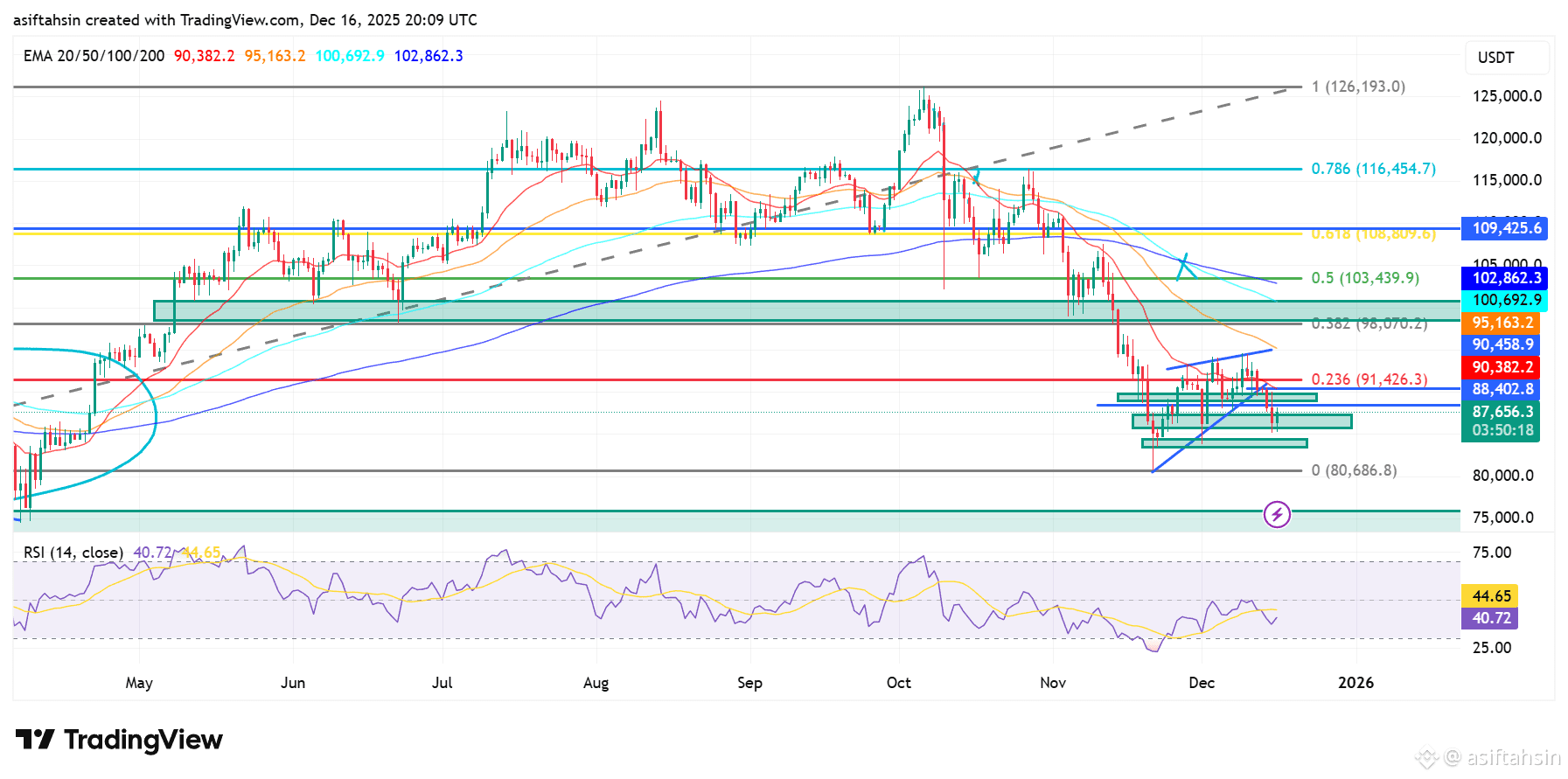

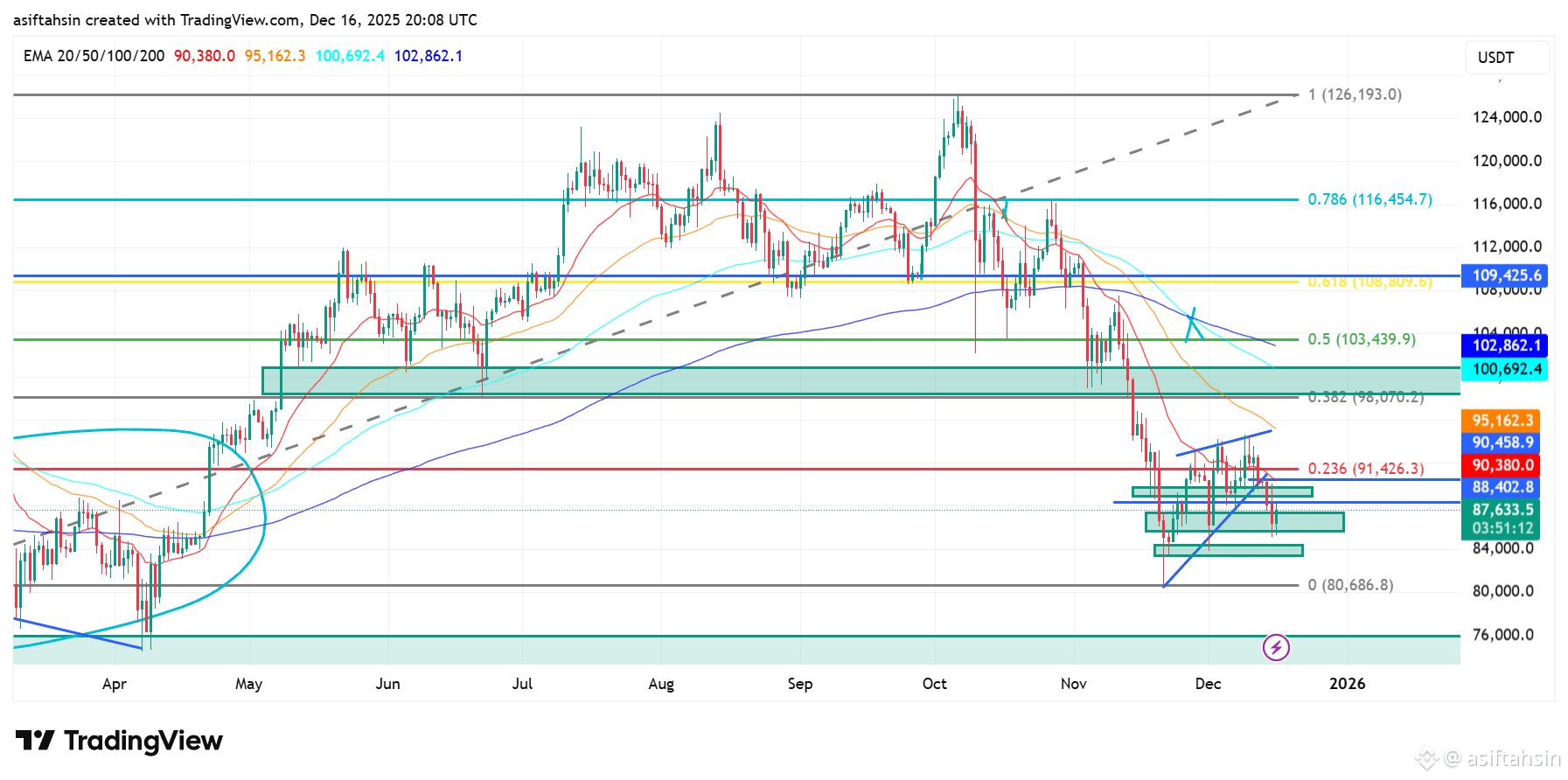

Bitcoin remains under short-term bearish pressure following a strong rejection from the $116K–$126K supply zone, where price failed near the 0.786 Fib and prior cycle highs. This rejection marked a clear distribution phase and triggered a sharp downside move.

The sell-off accelerated after BTC lost the $109K–$105K region (0.618–0.5 Fib), confirming a structural breakdown and shifting momentum in favor of sellers.

EMA Structure (Bearish Bias)

BTC is currently trading below all major EMAs, with averages acting as strong overhead resistance:

20 EMA – $90,382

50 EMA – $95,163

100 EMA – $100,693

200 EMA – $102,862

This EMA alignment confirms a bearish market structure, with any upside likely to face selling pressure near the $95K–$100K zone.

Price is now consolidating above a key demand zone between $88,000–$86,500, which aligns closely with previous support and the lower Fibonacci region. This area has absorbed recent selling pressure, suggesting selling momentum is weakening and increasing the probability of a short-term relief bounce.

