Long-term Bitcoin (BTC) whales selling covered calls, a strategy of selling call options that give the buyer the right but not an obligation to purchase an asset in the future at a predetermined price in exchange for the seller collecting a premium, is suppressing spot BTC prices, according to market analyst Jeff Park.

Large, long-term BTC holders, also known as “whales” or “OGs,” introduce a disproportionate amount of sell-side pressure through this covered call strategy, partly because market makers are on the other side, buying the covered calls, Park said.

This means that the market makers must hedge their exposure to buy the calls by selling spot BTC, forcing market prices down.

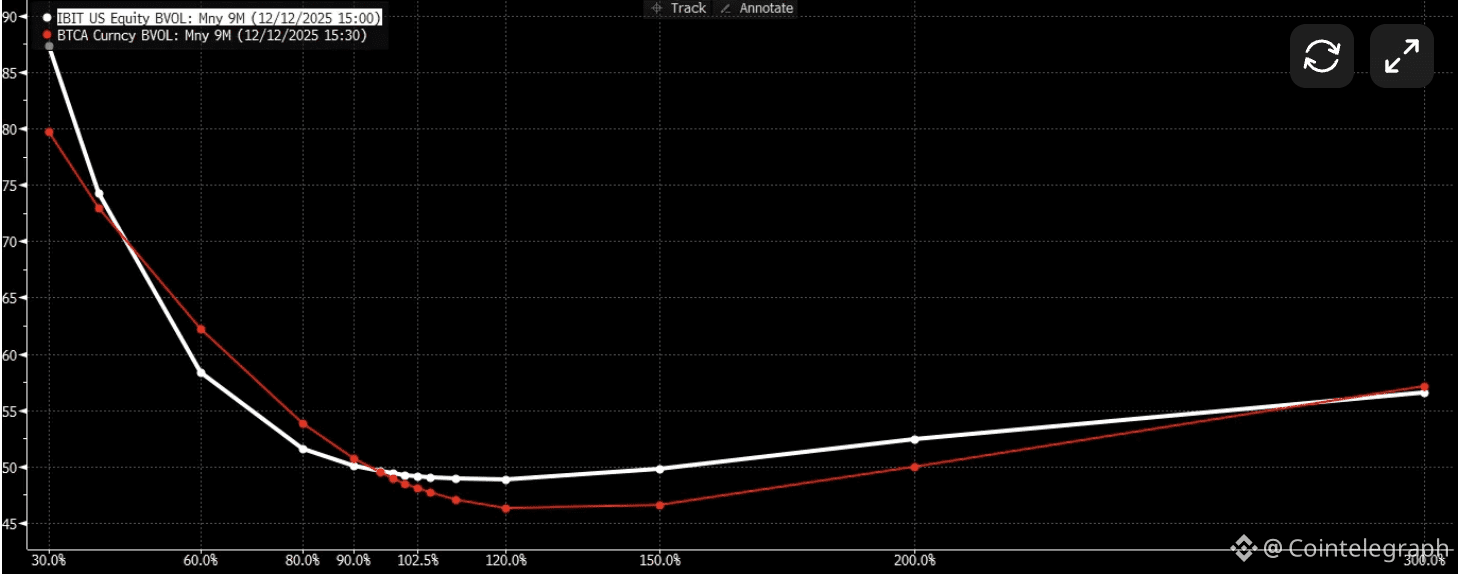

The volatility skews of BlackRock’s IBIT ETF versus native Bitcoin options, like those found on crypto derivatives exchange Deribit. Source: Jeff Park

The volatility skews of BlackRock’s IBIT ETF versus native Bitcoin options, like those found on crypto derivatives exchange Deribit. Source: Jeff Park

Because the BTC used to underwrite the options has been held for a long time and does not represent new demand or fresh liquidity, the calls act as a net downward pressure on prices. Park said:

“When you already have the Bitcoin inventory that you’ve had for 10-plus years that you sell calls against it, it is only the call selling that is adding fresh delta to the market — and that direction is negative — you are a net seller of delta when you sell calls.”

The analysis concluded that Bitcoin’s price is being steered by the options market and that price action will remain choppy as long as whales continue to extract short-term profits from their Bitcoin stash by selling covered calls.

Related: Short-term Bitcoin traders were profitable for 66% of 2025: Will profits rise in 2026?

Bitcoin decouples from stocks as analysts attempt to gauge where BTC’s price goes next

Bitcoin, which some analysts say is correlated with tech stocks, decoupled from the stock market in the latter half of 2025, as stocks continued to print fresh highs while Bitcoin fell back down to about the $90,000 level.

The price of Bitcoin hovers above the $90,000 level. Source: CoinMarketCap

The price of Bitcoin hovers above the $90,000 level. Source: CoinMarketCap

Several analysts forecast that BTC will resume its price rally when the United States Federal Reserve continues the rate-cutting cycle and injects liquidity into the financial system, which is a positive price catalyst for risk-on assets.

24.4% of traders expect another interest rate cut at the Federal Open Market Committee (FOMC) meeting in January, according to financial derivatives company CME Group’s FedWatch data tool.

However, other analysts project a potential drop to $76,000 and say that Bitcoin’s bull run is already over.

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary