Traditional finance leveraged investment products are at a record high, but the appetite for speculative assets remains muted in the cryptocurrency market.

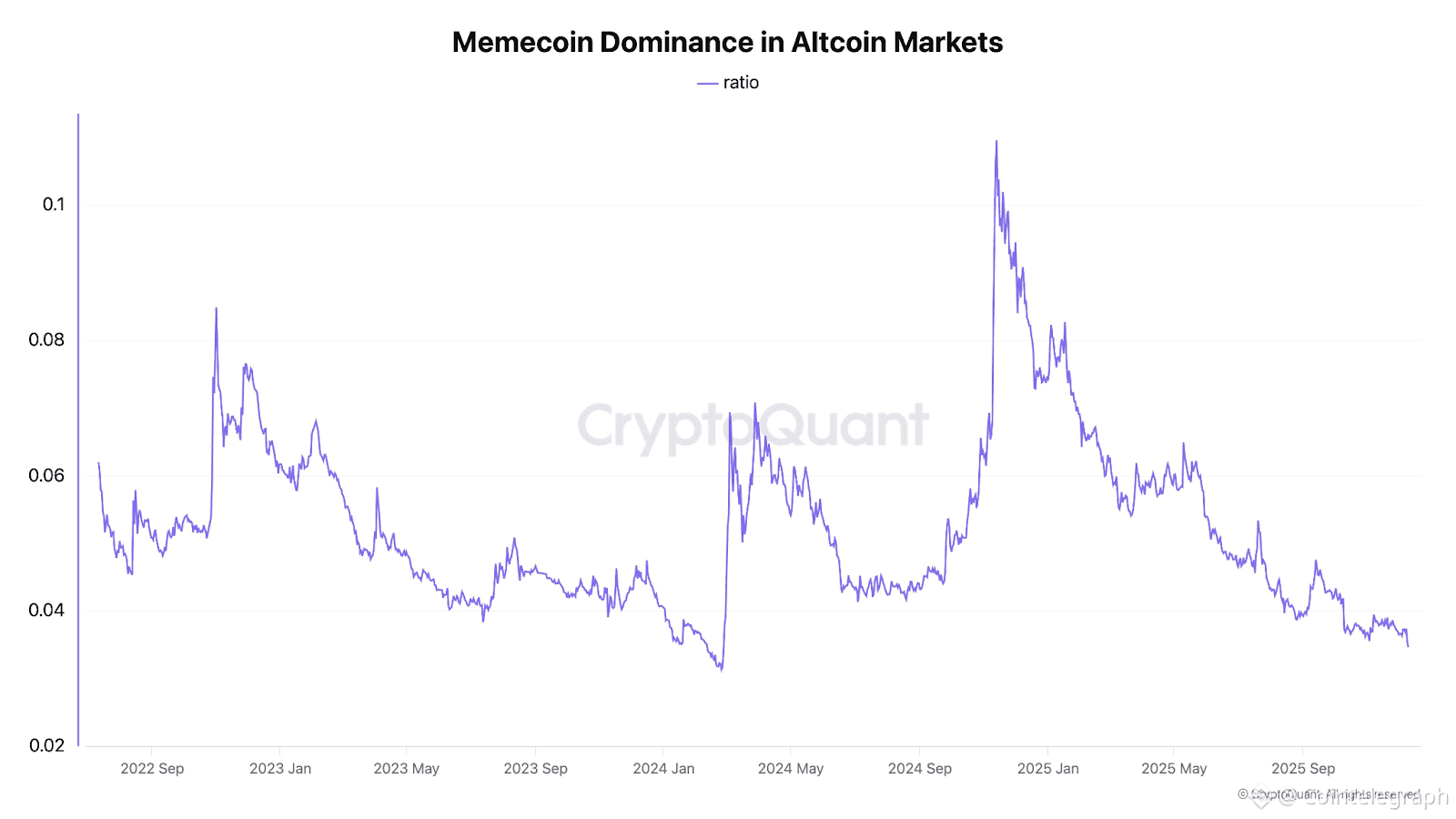

Speculative appetite is cooling among crypto investors, with memecoin dominance vs altcoins hitting a near two-year low last seen in February 2024, according to crypto data platform CryptoQuant.

“Memecoin markets are dead,” wrote CryptoQuant co-founder and CEO, Ki Young Ji, in a Thursday X post.

Memecoin dominance in altcoin markets. Source: Ki Young Ju

Memecoin dominance in altcoin markets. Source: Ki Young Ju

In contrast, speculative appetite is soaring among equities investors, as traditional leveraged exchange-traded funds (ETFs) hit a new all-time high of $239 billion in assets under management during the third quarter of 2025, according to Bloomberg data shared by Barchart.

The dynamic signals a waning enthusiasm for high-risk digital assets, as speculative appetite is recalibrating to regulated, TradFi leveraged products in less volatile equity markets.

Source: Bloomberg/Barchart

Source: Bloomberg/Barchart

The market dynamic signals a maturation in crypto and equities markets, as risk-taking is “expressed through regulated, familiar products with defined safeguards,” not memecoins that suffer from “thin” liquidity and regulatory uncertainty, Lacie Zhang, market analyst at Bitget Wallet, told Cointelegraph.

”A revival would likely require a strong catalyst — such as a new viral narrative, major exchange listings, or decisive price action — to reignite retail interest.”