For bulls, the first critical level is $91,426 (0.236 Fib). A daily close above this level would signal early stabilization. A stronger recovery would require BTC to reclaim $95,870 (0.382 Fib) and then $103,440 (0.5 Fib), where prior breakdowns occurred.

A full bullish trend resumption would only be confirmed if BTC regains and holds above $108,800–$109,400 (0.618 Fib) — a scenario that currently depends on broader market strength.

On the downside, failure to hold $86,500 could expose BTC to deeper losses toward $80,600 (Fib 0), which is the next major downside support.

RSI is hovering near 40, reflecting weak but stabilizing momentum, consistent with consolidation rather than aggressive selling.

📊 Key Levels

Resistance

$91,426 (0.236 Fib)

$95,870 (0.382 Fib)

$100,700–$102,860 (100 & 200 EMA)

$103,440 (0.5 Fib)

$108,800–$109,400 (0.618 Fib)

$116,450 (0.786 Fib)

Support

$88,000–$86,500 (major demand zone)

$84,000 (intermediate support)

$80,686 (Fib 0 / extended downside support)

RSI

40.7 — bearish but stabilizing

📌 Summary

BTC is consolidating above a major demand zone after a sharp corrective move. While weakening sell pressure may support a short-term bounce, the broader structure remains bearish unless BTC reclaims the $95K–$103K region with strong acceptance. Loss of $86.5K would open the door for a deeper retracement toward $80K.