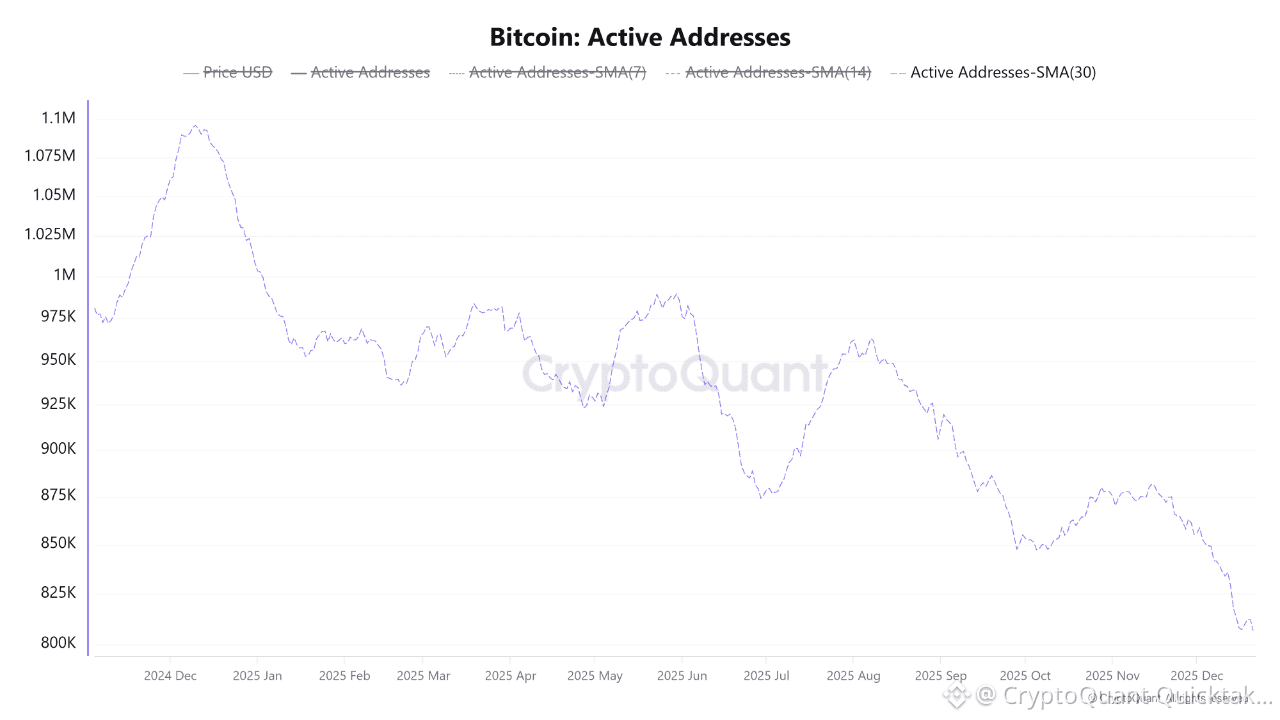

On-chain data reveals a significant cooling in Bitcoin network utility. The 30-day Moving Average (SMA30) of Active Addresses has dropped to 807K, marking its lowest point in the past year. This decline signals a retreat in overall participation from both retail and speculative traders.