Related: Bitcoin treasuries stall in Q4, but largest holders keep stacking sats

Crypto investor sentiment yet to recover from October market crash

The appetite of crypto investors remains muted for most cryptocurrencies since the record market crash at the beginning of October, not just for memecoins.

Crypto investor sentiment saw a small recovery from the “Extreme Fear” of 10 recorded on Nov. 23, but the current 29 reading still signals “Fear,” and remains far below the 62 “Greed” level from Oct. 7, before the $19 billion crypto market crash occurred, according to CoinMarketCap's Fear & Greed Index.

Crypto Fear & Greed Index, 1-year chart. Source: CoinMarketCap

Crypto Fear & Greed Index, 1-year chart. Source: CoinMarketCap

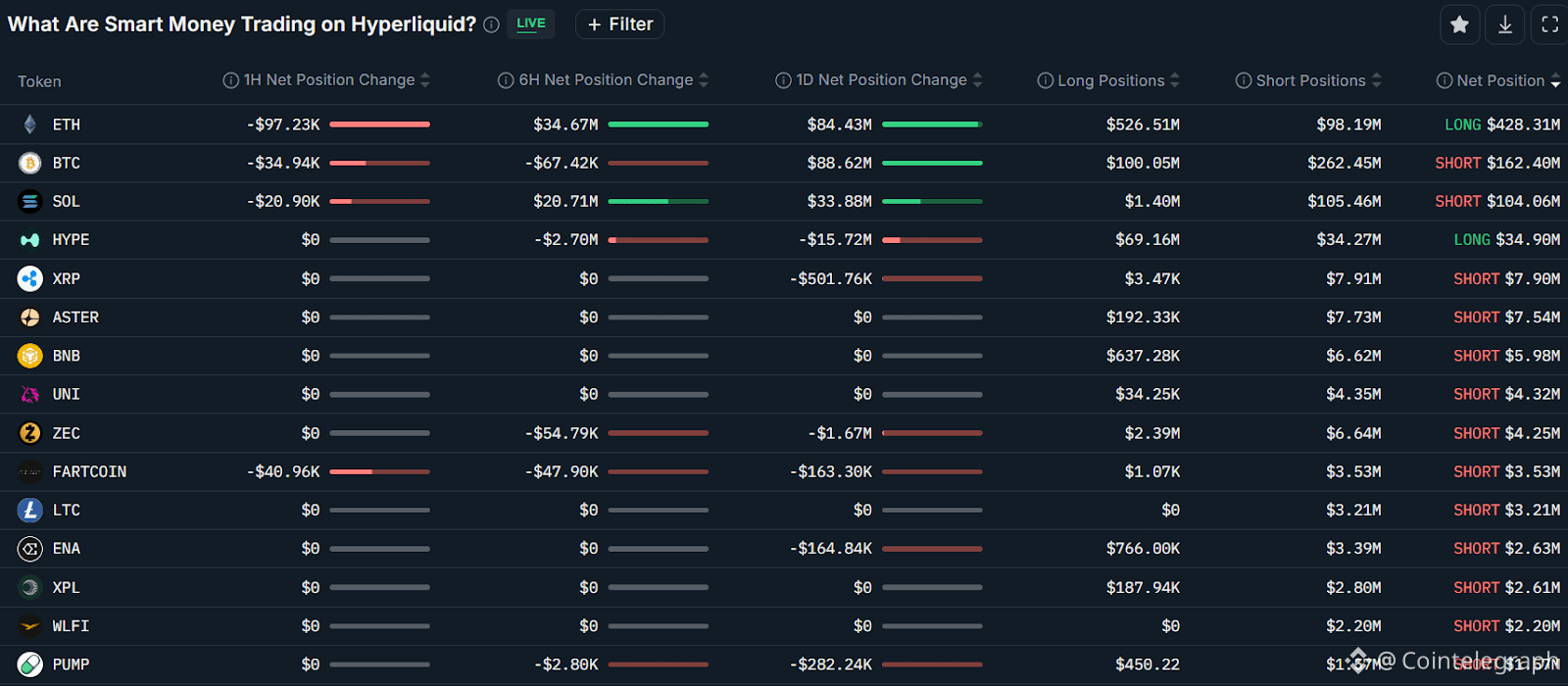

Meanwhile, the crypto industry’s best-performing traders by returns, who are tracked as “smart money” traders on Nansen’s blockchain intelligence platform, are betting on the decline of the leading memecoins and most cryptocurrencies.

Smart money was net short on Fartcoin (FART) for $3.5 million and net short on the Pump.fun (PUMP) token for $1.5 million, Nansen data shows.

However, the cohort is betting on more upside for Ether (ETH) and decentralized exchange Hyperliquid’s (HYPE) token, signaling a preference for tokens with real revenue-generating blockchain protocols.

Smart money traders top perpetual futures positions on Hyperliquid. Source: Nansen

Smart money traders top perpetual futures positions on Hyperliquid. Source: Nansen

Related: Crypto nears its ‘Netscape moment’ as industry approaches inflection point

The positioning from this cohort may also signal investor fatigue with the memecoin launches of the past cycle, as troubling data is emerging about some of these coins.

On Thursday, blockchain data from Bubblemaps claimed that about 30% of the Pepe (PEPE) token’s genesis supply was bundled under an entity that sold $2 million a day after the coin’s debut, casting doubt on the memecoin’s fair-launch premise.

Magazine: Memecoin degeneracy is funding groundbreaking anti-aging research