranked #1 spot DEX on Sui

Yep. These numbers are not just random, they can be considered very good. Momentum is basically the main gateway for real trading activities on Sui.

But... why can it be that big?

Why can Momentum accelerate? Two Key Reasons: 'Fresh Users' & 'Fresh Money'

The Uniqueness of the SUI Community

This is a big point.

Sui users are retail-heavy, energetic, and rarely cross over to other chains. What does that mean?

Fresh market

Fresh liquidity

Little competition

New users who have not yet saturated the Ethereum or Solana ecosystem

Momentum is at the heart of this community—like opening a store in a booming new city.

Crazy incentives #sui

In 2024–2025, Sui is among the chains that offer the most generous incentives for DeFi & liquidity growth.

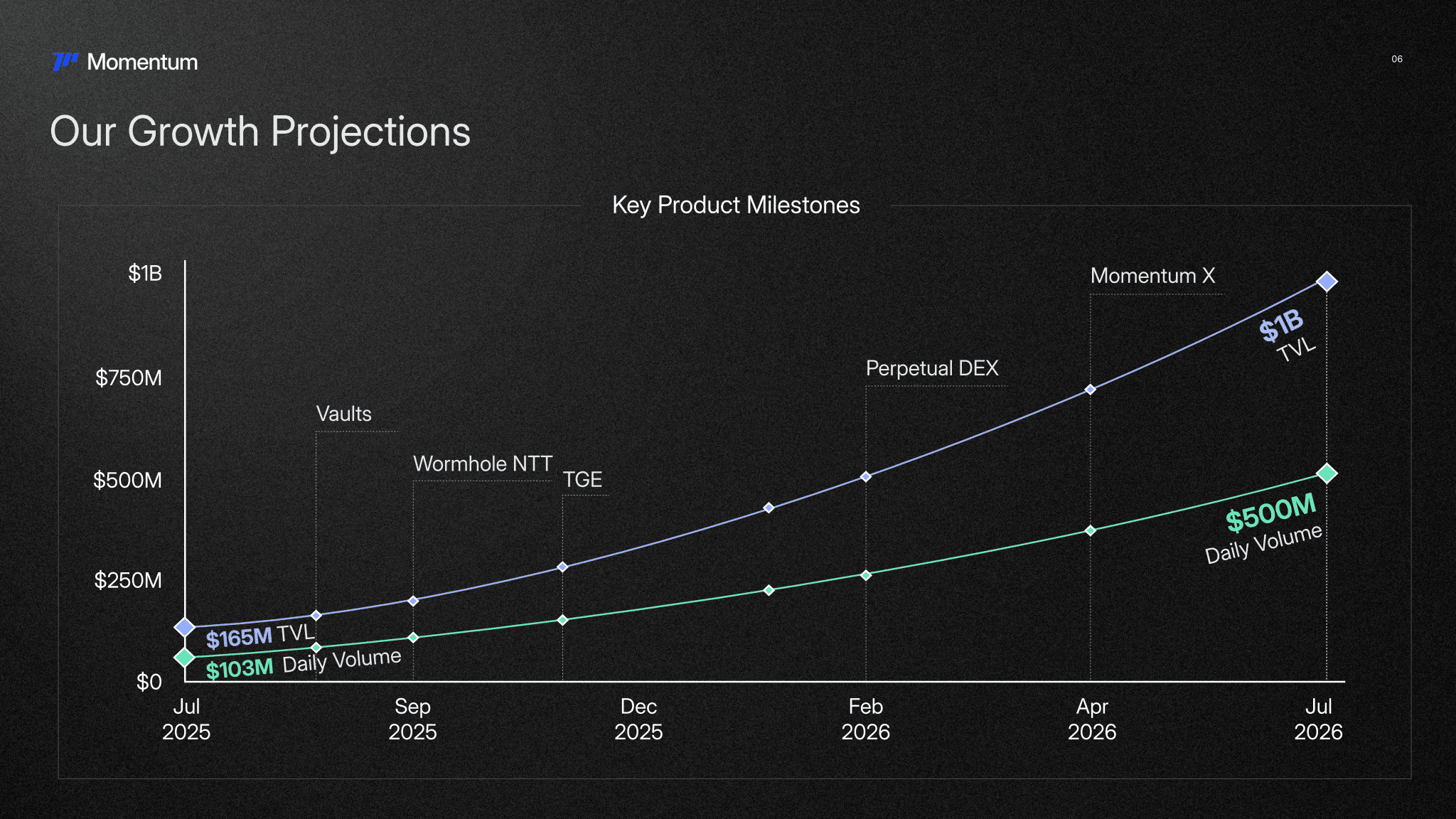

The protocol is growing faster

Liquidity is coming in more abundantly

Users are becoming more active chasing airdrops (Because last year's airdrops in the $SUI ecosystem were among the most legit)

Momentum is part of this snowball effect.