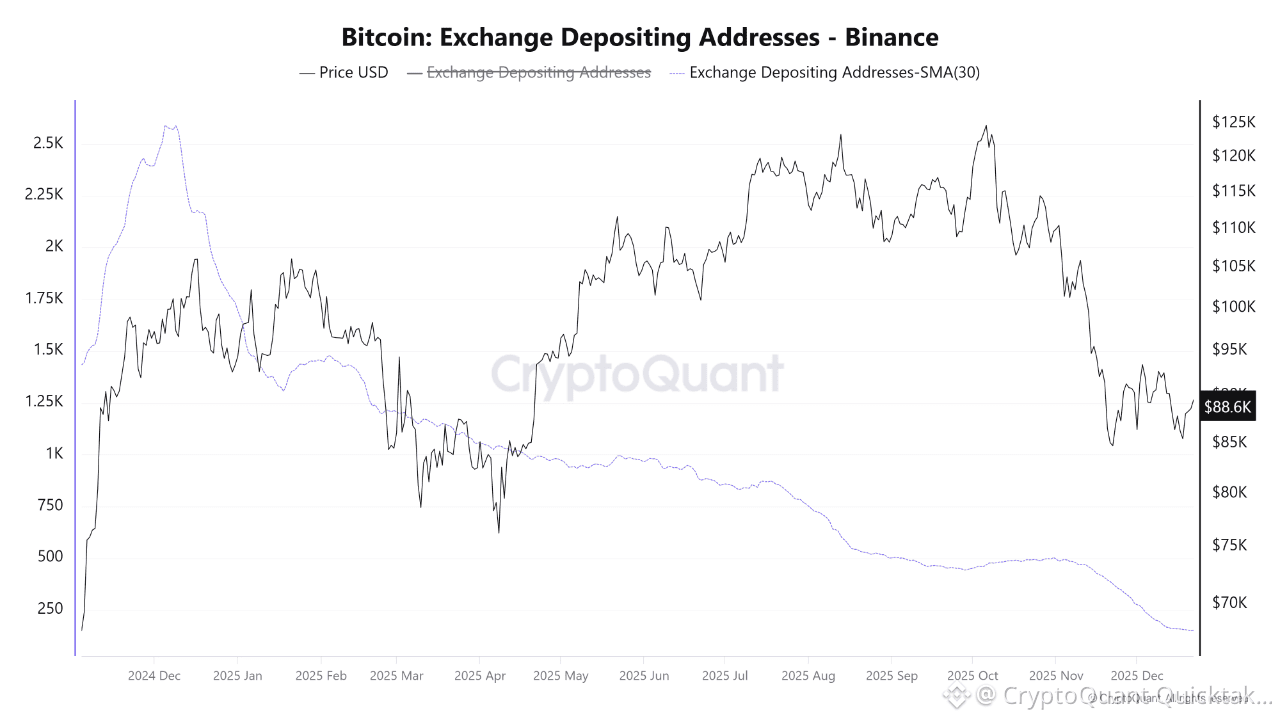

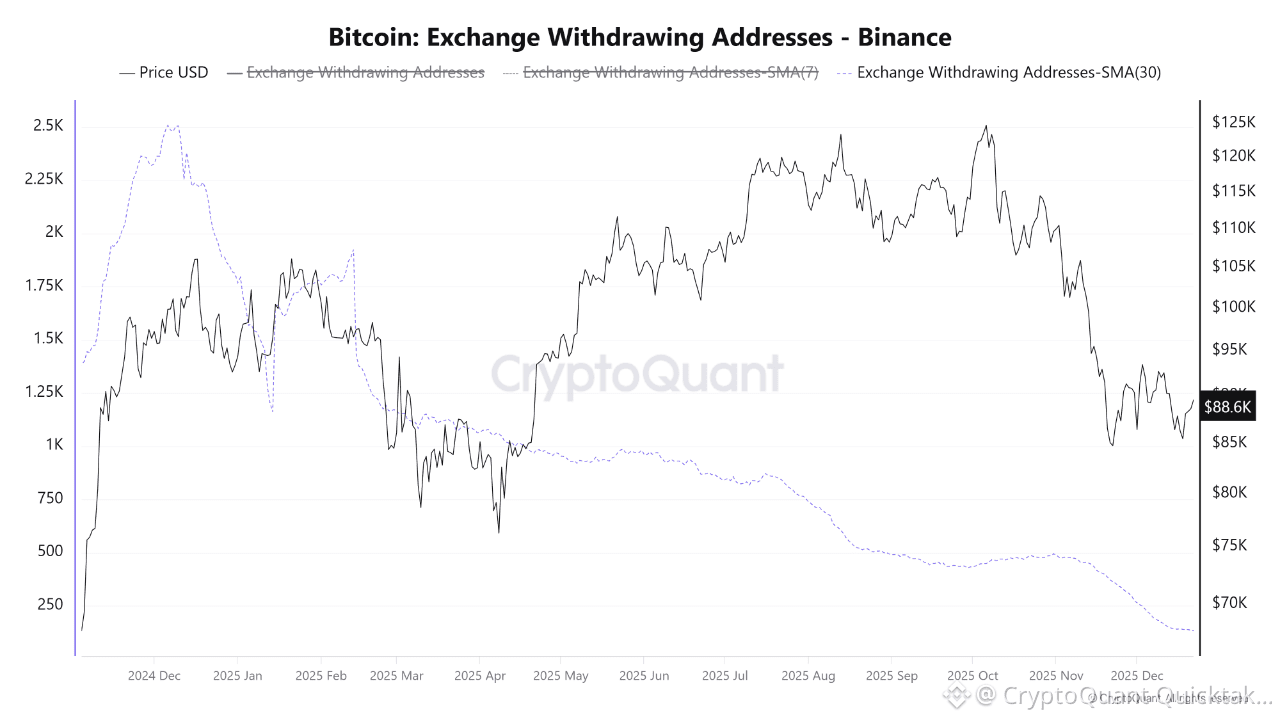

Crucially, this trend is corroborated by exchange flow metrics. An analysis of Binance Depositing and Withdrawing Addresses shows a synchronized decline, with the SMA30 for both metrics plummeting to annual lows.

Interpretation:

The market appears to be in a state of “Stalemate” or extreme inactivity:

Low Depositing Addresses: This is a constructive sign for price stability. It suggests that despite the price consolidating (around $88k), long-term holders are not rushing to move coins to exchanges to sell. Sell-side pressure is minimal.

Low Withdrawing Addresses: Conversely, the lack of withdrawals indicates that aggressive accumulation has paused. Investors are not currently motivated to move assets off-exchanges into cold storage.

Conclusion:

Bitcoin is currently exhibiting a strong divergence between Price (high) and Network Activity (low). This typically indicates a period of market apathy where both buyers and sellers are on the sidelines. Historically, such compression in on-chain activity often precedes a surge in volatility as the market seeks a new equilibrium.

Written by CryptoOnchain