Legendary trader Peter Brandt put Bitcoin's latest setup into one line, explaining what he is really seeing on the price chart of the leading cryptocurrency. Brandt's four-hour chart shows a continuation head-and-shoulders pattern. He says these formations are "very reliable," which puts pattern logic back into focus as BTC chops instead of trending.

That call happened whileBitcoin was stuck in a clear box on the shared higher-time frame chart: resistance is at $93,000 to $94,000, support is at around $85,000 and the price was below a dotted midrange marker with a rising diagonal line showing where it might bounce or fade.

In the same thread, another read framed the fork as simple: either Bitcoin fell out of an ascending triangle and this is a bearish retest, or Bitcoin is rotating inside an accumulation range, and both interpretations point to "somewhat logical" levels on the chart.

Bitcoin hits weekly price high, and fails

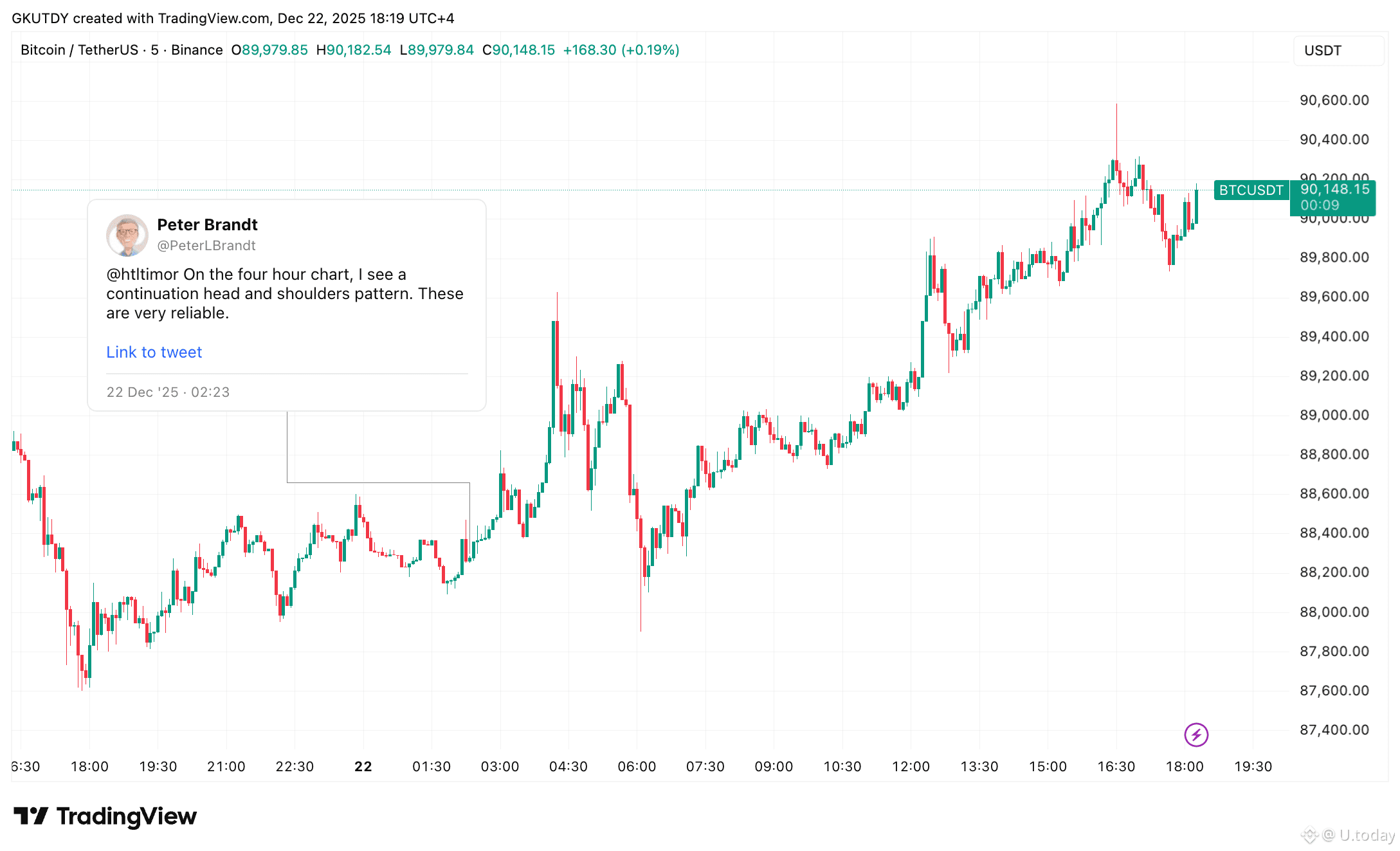

What happened next is interesting because it is the kind of mixed price action traders hate and headlines love. TheBTC/USDT chart shows an early spike followed by a fast dip to around $88,000, then a long recovery that turned into a midday pop and a late-session push that printed above $90,000 — a weekly high.

card

As of now,Bitcoin was at around $89,956. This may seem like a small net gain on a daily candle, but it is a major reminder of the day's real story: Bitcoin did manage to make a quick run up to $90,000, but it did not hold onto that level for long.

In Brandt's analysis, the focus is on whether the structure continues to rise, and the range read only stays alive if BTC can reclaim the middle of the box and start pushing the upper band again.