Market 'risk-off' sentiment is rising, with traders shifting funds to safer assets. Although the Federal Reserve lowered interest rates last week, it failed to effectively boost the market. As year-end approaches, market liquidity is dwindling, which can amplify price volatility. Reports indicate that a large number of mining machines (estimated to exceed 400,000) in Xinjiang, China, have been shut down, leading to a decrease in overall network computing power and raising concerns about short-term selling pressure.

For Bitcoin:

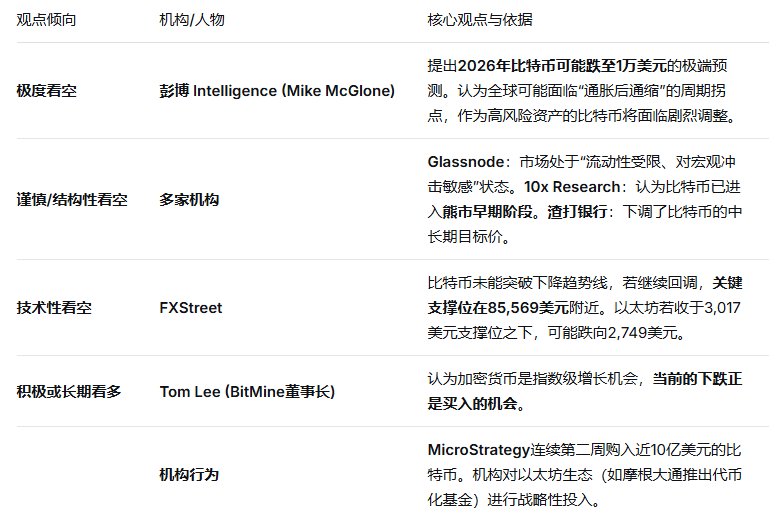

Key Resistance: $92,500 and $94,253 are strong resistance areas above and key positions of the downtrend line. Only a breakthrough of this area could reverse the short-term downtrend.

Key support: $85,569 (coinciding with recent lows) and $79,000 (near the annual low). A break below the latter could trigger a larger decline.

For Ethereum$ETH :

Key resistance: $3,280 (50-day exponential moving average) is an important short-term resistance level.

Key support: $3,017 and $2,749. The current price has fallen below $3,000, and it is important to watch whether it can recover quickly.