Ecosystem grows → trading increases → LP increases → fees increase → Momentum gets bigger.

Momentum Ecosystem

Momentum is not just a DEX, but a super-ecosystem that includes:

Spot DEX

Perpetual DEX (Launch early 2026)

Vault

Liquid Staking

MomentumX (on-chain KYC layer)

Token Generation Labs 🤯

Early Access Launchpad

MSAVE

XSUI ecosystem

Partner stablecoin, bridging, BTC layer solutions, lending, and much more.

In short:

➡️ #momentum this is an all-in-one crypto financial stack

➡️ All operations are 100% on-chain

➡️ And this is just the beginning.

Perpetual DEX: Fee Printing Machine for MMT Buyback

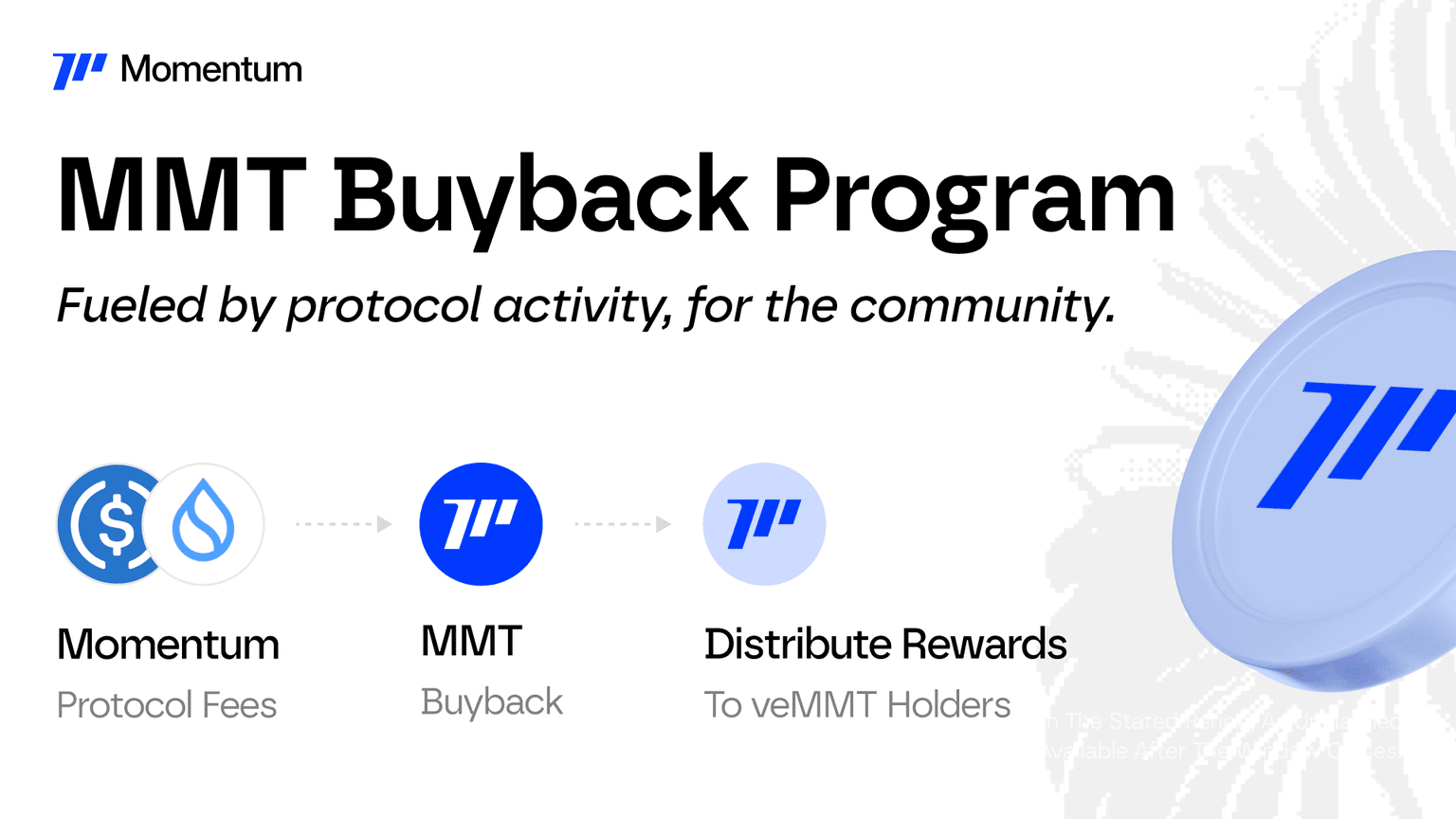

This is the part that makes holders$MMT aware: Momentum doesn't just rely on spot trading.

They will launch: Perpetual DEX with leverage

A.K.A the home for traders who love the thrill.

With over 2 million active spot users, it's very easy to 'upgrade' them to perp traders.

The benefits?

Volume is much larger

Fees are higher

Momentum's revenue is rising

Used for the MMT buyback program

Buyback → tokens become stronger

MMT is not a 'wild inflation' token.

They have a mechanism:

Protocol fees → bought back MMT → distributed to VMMT holders

Holders not only stake but literally participate in extracting protocol value.

VMMT: The token that can provide APR of up to 100%

there are several options:

7 days

1 year (25% share power)

2 years (50% share power)

3 years (75% share power)

4 years (100% power, maximum)

The longer you lock → the bigger the voting power & reward share.

APR can even be wildly varying depending on the pool. But... besides profit, VMMT holders also:

Gain governance power

Get priority access to new products

Get early allocation opportunities and potentially receive further airdrops (from TGL)

MomentumX: On-Chain KYC Layer

Momentum creates something unique: MomentumX.

This is on-chain KYC that:

Just verify once

Global applicability

Stored on-chain with double security:

Walrus

SEAL

TEE (Trusted Execution Environment)

This creates:

Institutions can enter without regulatory headaches

Retail users can access 'more serious' assets

DeFi gets new liquidity

Everything remains non-custodial

Bridging TradFi ↔ DeFi while remaining on-chain.

This is crazy.

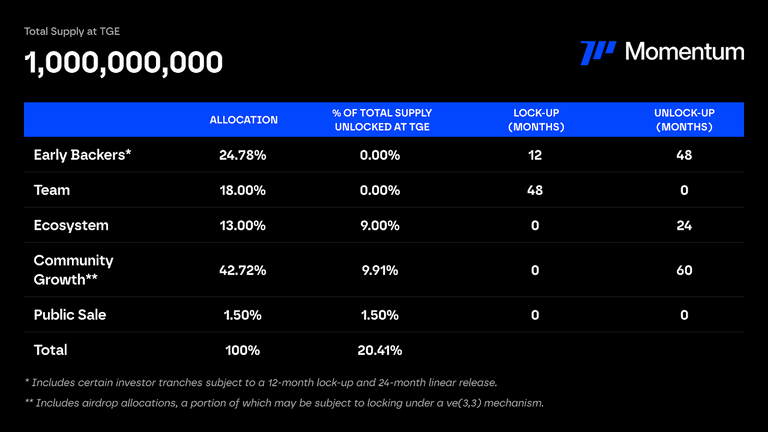

MMT Tokenomics: Super Focused on Community

MMT Distribution:

24.78% Backers

18% Team

13% Ecosystem

42.72% Community Growth 🤯

1.5% Public Sales

This tokenomics shows:

➡️ Momentum belongs to the community

➡️ Their growth is user-based, not big investors

MMT Utility:

Bonding → becomes VMMT

Governance

Community rewards

Priority access

Airdrop eligibility

Buyback benefits

LP, Staking, and #Airdrop : Many ways to earn in Momentum

LP status and staking make Momentum attractive:

APR can be 8% – 322% (depending on the pool)

There are daily rewards in various token forms

There are special farming opportunities

There is an XSUI yield layer

There are LP airdrops that can be checked directly in their dapps

FYI there are airdrops also for $BNB Hodlers..

Details: Momentum (MMT) on Binance HODLer Airdrops!

Join Binance & Hold Binance to receive other airdrops: www.binance.com/register?ref=W4OQ5FX5

NOTE: Do your own research…